The Central Bank of Nigeria (CBN) follows a managed exchange rate policy, but is it moving towards a crawling peg? Last year saw several changes in the CBN’s official rate, and smaller (though significant) changes in Naira exchange rates quoted by FMDQ, Nigeria’s over-the-counter (OTC) exchange. Moves recorded in the last trading sessions of 2020 brought the Importers & Exporters Window (I&E Window) to N410.25/US$1. This goes some way to narrowing the gap – now less than 15.0% – between the OTC currency market and the cash parallel exchange rate and goes some way to addressing the World Bank’s criticisms of multiple exchange rates. This suggests that there may be more step-changes in Naira/US dollar in 2021. See details below.

FX

Last week the exchange rate in the NAFEX rate weakened by 1.96% to N400.33/US$1 on Thursday, 31 December. In the parallel, or street market, the Naira depreciated by 1.08% to close at N470.00/US$1. The CBN also resumed forex cash sales to Bureaux de Change (BDC) operators to boost liquidity and ease demand pressure over the holidays.

Bonds & T-bills

Last week, the secondary market yield for an FGN Naira bond with 10 years to maturity rose by 68 basis points (bps) to 7.26% and at 7 years rose by 92bps to 6.50% while at 3 years the yield declined by 6bps to 3.54%. The annualized yield on a 301-day T-bill rose by 2bps to 0.65%, while the yield on a 299-day OMO bill remained 0.92%. We do not expect a significant change in current market sentiment over the coming weeks.

Oil

The price of Brent crude rose by 0.99% last week to US$51.80/bbl on Thursday 31 December. The average price in 2020 was US$43.22 /bbl, 32.67% lower than the average of US$64.20 /bbl in 2019. The increase is fueled by vaccine optimism, a weak US dollar and a rebound in manufacturing activity in Asia. Members of the Organization of the Petroleum Exporting Countries and Russia (OPEC+) were reported to have complied with previously-scheduled cuts . The group is scheduled to meet on today, 4 January to discuss output in February and beyond. We expect the group to consider increasing production levels at the upcoming meeting by 500,000 bpd.

Equities

The Nigerian Stock Exchange All-Share Index (NSE-ASI) rose by 3.79% last week with a gain of 50.03% in 2020 to close at 40,270.72, surpassing the 40,000 marks. Sustained buying enthusiasm in names like BUA Cement, MTN, and UBA can be said to have brought about the bullish close. BUA Cement (+28.92%), FCMB Group (+10.26%), and Sterling Bank (+6.25%) closed positive last week while Flour Mills of Nigeria (-6.98%), Guinness Nigeria (-2.56%) and Honeywell Flour Mills (-2.44%) closed negative. Over the weekend, an additional 4.36bn ordinary shares of AIICO Insurance plc were listed on the Nigerian Stock Exchange by way of a rights issue which was fully subscribed. For our view on the market, see Model Equity Portfolio below.

Naira crawling peg?

Currency traders who were hoping for a quiet end to 2020 did not get their Christmas wish. During 30 and 31 December the Naira/US dollar rate moved by 4.26%, to close at N410.25/US$1 in the Importers and Exporters Window (I&E Window). At the same time, the Naira weakened by 2.02% to close at N400.33/US$1 in the NAFEX market. Bloomberg reported that the Central Bank of Nigeria (CBN) was allowing the markets to do this.

Should we be surprised, or are these moves part of a deliberate strategy? We have argued for a long time that, over multi-year periods, the Naira/US dollar rate reflects differences between their inflation rates. This logic can also be applied to a single year. So, for example, given that Nigerian inflation is at 14.9% y/y (November 2020) and US inflation is 1.2% y/y (November 2020) then the Naira might reasonably depreciate by 13.5% over the same period. In fact, the Naira has devalued by roughly this much over the past year, depending on which rate you use. Taking the FMDQ OTC NAFEX rate, the Naira moved by 9.92% to N400.33/US$1 over the past year. Taking the FMDQ OTC I&E Window rate it moved by 12.53% to N410.25/US$1.

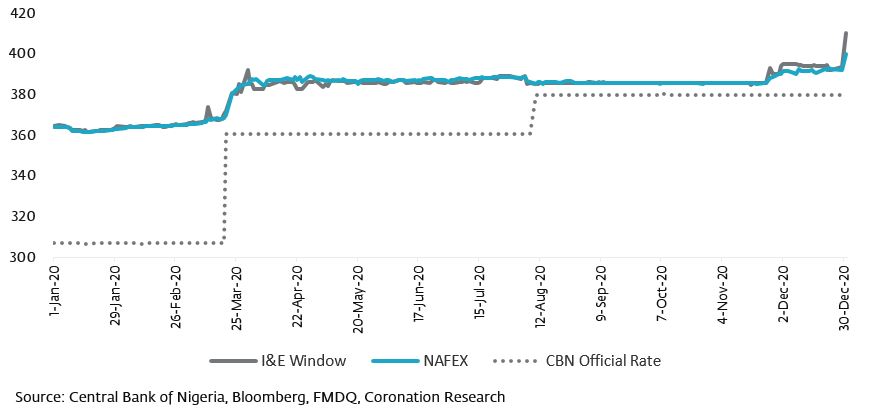

I&E Window, NAFEX rate & CBN Official rate

This calls to mind what CBN Governor Godwin Emefiele stated in a televised address after the Monetary Policy Council (MPC) meeting last November when he expressed frustration with people quoting parallel market rates. He said:

“But we are saying that, even if the currency is overvalued, shouldn’t you go through a step-wise process where the shock can be less-felt, rather than those (who are supposed to know how this works) beginning to cause panic by saying that the exchange rate of Nigeria is 480?”

Here the Governor hints at a crawling peg to make step changes in the exchange rate. A crawling peg can be based on inflation differentials, or on other exchange rate targets. The CBN itself made significant changes in its official rate last year, with steps that moved the exchange rate by 24.0% (see chart).

We do not expect see a crawling peg regime announced, but we do expect the CBN to continue with such step-changes in Naira/US$ exchange rates during 2021. This way the CBN would be able to gradually narrow the gap between, say, the FMDQ OTC I&E Window at N410.25/US$1 and the cash parallel exchange rate, reported at N470.00/US$). Doing this might go some way to addressing the World Bank’s stance that Nigeria needs to merge its currency rates. And it might improve liquidity in the NAFEX and I&E Windows, with time.

Model Equity Portfolio

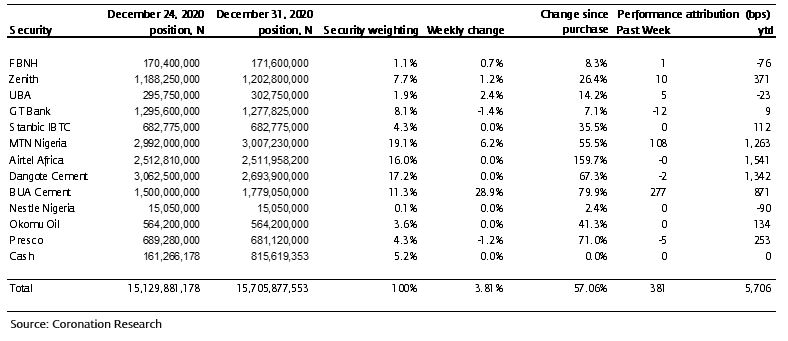

Last week the Model Equity Portfolio rose by 3.81% compared with a rise in the Nigerian Stock Exchange All-Share Index (NSE-ASI) of 3.79%, therefore outperforming it by 2 basis points. Over the year 2020, it gained 57.06% against a gain of 50.03% in the NSE-ASI, outperforming it by 703bps.

Our current concern is that that market is getting carried away. The four largest index weights are up substantially over the past two months: MTN Nigeria by 17.99%; Airtel Africa by 107.65%; Dangote Cement by 53.06% (this was the subject of a buy-back); BUA Cement by 70.00%. We doubt this rate of increase can be sustained at the same time as market interest rates are rising.

Model Equity Portfolio for the week ending 31 December 2020

So, and as mentioned last week, we are beginning to trim our notional positions in these stocks. This simply means, for the time being, raising the level of notional cash, which has risen from 1.1% to 5.2% over the past week. But it also means that we are putting relatively more emphasis on our notional positions in bank stocks, which have risen by far less over the past two months.

In practical terms, we have not got much of our trimming done. There were only three trading sessions last week and turnover in some stocks, notably Airtel Africa, was thin. We will continue this week.

At the same time, we remind ourselves of our maxim that we do not attempt to guess the direction of the market. We set out to take notional positions in the stocks that we like when their valuations are low relative to their own valuation history; when the return on equity (RoE) looks reasonable (20.5% or more in Naira); when there are growth prospects. We will look to these metrics as we re-shape the model portfolio.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.