What will be the Federal Government of Nigeria’s (FGN) next move when it comes to financing its deficit? Movements in the foreign exchange and open market operation (OMO) markets last week prompted market comment that Nigeria is courting foreign portfolio investment (FPI) to participate in Naira instruments. This may be true, but today’s market conditions suggest the Eurobond market, where conditions are good, in our view. See details below.

FX

Last week the exchange rate in the Investors and Exporters Window (I&E Window) weakened by 0.71% to N395.93/US$1. In the parallel or street market, the Naira remained unchanged to close last week at N480.00/US$1. Gross external reserves inched up to $36.11bn as of 3 February, providing some reassurance as the Central Bank of Nigeria (CBN) has set a target of $40.0bn in external reserves. The CBN’s plans to settle non-deliverable forwards (NDF) dated 24 February at N412.14/US$1 and the recent weakness of the Naira in the I&E window (albeit very slight) is being interpreted by some market participants as preparation for an exchange rate adjustment. Against this, we recall that central banks are often in a good position to wrong-foot the market. However, there were several small-step adjustments in the exchange rate last year and it is perfectly possible for these to continue this year.

Bonds & T-bills

Last week, the secondary market yield for a Federal Government of Nigeria (FGN) Naira bond with 10 years to maturity declined by 21 basis points (bps) to 8.87% and at 7 years declined by 35bps to 8.37% while at 3 years the yield declined by 14bps to 6.11%. The annualised yield on a 356-day T-bill declined by 28bps to 1.49%, while the yield on a 263-day OMO bill remained at 2.32%. The fall in yields in the bond market went against the trend we have seen since mid-December, though we must remember that local investors are still quite liquid, so occasional rallies like this are to be expected. The news was largely focused on a series open market operation (OMO) bills that were released with annualised yields just above 10.0% at 1-year, with market participants coming up with various interpretations (moving yields to a level attractive for foreign investors, signalling an adjustment in the foreign exchange rate, etc). All we can say with reasonable certainty is that, thus far, the CBN is not averse to market interest rates going up.

Oil

The price of Brent crude rose by 5.31% last week, closing at US$59.34/bbl, a 14.56% increase year-to-date. The average price to year-to-date is US$55.87/bbl, 22.64% higher than the average of US$43.22/bbl in 2020. The Saudi Arabian pledge of extra supply cuts in February and March on the back of reductions by OPEC+ (OPEC plus Russia) is another positive factor. Strong crude prices are encouraging US producers to increase output even as Covid-19 related lockdowns across parts of Europe and Asia put downward pressure on demand. Our view that Brent is likely to trade in a range of US$45.00/bbl to US$60.00/bbl this year may soon be challenged, though a rise above US$60.00/bbl could prompt some OPEC+ members to pump more oil, in our view.

Equities

The Nigerian Stock Exchange All-Share Index (NSE-ASI) fell by 1.66% last week with a gain of 3.57% year-to-date. MRS (+8.94%), Unilever Nigeria (+8.15%), and GT Bank (+4.35%) closed positive last week, while Lafarge Africa (-11.17%), Flour Mills of Nigeria (-9.37%) and Oando (-9.15%) closed negative. The equities market reversed the previous week’s bullish momentum. The reaction to the CBN policy affecting all bank accounts with affiliations to cryptocurrency trading might have had an indirect impact on the performance of the market on Friday, in our view. It is also possible that investors are reacting to the trend in market interest rates, even though bond yields remain well below inflation. See Model Equity Portfolio below.

Eurobonds and foreign financing

Over the weekend Bloomberg featured a discussion about the rates of a recent series of CBN open market operation (OMO) bills, which exceeded 10.0% at one-year duration. This, it was argued, could pave the way for an adjustment in the Naira/US dollar exchange rate which would, in turn, encourage foreign investors to purchase OMO bills again. Sales of OMO bills to foreign investors has been a key part of public sector financing in recent years.

Our issue with this line of reasoning is that foreign portfolio investment (FPI) depends on liquidity, as well as attractive interest rates and a solid exchange rate. Typically, a foreign investor’s purchase of OMO bills is backed with a purchase of non-deliverable forwards (NDF) for which the investor is paid back in Naira. The conversion back into US dollars depends on foreign exchange liquidity and this, in our view, is difficult to fix. It is not impossible to fix it (it would help if an exchange rate adjustment convinced the markets that a period of exchange rate stability lies ahead) but for the time being we think that issuing Eurobonds would be the better way of using foreign investors to finance the public sector.

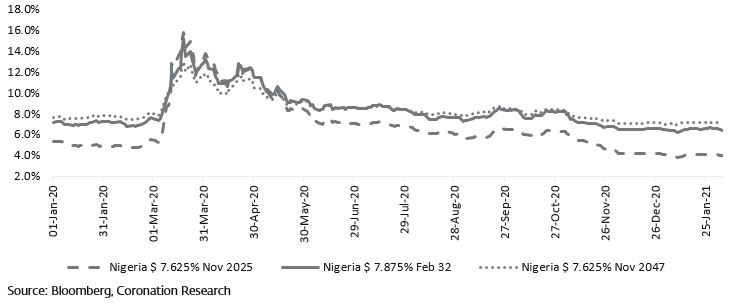

Yields of selected Federal Government of Nigeria Eurobonds

An argument against the Federal Government of Nigerian (FGN) issuing Eurobonds, until recently, was that their yields were higher, in US dollars, than those of FGN bonds in Naira. This was true up until December 2020, but since then yields of FGN Naira-denominated bond have risen sharply, so the interest cost of issuing US dollars is now lower than Naira. Exact comparisons between durations are difficult (because issues of FGN Eurobonds are few and far between) but the following may serve as a guide: a 5-yr FGN US$ Eurobond yields 3.97% while a 5-yr FGN Naira bond yields 7.49%; a 12-year FGN US$ Eurobond yields 4.88% while a 10-yr FGN Naira bond yields 8.73%.

However, for the FGN to fund its deficit substantially in US dollars would expose it to a high level of foreign exchange risk. As a rule, it is best for countries to borrow in their own currencies unless for the purpose of diversification. As a result of adhering to this maxim the outstanding face value of FGN public debt in US dollars is small in comparison with what it owes in Naira. At the end of last week, the total face value of FGN T-bills was N2,207bn and the total face value of FGN bonds was N10,883bn. The total face value of FGN Eurobonds was US$10,668 million. So, using an exchange rate of N395.9/US$1, the face value of the FGN’s Naira public debt to its US dollar public debt stood at a ratio of 3:1.

As an aside, Nigeria was widely judged to have missed the boat this time last year when it was slow to come to the market with a Eurobond issue. In the first months of 2020 Ghana and Gabon issued a total of US$3.0bn in Eurobonds between them before Nigeria could get to the market. Nigeria has been absent from the new issue market for over two years, and we believe a sale would be welcomed now.

All this is good news for investors in FGN Eurobonds. Nigerian Eurobonds not over-supplied and the country has a good track record in paying back both interest and principal. In January, for example, Nigeria paid back the principal of a US$500m Eurobond. And the so-called global hunt for yield (investors tolerating high-risk and high-yield issuers when interest rates in developed markets are extremely low) keeps investor interest high, with Nigeria’s yields trending down over recent months.

Model Equity Portfolio

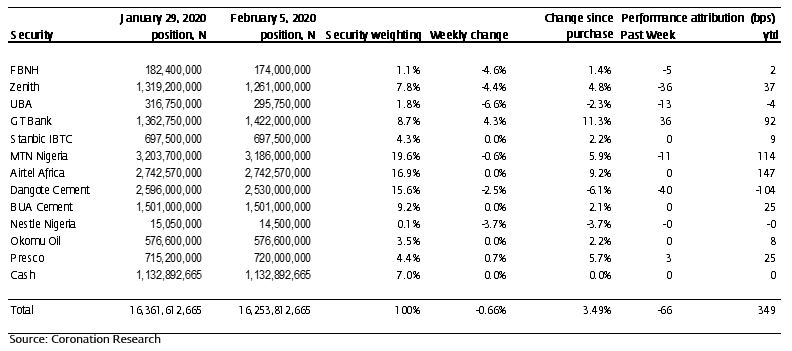

Last week the Model Equity Portfolio fell by 0.66% compared with a fall in the Nigerian Stock Exchange All-Share Index (NSE-ASI) of 1.66%, therefore outperforming it by 100 basis points. Year to date it has gained 3.57% against a gain in the NSE-ASI of 3.57%, underperforming it by 8bps.

Several factors worked in our favour last week. First, two mid-cap stocks which had performed very well in January, and in which we do not have notional positions, fell, notably Lafarge Africa and Flour Mills of Nigeria. At the same time, the market seemed unusually enthusiastic about GT Bank, in which we do have a notional position. We cannot expect to be this fortunate every week.

Model Equity Portfolio for the week ending 05 February 2021

We continue to search for ideas and do not rule out taking notional positions in some mid-cap stocks, especially if their prices correct. On the other hand, we find the market somewhat pricey at these levels and will take a degree of profits in some of the largest stocks by index weight, as we did during the first week of January. We will make small notional sales in Airtel Africa, MTN Nigeria, Dangote Cement and BUA Cement this week with a view to raising our notional cash position by between one and three percentage points.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.