At the end of the second quarter of the year we wrote about how Nigerian banks were moving lending rates in order to accommodate rising market interest rates (see Coronation Research: Nigerian Banks, Resilience Built In, 25 June). Since then market interest rates, and interbank lending rates, have been falling. This suggests margin expansion for banks, as well as support for those banks that rely on the interbank market for funds. See details below.

FX

Last week, the exchange rate at the Investors and Exporters Window (I&E Window) appreciated by 0.12% to close at N411.50/US$1. Conversely, the Naira weakened by 1.15% in the parallel (or street) market to close at N530.00/US$1. As a result, the gap between the I&E window and parallel market rates now stands at 28.80%. Elsewhere, the Central Bank of Nigeria’s FX reserves rose by 1.81% to US$34.18bn. We maintain our view that the Federal Government of Nigeria’s (FGN) scheduled Eurobond issuance and the US$3.3bn allocation from the International Monetary Fund’s (IMF) Special Drawing Right (SDR) are likely to help shore up external reserves considerably over the coming months. Amidst these developments, we expect the parallel rate and the I&E Window rates to trade range-bound in the near term.

Bonds & T-bills

Last week, the bullish trend in the secondary market for FGN bonds persisted. As a result, the yield of an FGN Naira-denominated bond with 10-years to maturity fell by 9bps to 11.55%, the yield on the 7-year bond fell by 15bps to 11.25%, while the yield on the 3-year bond was up by 9bps to 9.91%. The overall average benchmark yield fell by 11bps over the week to close at 11.04%. We reiterate that a future rise in bond yields, if any, is unlikely to be sharp over the coming three months due to unaggressive borrowing as the Debt Management Office (DMO) manages the FGN’s debt service costs.

Trading in the Treasury Bill (T-Bill) secondary market was bullish, given the increase in system liquidity. As a result, the average benchmark yield for T-bills fell by 34bps on the week to close at 4.61%, while the average yield for OMO bills was up by 8bps on the week to close at 6.12%. On the other hand, the annualised yield on a 314-day T-bill in the secondary market stayed flat at 6.68%, while the yield on a 193-day OMO bill fell by 13bp to 6.61%. At the Open Market Operation (OMO) auction, the CBN sold N50.0bn (US$121.6m) worth of bills across three tenors. Stop rates remained unchanged at 7.00% for the short, 8.50% for the mid and 10.10% for the long tenor bills. At this week’s T-bill primary market auction (PMA), the DMO is expected to offer N138.2bn worth of bills across all tenors. Accordingly, we expect quiet trading in the first few days of the week in the T-bill secondary market as participants position for the PMA. Given the indications of a favourable lower interest rate environment, we expect a further dip in the stop rate on the 364-day bill.

Oil

The price of Brent crude dipped by 0.12% last week to close at a US$72.6/bbl, showing a 40.17% increase year-to-date. The average price year-to-date is US$67.20/bbl, 55.48% higher than the average of US$43.22/bbl in 2020. The price dip came in the aftermath of the forced shutdown of 2.3 mbpd of US refining capacity (13% of total capacity) and evacuations of personnel from offshore oil platforms as Hurricane Ida slammed into the U.S. Gulf Coast. Last week, the Organisation of the Petroleum Exporting Countries and its ally Russia (OPEC+) confirmed the previously-agreed increase of 400,000 barrels per day (bpd) for the second half of 2021. Additionally, they revised their 2022 oil demand growth forecast to 4.2 mbpd, up from 3.28 mbpd. Consequently, we reiterate our view that the price of Brent oil is likely to remain well above the US$60.00/bbl mark for several months, a level that is compatible with healthy public finances for Nigeria.

Equities

The NGX All-Share Index (NGX-ASI) fell by –0.57% last week. Consequently, the year-to-date return fell to –2.51%. Oando -15.21%, Nigerian Breweries -7.69%, FCMB Group -3.91% and Stanbic IBTC -3.05% closed negative last week, while Presco +8.90%, Honeywell Flour Mills +4.23%, Flour Mills of Nigeria +3.45% and UBA +3.33% closed positive. Sectoral performances were mixed: the NGX Insurance –0.57%, followed by NGX Oil & Gas –0.12%, and the NGX Banking -0.01% declined, while the NGX Consumer Goods index +0.13% and NGX Industrial +0.11% indices gained. See Model Equity Portfolio below.

Interest rates and banks’ margins

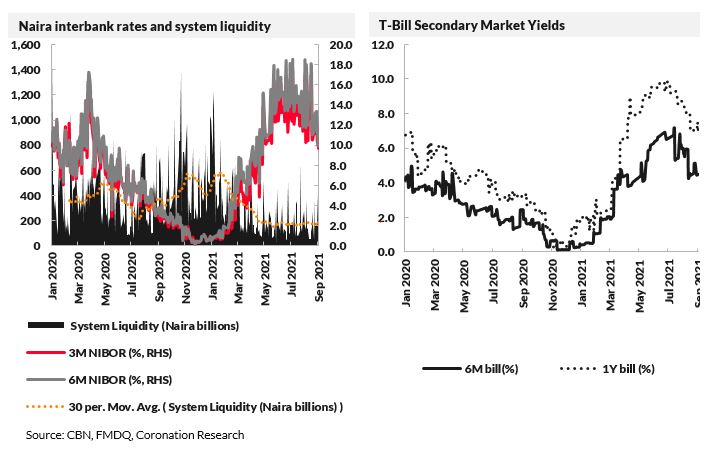

Naira-denominated interest rates have been trending downwards for just over three months, with 1-year T-bill yields touching 6.68% at the end of last week. Our focus is on what this means for banks and how they perform. Specifically, Zenith Bank opened the season for H1 2021 reports ten days ago with numbers that showed margins under pressure. By contrast, Access Bank reported, on Wednesday last week, showing strong margins. Pressure on banks can often be understood by charting interbank rates, the rates banks charge to lend to each other.

This year, interbank rates have followed the same trajectory as T-bill rates but have risen to considerably higher levels. The Nigerian Interbank Offered Rate (NIBOR), which represents the short-term lending rates of selected banks in the Nigerian interbank market, rose to a high of 17.8% on average across its four tenors in August, from 0.5% at the start of the year. However, the rate has since fallen to 10.7%, on average, at the end of last week.

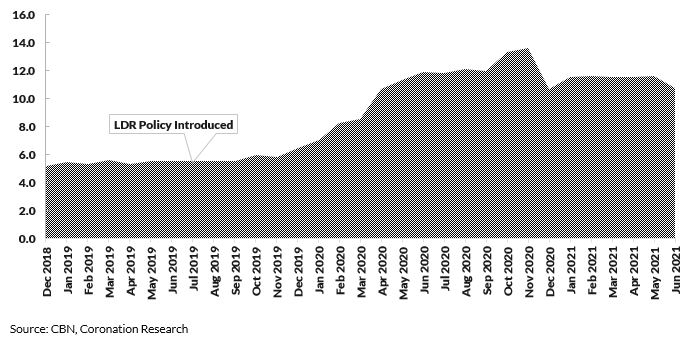

Our understanding is that the CBN can strongly influence system liquidity by applying the Cash Reserve Requirement (CRR), which is officially 27.5% but is widely acknowledged to be much higher; in the region of 50.0%, effectively. So, it may be the case that the CBN has eased liquidity conditions in order to ease pressure on the interbank market over the past few months.

Commercial and Merchant Banks Reserves with the Central Bank (Naira trillions)

When we spoke with banks for our report, Nigerian Banks, Resilience Built In (25 June), almost all of them related that they were adapting deposit and lending rates to reflect the rise in rates during the first quarter of the year. The timing of these changes is important. For example, most banks stated that they were implementing changes (e.g. making loans more costly for customers) at the end of Q1 2021 or at the beginning of Q2 2021. Therefore, if market rates fall, and their cost of funds also fall after they have just raised lending rates, spreads are likely to have increased.

In other words, this has the potential to improve banks’ Net Interest Margins. However, not all banks move at the same speed, as the different results from Zenith Bank and Access Bank show see our notes on 30 August and 3 September, respectively). The good news is that the interest rate decreases, which are likely to impact margins positively, have continued into Q3 2021. This not only helps the largest and most liquid banks but may take pressure off the smallest and least liquid banks that frequently depend on the interbank market to balance their books.

Model Equity Portfolio

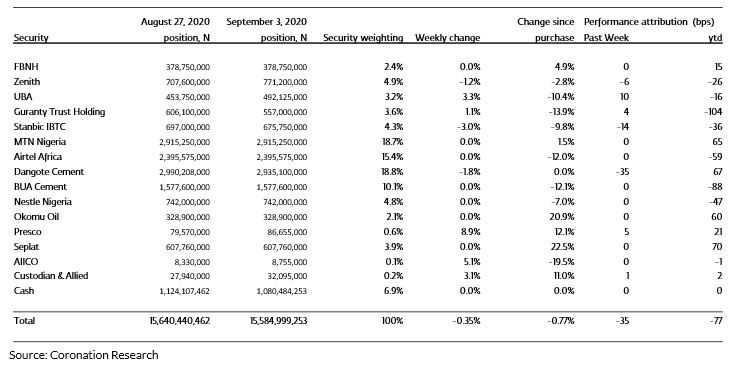

Last week the Model Equity Portfolio fell by 0.35% compared with a fall in the NGX Exchange All-Share Index (NGX-ASI) of 0.57%, therefore outperforming it by 21 basis points. Year to date it has lost 0.77% against a loss in the NGX-ASI of 2.51%, outperforming it by 174bps.

Model Equity Portfolio for the week ending 3 September 2021

Last week the most significant faller for the NGX All-Share Index, as well as our Model Equity Portfolio, was Dangote Cement, which fell 1.8% and cost us a notional 35bps. Our attention, however, was once again drawn to the banks. Although these continued to cost us in aggregate (a notional 6bps last week and a notional 5bps the week before) we actually see the data as enouraging. Two of our bank positions turned out positive last week, which suggests selective support rather than disenchantment with the sector. It is true that Stanbic IBTC cost us a notional 14bps last week, but Stanbic IBTC stock is not particularly liquid and price movements tend to be lumpy. It performs well in the long term and we will be patient with it.

As forewarned a week ago we began to rotate part of our notional position in Guaranty Trust Holding into Zenith Bank and UBA, and we will continue to do so this week. We also made some small notional purchases (the stock is not very liquid) of Custodian and Allied Insurance, and will continue to do this week, liquidity permitting.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.