The fiscal position of the Federal Government of Nigeria (FGN) is, not surprisingly, tight, as oil prices have crashed and economic growth has slowed down. As we describe below, being able to re-finance debt cheaply is critical to the FGN. So, the fact that Naira interest rates are so low (no government T-bill or bond yield exceeds the rate of inflation) enables the FGN to issue its debt cheaply to the private sector. The market is taking up the slack, and it is difficult to find an inflation-beating investment.

FX

The Central Bank of Nigeria (CBN) recorded a small decline in its FX reserves last week, which fell by US$119.29 million to US$36.33 billion (a one-month moving average). This is a very slow rate of attrition compared with earlier in the year (when attrition often exceeded US$1.0bn per month). It suggests that the CBN is supplying far fewer US dollars to the NAFEX market (also known as the I&E Window) than before. The Naira recorded small gains against the US dollar in the forwards market, the 3-month (+0.03% to N391.20/US$1) and 6-month (+0.05% to N396.70/US$1) contracts both appreciating. By contrast, the parallel market spot rate (offer) for US dollars fell from N450/US$1 to N455/US$1. We think that the NAFEX rate (quoted by Bloomberg) will hold firm for weeks, if not months, while the parallel market rate may come under further pressure.

Bonds & T-bills

The secondary market yield for a Federal Government of Nigeria (FGN) Naira bond with 10 years to maturity declined last week by 2 basis point (bps) to 10.97%, and at 3 years declined by 124bps to 7.28%. The annualised yield on 237-day T-bill remained flat at 3.06%, while a CBN Open Market Operation (OMO) bill with similar tenure closed flat at 5.59%. Last week, trading in the FGN bond secondary market was bullish, as investors covered lost bids at the primary market auction. FGN bonds worth N150.00 billion were sold last week. Given high institutional liquidity we expect rates for stay this low for several weeks, if not months.

Oil

The price of Brent crude increased by 8.93% last week to US$42.19/bbl. The average price, year-to-date, is US$42.14/bbl, 34.36% lower than the average of US$64.20/bbl in 2019, and 41.22% lower than the average of US$71.69/bbl in 2018. An improvement in the level of compliance with OPEC and OPEC+ production cuts was largely responsible. The global compliance level for the scheduled 9.7 million barrels per day (mbpd) production is reported at 87.23%, with Nigeria standing at 86.00%. We think that Brent crude prices will hold up above US$40.00/bbl, though reaching the next level, US$50.00/bbl, may be a tall order.

Equities

The Nigerian Stock Exchange All-Share Index (NSE-ASI) declined by 1.41% last week. The year-to-date return is negative 7.51%. Last week Honeywell Flour Mills (+17.39%), Nestle Nigeria (+10.00%) and Cadbury Nigeria (+6.67%) closed positive, while Sterling Bank (-11.11%), Seplat (-9.99%), Nigerian Breweries (-9.52%), closed negative. Losses were recorded in the Oil & Gas (-4.9%), Insurance (-3.1%) and Banking (-3.1%) segments. Industrial Goods (+2.2%) and Consumer Goods (+1.8%) indices were the sole gainers. Low turnover indicates a weak market going forward, in our view. Read more on Model Portfolio below.

Public debt: how much is enough?

The rising cost of Nigeria’s debt profile breached a new milestone when the country’s debt service as a percentage of revenue rose to 99% in Q1 2020. This is contained in the Medium-Term Expenditure Framework and Fiscal Strategy (MTEF/FSP) report, recently released by the Federal Ministry of Finance, Budget, and National Planning.

During Q1, Nigeria earned N950.5bn (US$2.4bn) in revenue compared with a budget estimate of N1.9tn (US$4.8bn), a 52% shortfall. Oil revenue was N464bn (US$1.2bn) representing a shortfall of 30% when compared with the budget estimate, while non-oil revenue was N269bn (US$0.7bn) representing a shortfall of 40%.

Nigeria’s ability to service its debt appears to be under pressure partly because debt has been a major source of financing for the government over the past five years. The Covid-19 pandemic and the associated crash in oil prices have revealed serious fault lines under Nigeria’s fiscal structure.

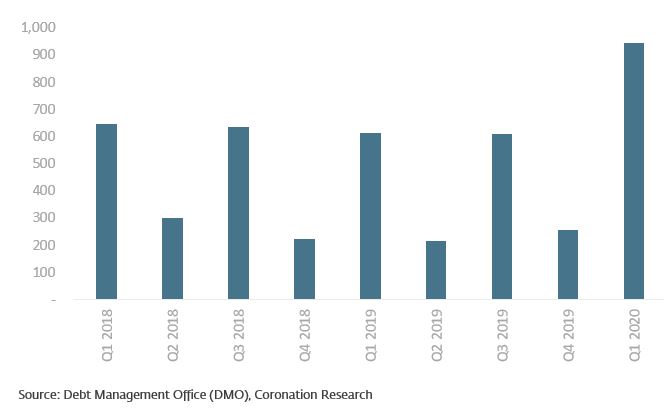

Debt service, Naira billions

With the economy quite possibly now entering a recession, government revenues may remain depressed this quarter and into the next, forcing the government to rely on debt for its budget. The government’s total debt stock, at December 2019, stood at N27.4tn (US$63.3bn). Given the recent US$3.4bn loan from IMF, a US$188m loan from the African Development Bank, and the Senate’s approval of a US$22.7bn borrowing request from the Federal Government, we think the debt ratios are set to get worse.

Q1 2020 may have been an unusually heavy period for debt servicing, given the timing of debt payments. As the chart shows, quarters of high debt service are followed by quarters of low debt service, and vice-versa.

The latest rise in crude oil prices presents certain benefits to the Federal Government’s finances, but Nigeria still faces a reduction in its crude oil output to comply with OPEC cuts. This is an unsustainable model for Nigeria, in our view. At some point, Nigeria will have to increase its fiscal revenues or face further spending cuts.

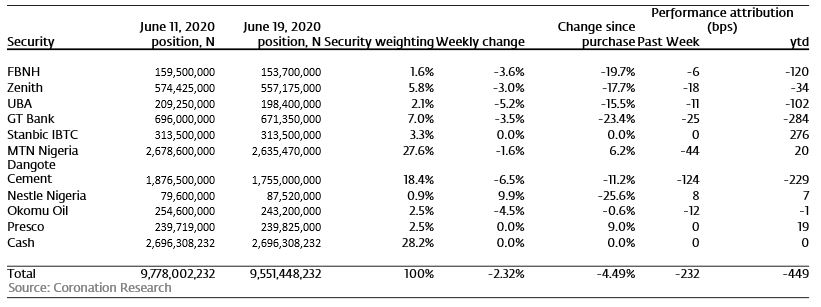

Model Equity Portfolio

Last week the Model Equity Portfolio underperformed the index by 90 basis points (bps) and, having examined the evidence, we attribute this to two factors. First, we do not have a notional position in BUA Cement, which is approximatley 10% of the index and rallied 8% last week, thereby delivering 80bps which the Model Equity Portfolio did not get. Second, we are out of step with the ebbs and flows of bank stocks, and the notional purchases we made in the week of 5 June to 11 June, which took our notional bank sector position from a total of 12.1% to 20.1% of the portfolio, cost us 17bps last week. We have made some useful outperformance (302 bps) this year and we do not want to throw it away. What are we going to do?

To go over the detail, the Model Equity Portfolio fell by 2.32% last week compared with a fall in the Nigerian Stock Exchange All-Share Index (NSE-ASI) of 1.41%, therefore underperforming it by 90 basis points. Year-to-date it has lost 4.49%, against a loss of 7.51% in the NSE-ASI, outperforming it by 302bps.

Model Equity Portfolio for the week ending 19 June 2020

First, we are going to look again at BUA Cement. Early this year we reasoned that it did not have a sufficient RoE to meet our expectations (we generally look for a sustainable RoE of 20.53%), and therefore we did not include it in our list of notional purchases. However, this may be a matter of us being too stubborn. It appears that the RoE is improving, and the company has gone to lengths to improve its communications. Both these factors are exciting the market. We will take another look at the evidence this week with a view to building a position.

Second, we are out of step with the market with regard to bank stocks. We identified our problem in Nigeria Weekly Update on 25 May when we realised that, having written the week before that we wished to buy the stocks which we like at close to the bottom of the market, we failed to do this with our favoured bank stocks. We belatedly made notional purchases of bank stocks during the week of 5 June to 11 June. The problem with correcting mistakes late in the day is that it is possible to get out of step with the market, and this is dangerous. Ideally, we would not trade much, but it now seems important to get back into step and take our notional bank positions down again, something we will do this coming week.

As we wrote last week, we may need to navigate through some stormy weather. There are several factors that make us think about this. One is low stock market turnover, which suggests that Nigerian institutional investors are not buying, despite the fact that all the available interest rates (T-bills and bonds) are below inflation and many Nigerian banks’ dividend yields are above the T-bill yield. Another factor is the likelihood that retail investors are sitting on good gains (if they invested in April) and may not wish to commit again to the market. Another is that Nigerian investors might count their blessings that Nigeria has done much better than other African bourses. In US dollars South Africa is down 21.0% year-to-date (YTD); Kenya is down by 29.2% YTD; Ghana is down by 16.12% YTD, and Egypt is down by 22.01% YTD. The Nigerian Stock Exchange All-Share Index, down by 7.51% YTD in Naira but by 13.04% in US dollars, has done considerably better.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.