If a surging stock market and falling risk-free rates are signs of optimism, then we can be optimistic about Nigerian markets this year. Indeed, the Central Bank of Nigeria (CBN) might congratulate itself on its bold policy experiments last year. We temper our enthusiasm by observing that T-bill rates are well below the rate of inflation and well below the rate (the CBN’s open market operation, OMO, rate) designed for foreign investors. Some anomalies may prove difficult to fix.

FX

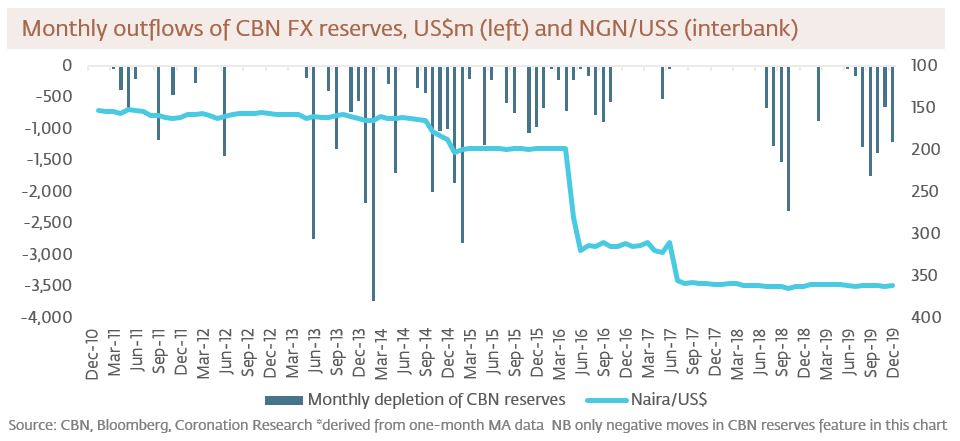

We argue in our outlook document, Year Ahead 2020, Re-risking the financial system, 16 January 2020, that the Naira is likely to remain firm against the US dollar. We premise our view on the continued appeal of the CBN’s OMO bills market to foreign portfolio investors, CBN reserves stabilising and favourable conditions for emerging market sovereign bond issuances – an instrument the government is likely to tap. Conditions in the parallel FX market remain balanced, and the Naira continues to trade around N362.50/US$1 in the NAFEX market. For now, all is well but we will keep a close eye on a) foreign portfolio investors’ appetite for the CBN’s OMO bills and b) the level of the CBN’s gross reserves, which stand at US$38.30bn (a one-month moving average).

Bonds & T-bills

The secondary market yield for a Federal Government of Nigeria (FGN) Naira bond with 10 years to maturity rose by 31bps to 11.39%, and at 3 years rose by 8bps to 9.78% last week. The annualised yield on 272-day T-bill, the longest duration available in the secondary market, fell by 9bps to 4.46%, while an OMO bill with similar tenure closed at 13.88%, 23bps down week on week.

Oil

The price of Brent fell by 0.20% last week to US$64.85/bbl. The average price, year-to-date, is US$65.83/bbl, 2.55% higher than the average of US$64.20/bbl in 2019, but 8.18% lower than the average of US$71.69/bbl in 2018. As a degree of calm is restored to the Middle-East, the crude oil price has begun to retreat and so too Nigeria’s hopes of attaining its oil revenue estimates for 2020. Recent OPEC compliance rhetoric from Nigeria’s oil minister, if adhered to, would put Nigeria’s oil production 24.57% below its budget’s assumptions, in our view. Nigeria, therefore, needs a catalyst in oil prices or a significant production shift to condensates to keep its revenue expectations in line with the budget, we believe.

Equities

The Nigerian Stock Exchange (NSE) All-Share Index rose by 0.69% last week, the year-to-date return is 10.34%. Last week Forte Oil (+21.89%), MTN Nigeria (+9.14%) and GTBank (+4.85%) closed positive while Nigerian Breweries (-8.83%), Presco (-8.17%) and Cadbury Nigeria (-5.21%) fell.

The Nigerian Stock Exchange is the world’s best-performing stock market in both local currency and US dollar terms (11.21%) year-to-date. One year ago, it as down 1.35% in Naira and 1.15% in US dollar terms. The consumer sub-index continues to be a laggard but strong buying interest persists from retail and institutional investors in banks and telecoms stocks.

Year Ahead 2020: Re-risking the financial system

Last week we published our views on the Nigerian economy in Re-risking the financial system, 16 January 2020. We reproduce the salient points below.

Oil prices – we think that Saudi-led OPEC cuts will reduce oil price volatility and that 2020 will be a repeat of 2019, with prices (Brent) hovering above US$60.00bbl most of the time. The forward curve for Brent in 2020 supports this view (as it did in 2019). This forms an integral part of our FX and interest rate forecasts because investor confidence tends to suffer when oil trends under US$60.00/bbl (and oil revenues are important – though less than 50% in value – the source of US dollars for the CBN).

Foreign exchange – we think Naira 362.50 / US$1 will hold for most, if not all, of 2020. The rate of depletion of the CBN’s FX reserve in H2 2019 was US$1.0 – US$1.4bn per month and this cannot be continued this year – not even for the duration of H1 2020 when reserves are today close to US$38.0bn. But the CBN is likely to get US dollars from FGN sovereign Eurobonds and from international loans in 2020. And the CBN itself may sell over US$1.0bn in Naira-denominated OMO bills per month to foreign investors in the first three months of the year.

Interest rates – We will likely see continued downward pressure on T-bill rates as domestic institutional money rotates from the much larger OMO market into the smaller T-bill market. This works for the CBN as banks are reducing the cost of lending and are lending more money to comply with the loan-to-deposit targets (65% by 31 Dec 2019). T-bills rates are close to 5.0% while OMO rates are close to 14.0%.

If the CBN does not sell sufficient OMO bills to foreign investors in Q1 2020 then this would, in our view, put a question mark over its FX reserve management and its interest rate management. It would need to either raise OMO bill rates or, more radically, reverse the ban on domestic corporates buying OMO bills which would have the effect of sharply driving up T-bill rates. This is not our base scenario – early indications are that foreign investors are returning to the OMO market in January.

Bank stocks – Some of these now have dividend yields well in excess of T-bill yields. This comes as a long-awaited catalyst to get some of these lowly-rated bank stocks moving at last. Although it has been difficult to maintain spreads as T-bill rates have fallen, banks have a degree of interest margin protection as they are still allowed to buy OMO bills.

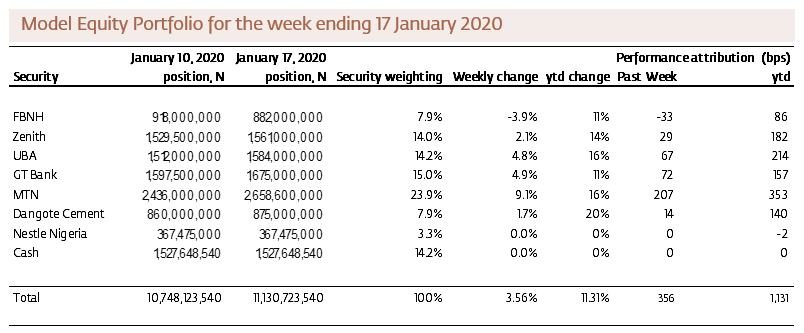

Model Equity Portfolio

Last week we reported that our Model Equity Portfolio had underperformed the market between 1 January and 10 January by 201 basis points (bps), returning 7.48% as opposed to the NSE ASI’s 9.59%. This week we are surprised to find that we are outperforming, with a year-to-date return of 11.31% against the NSE ASI’s 10.34%. In large measure, this has been due to our overweight in MTN Nigeria in which we have a notional position of 23.9% as opposed to the index weight of 18.3%. It is up 20.6% this year.

Our overall stance – aside from the overweight in MTN Nigeria – is to have a bank-heavy portfolio of stocks, reasoning that at least some investors faced with low T-bill yields will look to buy banks with dividend yields that are, in some cases, above 10.0%. We are light on brewers, food and fast-moving consumer goods (FMCG) manufacturers. This strategy is working quite well, though we are missing PZ Cussons (up 3.5% year-to-date) and Flour Mills of Nigeria (up 19.3% year-to-date).

We made no change to the Model Equity Portfolio last week. Last week we wrote: “If the prices of banks UBA, Zenith Bank and GT Bank correct more than 5% this week we intend to make further notional purchases.” None of those stocks corrected by this much (though UBA and Zenith Bank, as well as FBNH, did trade 5% off their highest levels so far this year) so we did not make any further notional purchases. We will now spend time figuring out what to do with our 14.2% notional cash position. We do not intend to change the portfolio this week.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.