The Monetary Policy Council (MPC) of the Central Bank of Nigeria (CBN) meets today and is due to deliver its verdict on its Monetary Policy Rate (MPR) tomorrow. We think that, after its surprising cut from 12.50% to 11.50% in September, it will leave the MPR on hold now. The CBN is happy with low market interest rates and can even argue these contributed to the mildness of the Q3 GDP print (negative 3.62%, year-on-year). It could even consider a further cut but, despite seeing little connection between interest rates and inflation, is probably chastened by the recent rise to 14.23%. See details below.

FX

The CBN last week reversed its ruling on the use of third parties to access foreign exchange for imports. The result was quickly felt in the NAFEX market (also known as the I&E Window) where turnover climbed to US$205.8m (N79.4bn) on Thursday, a level not seen since August and, before that, March. The Naira appreciated by 0.03% in the NAFEX market to N385.50/US$1. However, and probably due to the build-up of stocks ahead of the festive season, the Naira depreciated by 2.98% in the parallel market to N484/US$1. We think that there will be continued pressure on this rate over the coming weeks.

Bonds & T-bills

Last week, the secondary market yield for an FGN Naira bond with 10 years to maturity dropped by 31 basis point (bps) to 4.39% from 4.70%, and at 7 years also dropped by 5 bps to 4.10% from 4.15%, while at 3 years the yield dropped by 7 bps to 1.82% from 1.89%. The annualized yield on 343-day T-bill rose by 3 bps to 0.18% from 0.15%, while the yield on a 340-day OMO bill dropped by 9 bps to 0.19% from 0.28%. During the week it was reported that, intra-day, some T-bill maturities were priced with negative yields. Overall, we sense that liquidity will continue to be high in the fixed income markets as we go into December, as a high level of open market operation (OMO) bills are due to be redeemed during the month. Therefore, there is a real possibility that bond rates will reduce still further and that negative T-bill rates could be reported at market close. We note that the OMO redemption schedule for January is much lighter than in December, so the pressure may ease off next year.

Oil

The price of Brent crude rose by 5.10% last week to US$44.96/bbl. The average price, year-to-date, is US$42.43/bbl, 34% lower than the average of US$64.12/bbl in 2019. This increase can be attributed to the drop (by 9.5 million barrels) in the global storage level week-on-week to reach 112 mbbl. Interestingly, the current floating storage volumes are 100 mbbl lower than the June peak. We think oil will be supported around US$45.00/bbl, though it may be a while before it breaks decisively above US$50.00/bbl.

Equities

The Nigerian Stock Exchange All-Share Index (NSE-ASI) fell by -2.57% last week, with a gain of 27.18% year-to-date. Last week, BUA (+2.79%), Airtel Africa (+2.06%) and Lafarge Africa (+1.66%) closed positive while Oando (-19.75%), FBN Holdings (-12.12%) and Sterling Bank (-11.42%) closed negative. See Model Equity Portfolio on page 3.

CBN likely to leave MPR at 11.50%

Last week Naira fixed-income rates fell to new lows and the one-year Treasury Bill yield rose only slightly after significant declines in recent months. The mechanics of these interest rate moves are well-understood. In October 2019 most Nigerian institutions and companies were barred from bidding for new CBN open market operation (OMO) bills – a market of N14.2 trillion (US$36.8bn) at the time. As their OMO bills matured this year they have had little alternative but to buy Federal Government of Nigeria (FGN) bills and bonds – the FGN T-bill market was worth just N2.4 trillion a year ago. Money flowed from the large market into the smaller one and yields shrank.

How will this factor affect the CBN Monetary Policy Council’s decision on the headline Monetary Policy Rate (MPR) which is due tomorrow, Tuesday 24 November? The MPC cut the MPR from 12.50% to 11.50% at its last meeting in September. That cut signalled its approval of low market interest rates and its preference for stimulating economic growth over managing inflation (October: 14.23% y/y). In fact, the MPC communique stated that it sees structural factors (such as poor infrastructure) as causing inflation, less so monetary policy.

And the CBN can argue that its policy is successful. Credit to the private sector is sharply up this year and the FGN has been able to finance its deficit at low-interest rates. GDP was down 3.62% year-on-year in Q3, but this is much better than the negative 6.10% y/y print for Q2 and implies full-year performance better than the IMF’s estimate of negative 4.30% development for 2020.

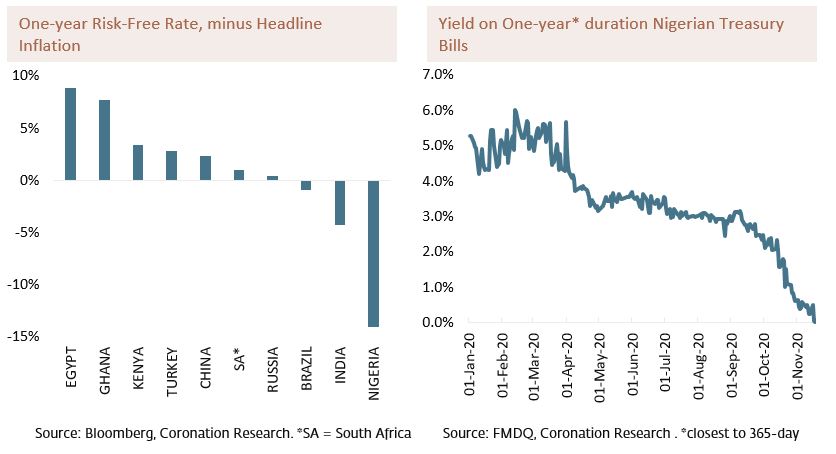

Nigeria now resembles certain developed markets, such as the US, Japan and the EU, where short-term interest rates are either very low or negative. In the US the 1-year T-bill yield is 0.10% (inflation: 1.2%), in Japan it is -0.16% (inflation: -0.4%) and in the Eurozone the interbank rate is -0.48% (inflation -0.3%). However, Nigeria is not a developed market. Most markets outside the developed world have interest rates above inflation. In the table, we show one-year risk-free rates minus inflation for the BRIC countries (Brazil, Russia, India and China) and selected African markets. Some markets have interest rates much lower than inflation, but they are not as extreme as Nigeria.

Nevertheless, we still expect Nigeria to pursue this unorthodox policy for a while, if only because its pro-growth strategy is (arguably) working. To this end, we believe the MPC will keep its 11.50% MPR rate. Though it could be tempted to further signal its intention to keep rates low with a further rate cut (a token 0.50% cut in the MPR, for example), we believe that the recent rise in inflation (from 13.71% y/y in September to 14.23% in October) will temper its enthusiasm.

Model Equity Portfolio

These are tense times in the Model Equity Portfolio department. We contend with a volatile market. Two weeks ago the market rose 12.97% and last week it fell by 2.57%. Every day we see stocks moving wildly, often stocks that we seldom look at. There prompt fears that we are missing out on the action (earlier we did, in Flour Mills of Nigeria and Dangote Sugar, alas). And we see the value of stocks in which we have notional positions, like FBN Holdings, fall by 12.1% in a week.

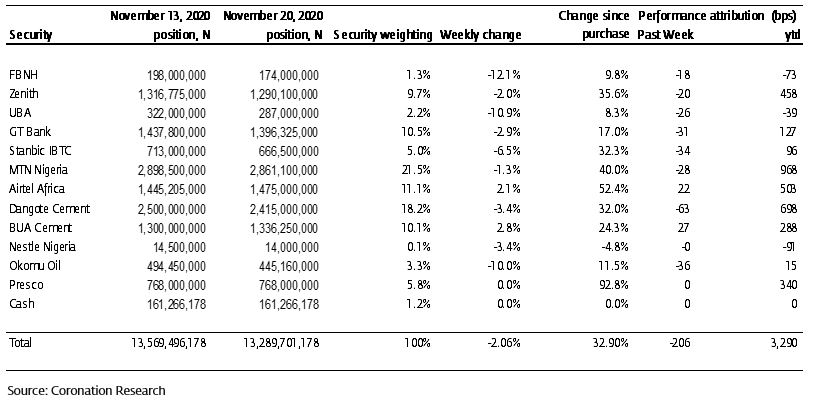

So, it is a relief to find that the Model Equity Portfolio outperformed last week. Last week the Model Equity Portfolio fell by 2.06% compared with a fall in the Nigerian Stock Exchange All-Share Index (NSE-ASI) of 2.57%, therefore outperforming it by 51 basis points. Year-to-date it has gained 32.90% against a gain of 27.18% in the NSE-ASI, outperforming it by 572bps.

Model Equity Portfolio for the week ending 20 November 2020

Our outperformance last week was caused by remarkable falls in several bank stocks (e.g. FCMB Group, Fidelity Bank and Sterling Bank) and one oil company (Oando) in which we do not have notional positions. These four stocks have small index weights but the quantum of their stock price moves had a negative effect on the index.

Flour Mills of Nigeria and Dangote Sugar, two stocks in which, arguably, we should have had positions over the past three months (they did well) also fell heavily last week. This means that there may be opportunities to take notional positions in them when we complete our research and if we become comfortable with their fundamentals and valuations. We look for a sustainable RoE above 20.5% and long-term sales growth above the rate of inflation (see Coronation Research, Navigating the Capital Markets: the Investor’s Dilemma, 14 July 2020).

As was the case two weeks ago, we were grateful for our neutral notional positions in large index-neutral stocks, notably Airtel Africa and BUA Cement, which both rose. We plan no changes in the Model Equity Portfolio this week.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.