Summary

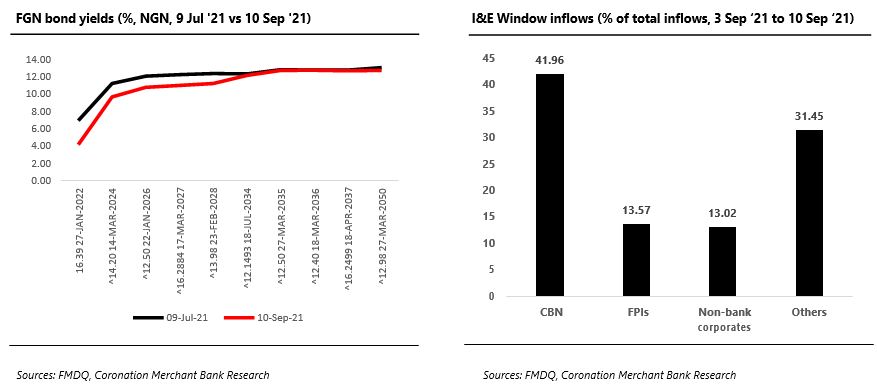

- Opening market liquidity was reported at NGN68.1bn on Friday (10 Sep ‘21). Overnight and repo rates closed within a range of 14.5-16.0%. The secondary market for NTBs was largely bearish due to the increased supply of NTBs and OMO bills from the auctions in the past weeks. As a result, the average NTB yield rose by 30bps w/w to close at 4.9%, the average yield for OMO bills also rose by 17bps w/w to close at 2%. The secondary market for FGN bonds was also bearish in response to the increase in rates at the primary market auction. As a result, the average yield increased by 5bps to close at 11.1%. At the Eurobond market, the average yield of the sovereigns under our coverage also increased by 7bps to 5.8% w/w.

- Last week, the CBN offered NGN138.2bn and allotted NGN209.5bn worth of NTBs to market participants as it maintained the stop rates across two of the three tenors (91-day: 2.5%, 182-day: 3.5%, and 364-day: 7.2% previously 6.8%).

- The European Central Bank (ECB) voted to keep its key interest rates unchanged and continue to conduct net asset purchases under the Pandemic Emergency Purchase Programme (PEPP), but at a moderately slower pace. China’s consumer price index (CPI) declined to 0.8% y/y in August, after a 1.0% y/y rise in July. The slowdown in China’s headline inflation is partly driven by a decline in food prices, which declined by 1% y/y in August compared with 3.7% in July. The price of pork, a staple meat in China, slumped by 44.9% y/y.

Repo rates and NTB yields (%)

| Repo | Current | Previous | NTB | Current | Previous |

| Overnight | 14.5 | 13.5 | NTB 25/11/21 | 3.51 | 3.20 |

| 30D | 14.5 | 10.0 | NTB 24/02/22 | 4.45 | 4.33 |

| 90D | 16.0 | 12.5 | NTB 26/05/22 | 5.71 | 6.61 |

| 180D | 16.0 | 13.0 | NTB 14/07/22 | 6.46 | 6.68 |

| OBB | 14.0 | 13.0 |

FGN bonds and Eurobonds

| Security | Price (close) | Yield (close, %) | Change (bps) |

| 16.39% FGN Jan’22 | 104.52 | 4.16 | 15 |

| 14.20% FGN Mar’24 | 109.90 | 9.67 | -24 |

| 12.50% FGN Jan’26 | 105.85 | 10.78 | 38 |

| 16.2884% FGN Mar’27 | 121.38 | 11.01 | -12 |

| 13.98% FGN Feb’28 | 112.48 | 11.21 | -4 |

| 12.15% FGN Jul’34 | 99.97 | 12.15 | 11 |

| 12.50% FGN Mar’35 | 98.58 | 12.72 | 47 |

| 12.40% FGN Mar’36 | 97.75 | 12.74 | 48 |

| 16.2499% FGN Apr’37 | 124.17 | 12.66 | 39 |

| 12.98% FGN Mar’50 | 101.92 | 12.73 | 10 |

| 6.38%FGN ’23 USD | 106.22 | 2.86 | 7 |

| 8.75% FGN ’31 USD | 113.13 | 6.82 | 7 |

| 7.88%FGN ’32 USD | 107.33 | 6.88 | 11 |

| 7.63% FGN ’47 USD | 99.70 | 7.65 | 9 |

| 10.50% Access ’21 USD | 100.48 | 5.35 | 10 |

| 7.38% Zenith ’22 USD | 103.04 | 3.01 | 1 |

| 7.75% UBA ’22 USD | 103.22 | 3.26 | -4 |

FX dynamics

Last week, the NAFEX rate depreciated by 0.1% or NGN0.5 to close at NGN412.0/USD. However, the Naira depreciated by 2.83% or NGN15.0 in the parallel market to close at NGN545.0/USD. The depreciation can be partly attributed to fx scarcity in the parallel market and ongoing speculative trading in the same market. As a result, the gap between the I&E window and parallel market rate now stands at 32.3%. In the forwards market, the rate appreciated at the 1-month (0.1% to NGN412.75/USD) and 3-month (0.1% to 417.31/USD) contracts.

Based on data from the FMDQ, NAFEX turnover showed a w/w decline of USD39m from USD127.5m to USD88.4m on Friday (10 Sep ’21). The I&E window (NAFEX) recorded inflows of USD549m with the CBN accounting for 41.96%, the FPIs accounting for 13.57%, non-bank corporates accounting for 13.02%, and others accounting for 31.45%.

Over the past week, Nigeria’s external reserves increased by 1.5% to USD34.8bn (as at 9 Sep ‘21). We maintain our view that the FGN’s imminent Eurobond issuance and the allocation from the International Monetary Fund’s (IMF) Special Drawing Right (USD3.4bn) are likely to shore up fx reserves. Amidst these developments, we expect the NAFEX rate to trade range-bound (NGN410.00/USD – NGN415.00/USD) in the near term.

Team

E-mail: coronationresearch@coronationmb.com

Tel: +234 (0) 1-2797640-43