From mid-March through to the beginning of this month, the Federal Government of Nigeria (FGN) bond market was a one-way bet, with yields tightening and prices moving up steadily. Two weeks ago the market cracked, with a brief sell-off, which was a reminder that prices can go down. However, it seems that institutional liquidity is set to increase, and more bond-buying may emerge in the weeks and months ahead. This is dangerous, in our view, and stores up trouble for the future. As we argue in Coronation Research: Navigating the Capital Market, 14 July, diversification of asset classes, and of risk in general, is called for. See details below…

FX

Last week, the reserves of the Central Bank of Nigeria (CBN) saw a slight decrease, falling by US$32.03m to US$35.62bn with the CBN promising to resume supply of FX to BDCs (Bureau de Change) as soon as international flights resume. The NAFEX rate (also known as the I&E window rate and the interbank rate quoted on Bloomberg) closed at N386.5/US$1, broadly flat on the week. In the parallel market (or street market) US dollars were offered at N475/US$1, a rate which has proven stable for two weeks. Although volume in the parallel market cannot be measured, recent stability of the N475/US$1 rate suggests a degree of demand for Naira at this level.

Bonds & T-bills

Last week the secondary market yield for an FGN Naira bond with 10 years to maturity decreased by 60 basis point (bps) to 8.08%, and at 3 years increased by 169bps to 5.59%. The annualised yield on 300-day T-bill remained unchanged at 2.95% while the yield of a CBN Open Market Operation (OMO) bill with similar tenure decreased by 31bps to 4.25%. The Nigerian Government T-bill August auction was oversubscribed. A total subscription of N118bn (US$311m) was recorded while the Debt Management Office (DMO) sold N56bn (US$149m) worth of T-bills across different maturities. Our sense is that institutional liquidity remains strong and that FGN bonds will remain firm.

Oil

The price of Brent crude increased by 0.09% last week to US$44.80/bbl. The average price, year-to-date, is US$42.44/bbl, 32.12% lower than the average of US$64.20/bbl in 2019. Even though a shadow still hangs over demand, oil prices seem to have a new standing around $45/bbl. Last week, the IEA (International Energy Agency) reduced its 2020 demand forecast by 140,000b/d, its first downgrade in months. This is attributable to reduced demand in aviation, as Covid-19 cases are increasing in some countries. We expect prices to remain stable going into next week’s OPEC+ meeting.

Equities

The Nigerian Stock Exchange All-Share Index (NSE-ASI) gained 0.63% last week. The year-to-date return is negative 6.12%. Last week Cadbury Nigeria (+12.88%), Nigerian Breweries (+12.50%) and Unilever Nigeria (+11.61%) closed positive, while Honeywell Flour Mills (-9.52%), International Breweries (-9.52%) and Sterling Bank (-1.67%) closed negative. The sectoral performance was negative except for the industrial index. See page 3 for the Model Equity Portfolio.

Cracks in the bond market?

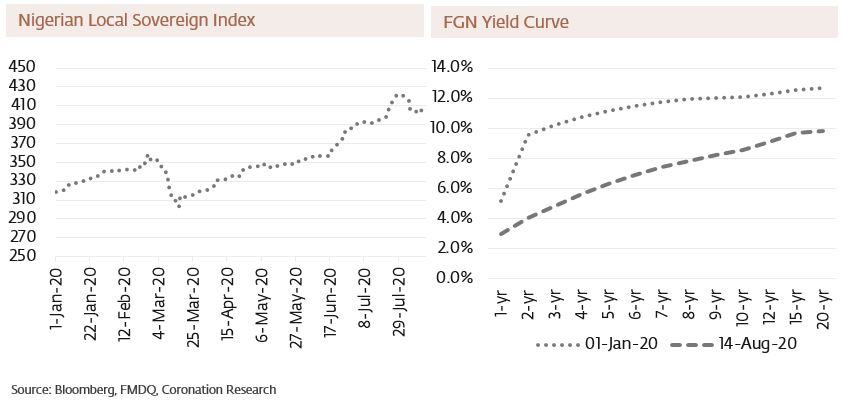

Two weeks ago we wrote about the risks of being exposed to long-dated Naira-denominated bonds, at least in terms of mark-to-market risk. During the following week, the Nigerian Local Sovereign Index fell 4.2%, before rallying by 1.1% last week.

The problem, in our view, is that bond rates have fallen sharply this year so that no Federal Government of Nigeria (FGN) bond yields anything close to inflation at 12.82% year-on-year (for July). At the end of last week, a 20-year FGN bond yielded 9.82%, having yielded 12.67% back in January.

What caused the sell-off two weeks ago? It seems that some pension funds, facing an unexpected realisation of liabilities, sold bonds. If that is the correct explanation, then it is unlikely that the bond market has turned decisively downwards. An index of the value of Naira bonds is up 27.9% this year and is still trending upwards.

As is well-known, the flow of redeemed Open Market Operation (OMO) bills, flowing into pension funds and other institutions, is landing up in the Treasury bill (T-bill) and FGN bond markets. When the OMO and FGN markets were split, last October, the OMO market was six times the size of the T-bill market. Coming up this September is OMO redemptions worth some N1.2 trillion (US$3.1bn). Some of this, owned by Nigerian funds and institutions, is likely to end up in the T-bill and FGN bond markets again.

This suggests that the FGN bond market will continue to rally. But this would be dangerous. In our view, an instantaneous rise in short-term interest rates – to somewhere close to the rate of inflation – would crash the value of long-dated bonds, causing mark-to-market losses, and damaging confidence in Fixed Income funds (which grew by 59.7% in the first six months of 2020).

As we argue in Coronation Research: ‘Navigating the Capital Market: the Investor’s Dilemma’, 14 July, portfolio managers need to think about diversifying their holdings across durations and across asset classes.

Model Equity Portfolio

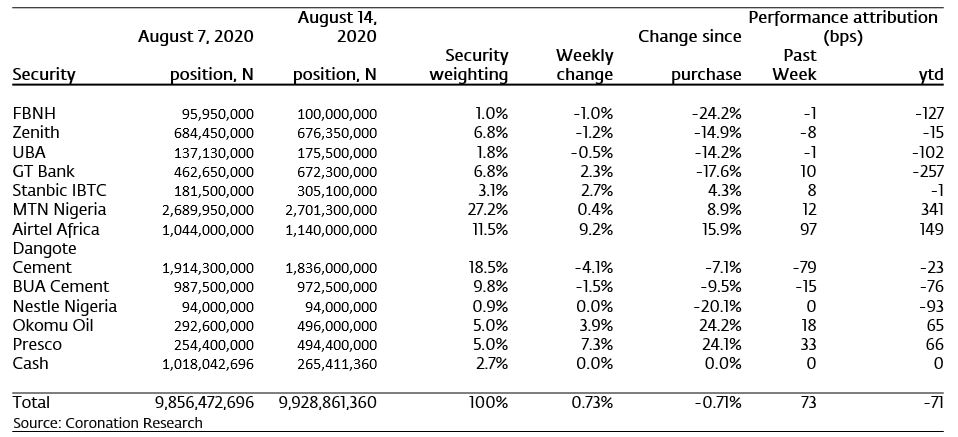

Last week the Model Equity Portfolio rose by 0.73%, compared with a rise in the Nigerian Stock Exchange All-Share Index (NSE-ASI) of 0.63%, therefore outperforming it by 10 basis points. Year-to-date it has lost 0.71%, against a loss of 6.12% in the NSE-ASI, outperforming it by 541bps.

We were surprised to outperform last week, given that a number of stocks which we do not own rallied strongly. These included: Cadbury Nigeria (+12.8%); Nigerian Breweries (+12.5%); Unilever Nigeria (+11.6%); Seplat (+10.0%); and Guinness Nigeria (+9.2%). We generally do not like the consumer-facing industrials and fast-moving consumer goods companies, as explained in our report last year Coronation Research, Power the Price Point (May 2019); nor do we like brewers. Fortunately for us, the stocks of these companies no longer form a significant part of the index, so not owning them during a rally did not have much ill effect.

By contrast, our notional positions in palm oil and rubber producers Presco and Okomu Oil did well last week, as did our overweight notional position in MTN Nigeria.

Model Equity Portfolio for the week ending 14 August 2020

Last week we wrote that we would increase our notional positions in FBN Holdings, UBA, GT Bank and Stanbic IBTC, which we did, taking our overall position in the banks from 15.8% to 19.4% of the portfolio with notional trades during the week. And last week we wrote that we would increase our positions in Okomu Oil and Presco, which we did, taking our overall position in those two stocks from 5.5% to 10.0% of the portfolio. We have no changes in the Model Equity Portfolio planned for this week.

At the same time, we need to reflect on the shape of the portfolio as it has emerged over the past couple of months. We have a lot of nearly-neutral notional positions, relative to the index, notably Airtel Africa (which rallied strongly last week), Dangote Cement and BUA Cement, while we have an overweight position in MTN Nigeria and, overall, a close-to-neutral position in the banks. If we wish to continue outperforming, we may have to position ourselves further away from the index, and we must start figuring out how to do this.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.