Last week the Central Bank of Nigeria (CBN) surprised the market by cutting its policy rate from 13.50% to 12.50%, a clear signal that it approves of market interest rates (see sidebar) that are all below inflation. The CBN’s idea is to avert a recession with a monetary stimulus after a weak GDP print (growth of 1.87% y/y for Q1). Clearly, the CBN is relaxed about the currency, given recent inflows into its FX reserves, even though the parallel rate is well above the interbank rate. Meanwhile, recent forecasts from the International Monetary Fund (IMF) suggest starkly different outcomes for different countries’ economic planning over the coming two years. Read more below …

FX

Last week, the Naira appreciated by 2.17% against the US dollar in the parallel market to close at N450/US$1. In the NAFEX market, it appreciated by 0.30% to N387.60/US$1. We think that the rally may is due to the improved liquidity in the foreign exchange market due to the intervention of the Central Bank of Nigeria (CBN), as well as the continued accretion of the CBN’s FX reserves, which now stand at US$36.5bn. Despite improved liquidity in the foreign exchange market, the volatility of the market is expected to continue as the demand for dollars by importers and manufacturers puts pressure on the Naira, in our view.

Bonds & T-bills

The secondary market yield for a Federal Government of Nigeria (FGN) Naira bond with 10 years to maturity declined last week by 37bps to 10.82%, and at 3 years fell by 79bps to 8.38%. The annualised yield on 258-day T-bill, declined by 1bp to 3.06%, while a CBN Open Market Operation (OMO) bill with similar tenure closed at 6.48%, 1bp down week-on-week. Last week, the Monetary Policy Council (MPC) of the Central Bank of Nigeria (CBN) cut the Monetary Policy Rate (MPR) by 100bps, in our view, we do not expect the reduction to lead to any adjustment in the fixed income market because the MPR is far in excess of market rates.

Oil

The price of Brent crude rose by 0.57% last week to US$35.33/bbl. The average price, year-to-date, is US$42.39/bbl, 33.98% lower than the average of US$64.20/bbl in 2019, and 40.88% lower than the average of US$71.69/bbl in 2018. Oil prices rallied slightly last week as the Organization of the Petroleum Exporting Countries (OPEC) is considering meeting this week to discuss whether to extend record production cuts beyond the end of June. These cuts, along with improved global oil demand, have supported recent price gains, but renewed tension between the USA and China and recent riots in major US cities may impact oil prices negatively.

Equities

The Nigerian Stock Exchange All-Share Index (NSE-ASI) gained 0.25% last week. The year-to-date return is negative 5.86%. Last week Guinness Nigeria (+12.68%), Cadbury Nigeria (+10.19%), Stanbic IBTC (+9.98%), Nigerian Breweries (+9.62%) and PZ Cussons (+6.08%) closed positive, while Ardova Oil (-10.00%), Dangote Cement (-7.33%), UBA (-2.21%), FCMB Group (-1.66%) and International Breweries (-1.04%) closed negative. The market is in full spate, we may soon have to revise our market call: this looks like a recovery in earnest.

Shifts in economic power

This time last week the National Bureau of Statistics (NBS) released the GDP print for Q1 2020, with growth at 1.87% year-on-year compared with 2019’s full-year growth rate of 2.27% y/y. We examine the data, and the outlook, in Coronation Research, Nigeria GDP – Sliding into recession, 29 May 2020. We also examined the IMF’s forecasts of growth in order to put Nigeria into a global context.

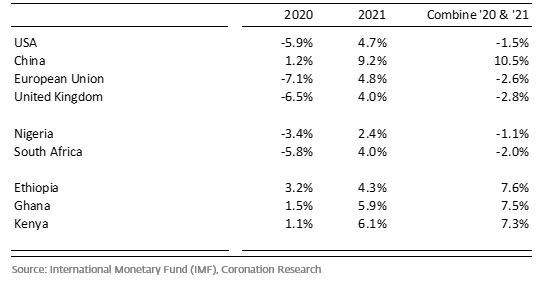

We were struck by the enormous variables in the IMF’s forecasts for different economies in 2020. And then we realised that by combining the IMF’s 2020 and 2021 forecasts we could derive some spectacular two-year forecasts. The picture that emerges is one of China pulling far ahead of the US and Europe.

In Africa, the IMF sees a shift in relative economic power which is no less dramatic than the global outlook. The two largest economies, Nigeria and South Africa, are forecast to contract over the two years 2020 and 2021, while the mid-size economies of Ethiopia, Ghana and Kenya are forecast to expand quickly.

IMF GDP forecasts for selected nations in 2020 and 2021

This is not to say that Ethiopia, Ghana and Kenya can overtake Nigeria any time soon. The economies of Kenya and Ethiopia are less than a quarter the size of Nigeria, Ghana is a little over a tenth the size of Nigeria. However, these differences in growth rates do suggest that Foreign Direct Investment (FDI) into Africa is likely to seek out Ethiopia, Ghana and Kenya over the coming years, preferring these destinations to low-growth economies.

Of course, we are only looking at one set of forecasts here. The Monetary Policy Council (MPC) of the Central Bank of Nigeria (CBN) issued a communique last week to accompany its decision to cut the Monetary Policy Rate (MPR) from 13.50% to 12.50%. It pointed out that the Organisation for Economic Co-operation and Development (OECD) has rosier forecasts for the global economy than the IMF. And the communique argues that Nigeria itself may be able to avoid a recession in 2020 (though not a slowdown in Q2 2020) with a sufficient degree of fiscal and monetary stimulus – hence the cut in the MPR.

Our own view is that Nigeria is likely to enter a recession (defined as two successive quarters of negative growth) in 2020, though much will depend on how quickly oil prices bounce back from their lows and how high they settle after the rebound. The IMF’s forecasts seem reasonable at this stage.

Whatever the precise outcomes, it is striking how the of fates different countries may vary as they negotiate their way through the COVID-19 pandemic. The crisis, it appears, is exposing relative strengths and weaknesses in economic planning.

Model Equity Portfolio

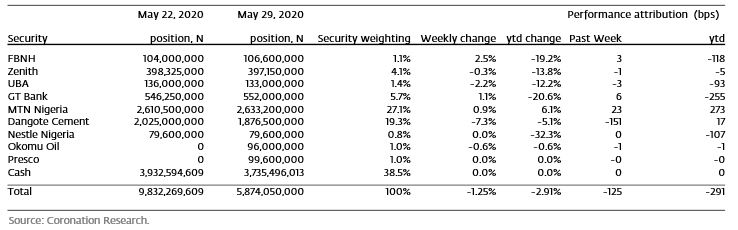

Last week was a short but complicated week for the Model Equity Portfolio. There were only three trading sessions. Dangote Cement went ex-dividend, with a dividend of N16.0 per share, so the ex-dividend price should have been N134.0/s, but by the end of the week, it had moved from N150.0/s to N139.0/s. So, despite appearances, it went up by N5.0/s, not down by N11.0/s.

Next BUA Cement. We do not hold a notional position in it because its return on equity (RoE) generally falls short of the 21% which we look for and, for our purposes, it does not have the visibility to make us comfortable with its story at the moment. However, it is 10.9% of the Nigerian Stock Exchange All-Share Index (NSE-ASI) and when it gains 6.8% in a week it has an effect on the NSE-ASI (+0.7%, to be precise). We just have to live with that, for now.

Last week the Model Equity Portfolio lost 1.25%, compared with a rise in the Nigerian Stock Exchange All-Share Index (NSE-ASI) of 0.25%, therefore underperforming by 150 basis points. Year-to-date it has lost 2.91%, against a loss of 5.86% in the NSE-ASI, outperforming it by 296bps. At a later date, we will make a parallel calculation to include the effects of dividends (when they are paid) and compare this with a total return index, which is appropriate.

Model Equity Portfolio for the week ending May 29 2020

Our intention last week was to increase our national positions in bank stocks. However, we usually make notional purchases at prices prevailing mid-week, which in this case would have meant Thursday. There was a sharp rally on Wednesday (the first trading day of the week) and, from our experience earlier in the year, we do not chase sharp rallies. We still wanted to make a notional purchase in Stanbic IBTC but the stock was too scarce to do this. We began building notional positions in Presco and Okomu Oil, as these were not rising and it appeared that a small amount of stock was available.

We will again look for opportunities to increase our bank positions this week and add Stanbic IBTC to them. Some share price charts (BUA Cement, for example) look like the profile of a staircase, which is a little unsettling. Caution will be our watchword.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.