Last week, in a surprise announcement, the CBN governor halted the sale of the apex bank’s FX to Bureau De Change (BDC) operators. The statement, and reasons given for the action, gave us a feeling of déjà vu – the CBN did this in 2016. So, we took a trip down memory lane and explored the impact of the policy back then and discussed what it could mean for today’s markets. Read details below.

FX

Last week, the exchange rate at the Investors and Exporters Window (I&E Window) appreciated by 0.01% to close at N411.44/US$1. On the other hand, in the parallel (or street) market, the naira weakened by 2.18% to close at N515.00/US$1. In the last MPC meeting, the CBN governor, Godwin Emefiele, announced the discontinuation of the weekly allocation and sale of foreign exchange to Bureaux De Change (BDC) operators and an end to the processing of licenses for new BDCs. He accused them of rent-seeking and of “engaging in the illicit graft of dollarising the Nigerian economy”. The initial response of the parallel market to the ban on Wednesday, 28 July, was a 3.96% decline in naira in the parallel market to N525/US$1. However, since the initial jump, the naira has since settled lower at N515/US$1. Currently, the gap between the I&E window and the parallel market stands at 25.17%. The CBN’s reported FX reserves rose by 0.39% to US$33.38bn. Amidst the recent developments, we expect the parallel rate and the I&E Window rates to continue to be under pressure over the months to come.

Bonds & T-bills

Last week, trading in the secondary market for FGN bonds was mixed with a bullish tilt. The yield of an FGN Naira-denominated bond with 10-years to maturity was up by 9bps to 12.65%, the yield on the 7-year bond was also up by 17bps to 12.50%, while the yield on the 3-year bond fell by 26bps to 10.82%. The overall average benchmark yield fell by 2bps w/w to close at 12.07%. Selloffs were focused at the mid segment of the curve, while demand was seen at the short and long ends of the curve.

Activities in the Treasury Bill (T-bill) secondary market was bullish. The annualised yield on a 349-day T-bill in the secondary market fell by 2bps to 8.85%, while the yield on a 221-day OMO bill fell by 4bps to 8.91%. While the average benchmark yield for T-bills fell by 100bps w/w to close at 5.90%, the average yield for OMO bills rose by 12bps w/w to close at 8.69%. Selloffs were concentrated at the mid and long ends of the OMO curve, while demand was strong across the entire T-bill curve as investors who lost out on the NTB primary auction returned to the secondary market to cover lost bids. At the primary auction held on Wednesday, the CBN allotted N265.24bn in instruments across all tenors. The stop rates on the 91-day bill (2.50%) and the 182-day bill (3.50%) remained unchanged from the previous auction, while the stop rate on the 364-day bill fell by 47bps to 8.20%. The auction recorded a total subscription of N452.9bn, with a bid-to-cover ratio of 1.7x (3.8x at the previous auction). We expect a slight uptick in yields in the T-bill secondary market this week in the absence of any significant inflows to boost liquidity.

Oil

The price of Brent crude rose by 3.01% last week to close at US$76.33/bbl, showing a 47.36% increase year-to-date. The average price year-to-date is US$66.60/bbl, 54.11% higher than the average of US$43.22/bbl in 2020. Oil prices rose last week due to the fall in US inventories and as concerns over the delta variant’s impact on global fuel demand eased. On the back of favourable supply and demand dynamics, we reiterate our view that the price of Brent oil is likely to remain well above the US$60.00/bbl mark for several months.

Equities

The NGX All-Share Index (NGX-ASI) was down by -0.31% last week. Consequently, the year-to-date return fell to -4.28%. BUA Cement -4.23%, Guaranty Trust Holdco -3.72%, and Honeywell Flour Mills -3.45% closed negative while Oando +23.17%, Lafarge Africa +5.29%, and Dangote Sugar +4.82% closed positive last week. Sectoral performances were broadly bearish; the NGX Industrial index -1.32% was the biggest loser, followed by NGX Insurance index -1.12%, the NGX Banking index -0.95%, and the NGX 30 -0.60%. Conversely, the NGX Oil and Gas +3.84% and NGX Consumer Goods +0.60% closed the week in the green. See Model Equity Portfolio below.

FX Policy déjà vu

In the last monetary policy committee (MPC) briefing held on 27 July, the CBN Governor, Godwin Emefiele, announced that the CBN would discontinue the weekly allocation and sales of foreign exchange to Bureau De Change (BDC) operators. The Governor also stated that the bank would no longer process licenses for new BDCs. The apex bank accused BDC operators of engaging in graft and becoming a conduit for illicit financial flows and money laundering. Subsequently, the CBN will channel weekly allocations of dollar sales to commercial banks to meet legitimate FX requests – personal travel allowance (PTA), business travel allowance (BTA), tuition fees, medical payments, SME transactions, among others – in an attempt to maintain the country’s foreign exchange reserves (currently at US$33.38bn).

The most common reaction is a feeling of déjà vu, given that the CBN had on 11 January 2016 made a similar announcement banning the sale of foreign exchange to BDCs. The apex bank stated at the time that “operators in this segment have not reciprocated the Bank’s gesture to help maintain stability in the market”. As a result, the naira, which was already under pressure due to the decline in oil prices and the depleting foreign reserves, maintained a steady downward trend in the parallel market – parallel market rates spiked by 3.55% following the announcement. In a bid to salvage the dire situation, the CBN reversed its position and resumed the sale of dollars to BDCs in November 2016, 10 months after the ban. Within the period, the naira weakened by 42.1% in the parallel market and the spread between the official and parallel rates widened from 38.1% to 54.0%. The CBN hoped that resuming sales would help to drive down, or at worst stabilize, the parallel rate. Unfortunately, that was not the case, as the rate continued its upward trajectory, peaking at N520/US$1 in February 2017.

Similar to 2016, this time, the initial market response to the ban was a 3.81% decline in naira in the parallel market to N525/US$1. However, since this initial decline, the naira has witnessed two days of successive appreciations, closing at N515/US$1 on Friday. The Committee of Bank Chief Executive Officers has predicted that the exchange rate to the U.S dollar will recover to at least N423/US$1. The Committed stated that the banking industry is ready to begin foreign exchange sales to customers and that banks are better equipped than BDCs, to meet customers’ forex needs.

In the short term, we expect the pressure on the parallel rate to persist, as regular individuals and businesses who do not meet the narrow criteria to access funds through the banks and the I&E window are likely to resort to the parallel market. Consequently, the spread between the I&E rate and the parallel market rate could continue to expand.

Model Equity Portfolio

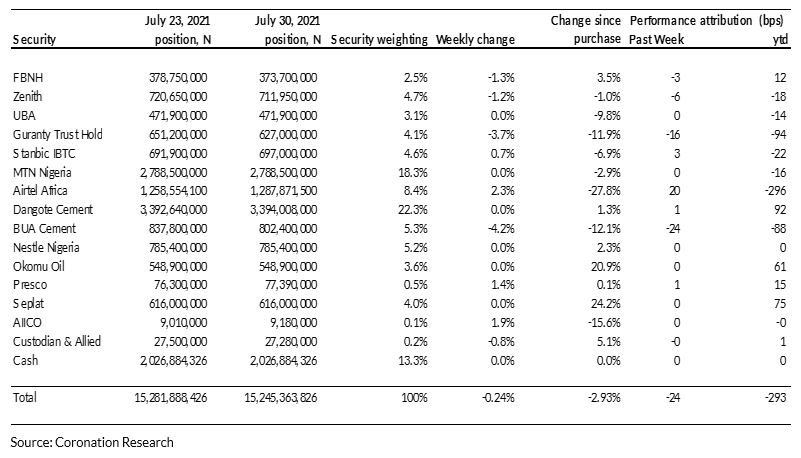

Last week the Model Equity Portfolio fell by 0.24% compared with a fall in the NGX Exchange All-Share Index (NGX-ASI) of 0.31%%, therefore outperforming it by 7 basis points. Year to date it has lost 2.93% against a loss in the NGX-ASI of 4.18%, outperforming it by 135bps.

Model Equity Portfolio for the week ending 30 July 2021

We made no notional sales or purchases during the week. This week we will seek to neutralise (i.e. take our notional exposure to close to index-neutral weights) in the four big index weights, namely Dangote Cement, Airtel Africa, MTN Nigeria and BUA Cement and we will adjust our notional cash position accordingly.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.