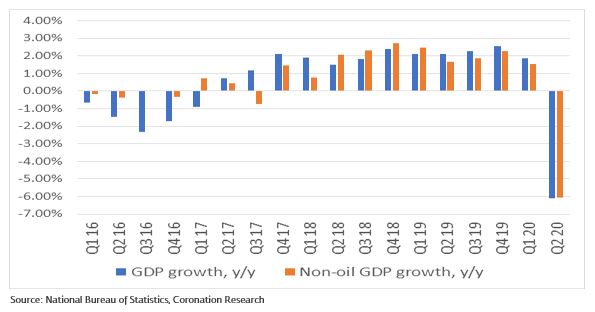

Nigeria’s Q2 GDP performance was released this morning, with GDP down 6.10% year-on-year and non-oil GDP down 6.05% y/y. This was not a surprise (although one forecast poll predicted a 4.05% decline), given that in June the World Bank forecast a 3.2% contraction and the IMF forecast a 5.4% contraction for full-year 2020, suggesting that some poor quarters lay ahead. After growth of 1.87% y/y in Q1 2020, the Q2 2020 data are consistent with Nigeria experiencing a significant recession in 2020. Q2 was weak and Q3 is likely to be weak, too. Even then, the volatility of some of the moves in GDP sub-sectors (notably Trade and Telecoms) during Q2 was surprising. See details below…

FX

The NAFEX rate (also known as the I&E window rate and the interbank rate quoted on Bloomberg) closed at N386/US$1 last week. In the parallel market US dollars were offered at N477/US$1. The CBN is reported to soon start supplying US dollars to Bureaux de Change (BDC), though we expect the CBN to guard its US$35.6bn reserve position carefully. Given reasonably liquidity in the parallel market we only expect slight pressure on the N477/US$1 rate over the coming weeks.

Bonds & T-bills

Last week the secondary market yield for an FGN Naira bond with 10 years to maturity decreased by 28 basis point (bps) to 8.76%, and at 3 years increased by 4bps to 5.63%. The annualised yield on 293-day T-bill decreased by 61bps to 2.34% while the yield of a CBN Open Market Operation (OMO) bill with similar tenure decreased by 4bps to 4.21%. With N1.2trillion (US$3.1bn) of CBN OMO bills due to be redeemed in September (and a further N1.5tn in October), we anticipate the fixed income market to be flush with money and demand for T-bills and bonds to remain strong.

Oil

The price of Brent crude decreased by 1.00% last week to US$44.35/bbl. The average price, year-to-date, is US$42.52/bbl, 32.80% lower than the average of US$64.20/bbl in 2019. Last week, the OPEC+ Joint Ministerial Monitoring Committee met virtually to discuss compliance with production cuts among member countries. The need for 100% was stressed by Saudi Arabia in order to compensate for non-compliance in May, June and July. A determined move to control supply suggests that OPEC+ is concerned about downward pressure on prices in the light of renewed fears about global Covid-19 outbreaks. Such concerns indicate that the market is a little weaker than previously thought. We think that the bounce back towards US$50.00/bbl may be delayed for several weeks if not longer.

Equities

The Nigerian Stock Exchange All-Share Index (NSE-ASI) gained 0.07% last week. The year-to-date return is negative 6.04%. Last week International Breweries (+26.32%), Unilever Nigeria (+11.60%), Dangote Sugar (+5.04%), Cadbury Nigeria (+4.70%) and Stanbic IBTC (+1.77%) closed positive, while PZ Cussons (-9.41%), Flour Mills (-6.09%), Oando (-5.24%), Guinness Nigeria (-1.30%) and Okomu Oil (-1.25%) closed negative. The sectoral performance was positive except for the Banking index. See page 3 for the Model Equity Portfolio.

GDP slumps as expected

There are few occasions when not being an industrialised nation looks like an advantage. One of them is during a global recession when a high proportion of GDP anchored in Agriculture (24.6% of Nigerian GDP) acts as a brake on economic calamity elsewhere. Nigeria’s economy contracted by 6.1%, year-on-year (y/y), in Q2 2020, but this actually looks good when compared with an industrialised nation like Germany whose economy contracted by 10.1% y/y in Q2; or a services-led economy like the UK whose GDP contracted by 20.4% y/y in Q2; or the USA whose economy is estimated to have contracted by 32.9% y/y in Q2.

The quarterly data from the National Bureau of Statistics (NBS) is eagerly awaited by analysts as it provides reliable and long-term data. We tend to concentrate on the top six sectors (Agriculture; Trade; Telecoms; Manufacturing; Oil & Gas; Real Estate) as these account for 76.3% of total GDP, but there is a wealth of other data on industry trends unavailable elsewhere.

As with almost all economies around the world (China is an exception), the scale of the GDP chart must be re-drawn to accommodate the most recent data.

Year-on-Year GDP

Is there anything surprising? We were expecting mild and continued growth from the Agricultural sector (24.6% of GDP) and it grew by 1.58% y/y. We were expecting a contraction from Trade (14.3% of GDP) and some growth from Telecoms (also 14.3% of GDP), but the volatility of these sectors surpassed our expectations. Trade fell by 16.59% y/y (a savage correction, presumably exacerbated by the shortage of foreign exchange) while Telecoms grew by 18.10% y/y (far above its trend growth rate, helped by the rise of remote working).

We also thought that Manufacturing (8.8% of GDP) would suffer very badly, but it contracted by 8.78% y/y (rather than the double-digit percentage decrease we expected), suggesting that Manufacturing is either less reliant on imported raw materials than we thought, or that manufacturers were able to use old stocks of supplies. Oil & Gas (8.9% of GDP) fell by 6.63% y/y, again less than we thought but likely reflecting the benefit of selling oil forward at prices available earlier in the year. Real Estate (5.3% of GDP) fell by 21.99%.

What does this mean for Q3? Despite the easing of lock-down (which we think was not very severe) and government efforts to stimulate the economy (but the government is only a small part of the economy), we think that broadly speaking, these trends will continue.

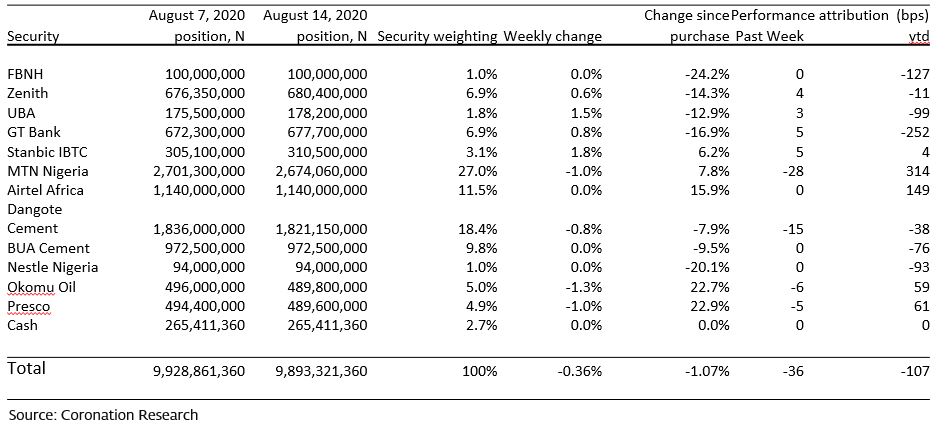

Model Equity Portfolio

Last week the Model Equity Portfolio fell by 0.36%, compared with a rise in the Nigerian Stock Exchange All-Share Index (NSE-ASI) of 0.09%, therefore underperforming it by 45 basis points. Year-to-date it has lost 1.07%, against a loss of 6.04% in the NSE-ASI, outperforming it by 497bps.

Last week’s underperformance can be explained by two factors, one of which will receive a further examination. To begin with, the performance of the NSE-ASI last week was partly attributable to the continued rise in consumer-facing industrial stocks and brewers, such as Unilever Nigeria, Cadbury Nigeria and International Breweries (we featured the early part of their rise in these pages last week). We generally do not like these sectors and are happy to leave them alone, and we do not chase stocks just because they going up.

Second, our overweight position in MTN Nigeria cost us 28bps last week. It has performed very well this year, delivering 314bps so far, but if the market does not react soon to the extraordinary Q2 performance of the telecoms sub-sector of GDP (which was already reflected in MTN Nigeria’s Q2 results announced several weeks ago) then it is difficult for us to see a catalyst to drive the price further. We will cut half the difference between our current notional weight in MTN Nigeria and a neutral weight with notional sales this week.

Model Equity Portfolio for the week ending 24 August 2020

Increasing our notional positions in Okomu Oil and Presco two weeks ago cost us 5bps in price movements last week while increasing our notional positions in FBN Holdings, UBA, GT Bank and Stanbic IBTC earned us 4bps in price movements. It is too early to tell whether this latest adjustment to our Model Portfolio is working.

Our sense is the NSE-ASI lacks a catalyst for further performance over the coming weeks, even though the banks are due to report their Q2 results within a matter of weeks. (Presumably, the market understands that their results are likely to be down, year-on-year, though not dramatically down.) There is little activity with regards to the big drivers of the market sentiment (e.g. commodities and the exchange rate). We continue our search for companies and investment themes which we believe are fundamentally sound and where valuations are attractive.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.