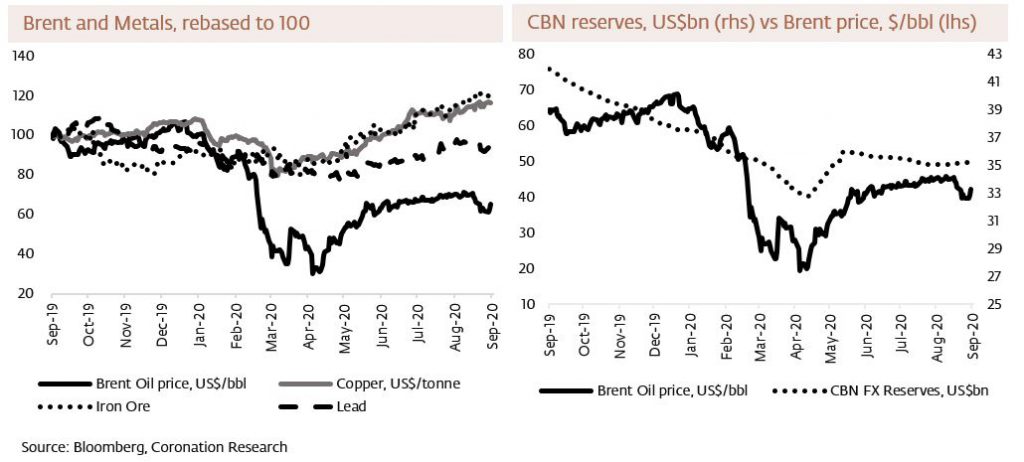

As we often write, Nigeria’s public finances – all the way from trade balances through to the Federal Government’s budget – work well when oil trades over US$50.00/bbl. We have seen some forecasts predict oil prices above US$50.00/bbl as early as Q4 this year, and indeed oil (in this case Brent) traded at around US$47.00/bbl recently. Yet last week’s meeting of the Organisation of the Petroleum Exporting Countries (OPEC) seemed to be in no hurry to deepen its production cuts to support prices. On page 2 we argue that the cartel, and its partner Russia, may bid their time before letting prices rise above US$50.00/bbl again.

FX

Last week, the FX rate in the parallel market continued downwards and closed at N465/US$1 from N455/US$1, down 2.2%. Turnover in the NAFEX market, also known as the I&E window, remains low when compared with the pre-COVID-19 period. Here the Naira closed the week down 0.8% at N384.25/US$1. Although the FX reserves of the CBN closed up marginally last week, at US$35.8bn, the problem is not the reserve level but the lack of liquidity in our view. We believe we will see moderate but sustained pressure in the exchange rate going forward.

Bonds & T-bills

Last week the secondary market yield for an FGN Naira bond with 10 years to maturity increased by 3 basis points (bps) to 9.03%, and at 3 years increased by 7bps to 3.93%. The annualised yield on 356-day T-bill increased by 16bps to 2.72% while the yield on a CBN Open Market Operation (OMO) bill with similar tenure decreased by 34bps to 2.57%. This week we expect market activities to be influenced by strong market liquidity as a total of N318.12bn (US$815.7m) is due to come into the system: N300.0bn from OMO maturities and N18.1bn from T-bill maturities. We think that, overall, rates will stay low or even come under downward pressure over the coming weeks.

Oil

The price of Brent crude increased by 8.34% last week to US$43.15/bbl. The average price, year-to-date, is US$42.57/bbl, 33.68% lower than the average of US$64.20/bbl in 2019. This appreciation in oil prices was due to a combination of the disruption of oil production in the Gulf Mexico by hurricane Sally and the extension of production cuts by OPEC and OPEC+ countries to December. Although economies are beginning to recover, the demand for oil is not yet at pre-COVID 19 levels. we think it might be difficult for oil prices to exceed US$50.00/bbl until the end of this year. See more below.

Equities

The Nigerian Stock Exchange All-Share Index (NSE-ASI) declined by 0.08% last week. The year-to-date return is negative 4.73%. Last week Sterling Bank (+2.59%), Nigerian Breweries (+2.31%), Lafarge Africa (+1.58%), Flour Mills of Nigeria (+1.54%) and GT Bank (+1.40%) closed positive, while FCMB Group (-6.36%), International Breweries (-5.71%), Cadbury Nigeria (-4.52%), Access Bank (-4.44%) and Oando (-4.17%) closed down. See Model Equity Portfolio below.

In the hands of OPEC+

Nigeria’s policymakers and her markets are watching the oil price closely. As we often write, Nigeria’s public finances work well when oil prices are above US$50.00/bbl (Brent). With prices close to US$45.00/bbl we are, along with other people, anxious about the balance of payments and government finances. When will Brent trade above US$50.00/bbl again?

Most people assume that oil prices are related to global industrial production and to global GDP. But there is more to it than that. For example, when we look at other indicators of global economic health, the price of metals, we see something very different going on.

Metal prices fell much less than oil at the onset of the Covid-19 crisis, and have since rallied – copper and iron ore are about 20% higher than one years ago. This reminds us that the oil markets’ principal players, the Organisation of the Petroleum Exporting Countries (OPEC) and Russia (collectively known as OPEC+) wanted a lower price early on in the crisis, then agreed production cuts a little later, in April. This suggests that the price crash (Brent was briefly less than US$20.00/bbl) was more than they had intended.

The declared intention of OPEC+ is to drive a proportion of US shale production out of business and to re-instate the former global market shares enjoyed by Saudi Arabia (the leader of OPEC) and Russia. Some American oil industry CEOs have responded compliantly by claiming that the US will not produce 13 million barrels per day (mbpd) again and that recovery to 11mbpd is what they expect.

But can OPEC+ be sure? It seems to us that it can move oil prices effectively with production cuts, which were agreed at a total 9.7mbpd back in April but which have since been tapered to 7.7mbpd (and extended to December at a meeting last week). If OPEC+ wants prices to move up again, in our view, it just needs to deepen production cuts. In many ways, the oil price is not so much a function of global economic recovery as the plaything of OPEC+. When it is confident that its policy objective has been achieved it may well arrange a return to prices above US$50.00/bbl. This may not happen until the end of this year, or even the beginning of next year, in our view, though naturally, we would be happy if we are proven wrong.

Model Equity Portfolio

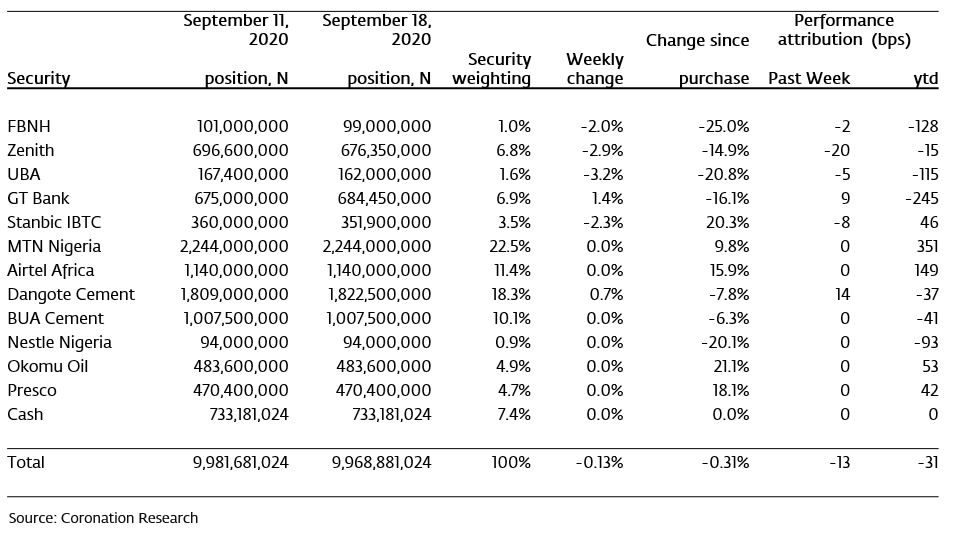

Last week the Model Equity Portfolio declined by 0.13% compared with a fall in the Nigerian Stock Exchange All-Share Index (NSE-ASI) of 0.08%, therefore underperforming it by 5 basis points. Year-to-date it has lost 0.31% against a loss of 4.73% in the NSE-ASI, outperforming it by 442bps.

On the face of it, the damage last week was done by our notional holdings in banks, and we tend to hold the more actively-traded names, even though our overall total notional position in banks is index-neutral. However, several banks went ex-dividend last week (ex-interim dividend) and it seems to us that much of the correction, therefore, was technical. We do not wish to adjust our opinions on technical grounds.

Model Equity Portfolio for the week ending 18 September 2020

In mid-August, we raised our notional position in the banks from 15.8% to 19.4%, a neutral index weight. Using our performance attribution model we can see that this decision has earned 21bps since then. Although we might like to re-consider which banks to hold (for example, FBN Holdings does not seem to have caught the market’s imagination recently) we are – so far – not persuaded to reduce our overall notional holding in this sector.

Going forward, we are experiencing smaller movements in the index overall than earlier in the year. And we are seeing smaller differences between our own performance and that of the index than we saw at the beginning of the year. This persuades us to be gentle in the management of our Model Portfolio. At this stage, it is not easy to see how large changes in allocation will be rewarded. Nevertheless, the hunt for new ideas continues and we will report back.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.