The Federal Government of Nigeria (FGN) is proposing a revised budget for 2020 which is designed to generate a deficit in the region of N5.2 trillion (US$13.5 billion), up from the previous estimate of N2.2 trillion. Normally one would expect the prospect of rising government debt to spur interest rate rises. But there appears to be a delayed reaction. First, the government continues to believe that it will finance the bulk of the deficit in foreign currencies; second, it believes that it will crowd out private-sector lending if it issues a high level of T-bill and Naira-denominated bonds. Meanwhile, the liquidity of the banking system is fair. So we do not expect significant interest rate rises this quarter, though things could change a lot later this year.

FX

Last week the Naira depreciated by 0.34% to N386.13/US$ in the NAFEX market (also known as the I&E Window, where the rate is the one quoted by Bloomberg) and by 0.24% to N416.00/US$ in the parallel market. The volatility in the Naira/US dollar rate may extend longer, in our view, given depressed oil prices, difficulty in wooing foreign portfolio investors and in issuing eurobonds. The prospect of the IMF and the World Bank supplying US dollar loans to the government is important, but these initiatives are linked to the coronavirus pandemic rather than the related oil price slump specifically. In any case, it is unlikely that loans from the IMF and World Bank would be sufficient to stem the shortfall of US dollar supply to the Central Bank of Nigeria (CBN) from the usual state (oil sector) and private sector (loans and eurobond) sources, in our view.

Bonds & T-bills

The secondary market yield for a Federal Government of Nigeria (FGN) Naira bond with 10 years to maturity declined by 45bps to 11.81%, and at 3 years increased by 5bps to 9.26% last week. The annualised yield on 300-day T-bill, the longest duration available in the secondary market, increased by 61bps to 4.04%, while a CBN Open Market Operation (OMO) bill with similar tenure closed at 12.23%, 236bps down week-on-week. This week inflows worth N267.67bn are expected from OMO maturities. We think this will lead to compression of yields even as the CBN will likely mop up excess liquidity from the system.

Oil

The price of Brent declined by 10.80% last week to US$28.08/bbl. The average price, year-to-date, is US$47.58/bbl, 25.89% lower than the average of US$64.20/bbl in 2019, and 33.64% lower than the average of US$71.69/bbl in 2018. The pressure on oil prices, despite an approximate 10.0% cut in global production, may be attributed to lack of sufficient storage facilities around the world as global demand continues to crumble amid lockdowns and travel restrictions in many countries.

Equities

The Nigerian Stock Exchange All-Share Index (NSE-ASI) advanced by 7.19% last week, the year-to-date return is negative 14.61%. Last week Nigerian Breweries (+45.72%), Nestle Nigeria (+16.48%), Dangote Cement (+16.24%) and Dangote Sugar (+15.42%) closed positive, while Ardova Oil (-10.22%), Cadbury Nigeria (-8.70%), Lafarge Africa (-8.30%) and FCMB Group (-6.43%) fell. On balance, we do not think that this will be a sustained rally like the one we saw begin in April 2017, which anticipated currency devaluation that year. All the same, we think it makes sense to increase portfolio weights in the stocks with deep value, without chasing the rally indiscriminately.

The interest rate conundrum

Usually there is a clear relationship between currency weakness and interest rates. Currencies that weaken have interest rates that go up. And usually there is a clear relationship between government deficits and interest rates. Government deficits rise and, in order to provide investors with sufficiently attractive returns, interest rates go up. However, this is not happening in Nigeria, at least not yet. The direction of interest rates, as least for the rest of this quarter, seems to be flat-to-declining, in our view.

To begin with, the Central Bank of Nigeria (CBN) created a clear distinction between the foreign investor elements in its interest rates and domestic investors when, last October, it banned most domestic institutions from buying its Open Market Operation (OMO) bills. After a few months of redemptions this has left the OMO market largely in the hand of foreigners, while rates on Naira-denominated T-bills and Naira-denominated bonds have crashed. There appears to be very limited buying of new OMO bills (or of T-bills) by foreigners at the moment, so interest rates are – for the time being – not relevant to foreign exchange rate management.

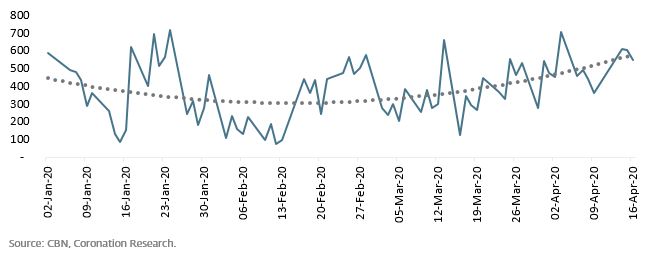

Banks closing balances y-t-d excluding outliers, billions of Naira

Next, the government believes that it should not be asking domestic institutions, including pension funds, mutual funds, insurance companies and banks, to fund the bulk of its deficit. The government’s Debt Management Office (DMO) made this clear at the beginning of the year, admittedly when the budget deficit in 2020 was envisaged to be N2.2 trillion rather than N5.2 trillion now.

A third point is that the CBN believes that the mission of the commercial banks is to lend money to customers, which of course is difficult when the challenging oil price and foreign exchange environment provide enormous headwinds to the trade sector of the economy (about 16% of GDP), the manufacturing sector of the economy (about 9% of GDP) and, of course, the oil sector (about 9%) of GDP. With 34% of the economy likely to be in recession, one cannot expect banks to make a lot of new loans.

And it is unlikely that they are making many new loans, not least because in times like these they are most likely concerned with risk management rather than with expanding risk assets. Therefore, the liquidity positions of the banks remains quite high (see chart) and this situation may continue for quite some time. Banks with an increasing supply of funds, and limited options when it comes to creating risk assets, are likely to invest in fixed income, in our view.

All the above dynamics are likely to change in a few months, assuming that Nigeria will have to fund a large part of its deficit internally and assuming that interest rates across the board will have to appeal to foreign investors (if they can be persuaded that the currency has reached a stable level). For the time being we believe that policies are likely to keep rates from rising sharply.

Model Equity Portfolio

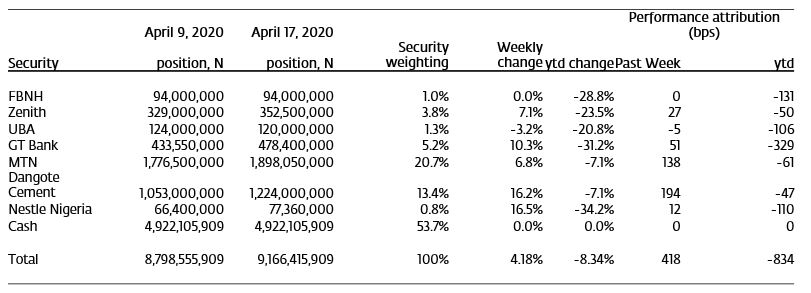

Last week the Model Equity Portfolio gained 4.18%, compared with a rise in the Nigerian Stock Exchange All-Share Index (NSE-ASI) of 7.19%, therefore underperforming by an alarming 301 basis points. Year-to-date it has lost 8.34%, against a loss of 14.61% in the NSE-ASI, therefore outperforming it by 627bps. Over the last two weeks (both of them with just four trading sessions) the NSE-ASI has risen by 8.66%. Clearly, it is difficult to keep up when we are carrying a notional cash position of 53.7%.

Understanding the nature of the rally is important when figuring out what to do next. To an extent, it was a rally inspired by other rallies in equity markets around the world and, locally, by reinvestment of recently-paid dividends. And it was a rally inspired by the fact that the NSE-ASI had earlier fallen to close to 20,000 points, and many stocks were at multi-year lows. Neither of these two factor alter the fundamentals of listed companies, nor give investors profound reasons to buy, however. Valuations are at multi-year lows, which is encouraging. A cautious investor would make some purchases at low levels with a view to holding for the medium-to-long term (in our book, two-to-five years). In other words, it makes sense to buy more of the stocks that we like, and hold less cash than before, but not to buy fast-rising stocks just because they are rising.

For example, Nigerian Breweries rallied by 43.78% last week. We are not convinced by the investment case for Nigerian Breweries (we think consumers will have limited discretionary spending for several years to come, so there is a question mark over beer and spirits sales) and a rally of 43.78% in the stock in a week does not change our minds. BUA Cement, we note, rallied by 8.33% on Friday (and contributed 160 basis points to the performance of the NSE-ASI in a single day), but that does not make an investment case for BUA Cement, in our view.

Model Equity Portfolio for the week ending 17 April 2020

The strategic question is whether this is the rally, the one that predicts (because equity markets do predict) the end of the crisis, and the one that signals the imminent return of normal (i.e. average for the cycle) valuations. It is a tough question. In early 2017 the NSE-ASI rallied strongly and consistently, starting in April, ahead of the final resolution of the currency issue in August – the equity market predicted well. But in both 2015 and 2016 (when the Naira devalued from N199/US$1 to N316/US$1) there were rallies that later reversed. The danger is that this rally does not predict the end of the crisis accurately, and that the rally in the NSE-ASI is coming too soon.

Having said this, our notional cash position is very high and it seems reasonable to buy stocks which we like (there aren’t very many of them) and which are cheap. We intend, this week, to raise our notional position in MTN Nigeria to 26.0% of the portfolio after it goes ex-dividend and to raise our notional position in Dangote Cement to close to a neutral weight of 19.0%.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.