Nigerian market interest rates are on the rise. This marks the end of the long – over a year – march south. But what next? In our view, the key determinants are how the 2021 budget deficit will be financed and how normal (given that the present interest rate/inflation mix is not normal) the Central Bank of Nigeria (CBN) wants interest rates to be. See details below.

FX

Last week the exchange rate in the NAFEX market (also known as the I&E Window and the interbank market) weakened by 0.05% to N391.74/US$1. In the parallel or street market, the Naira slid by 0.42% to close at N477.00/US$1. Going by the recent data from the Central Bank of Nigeria (CBN), FX reserves dropped to $34.8bn on Tuesday, 15 December from $35.4bn as of Friday, 27 November indicating a loss of $1.7 billion since May 29, 2020. The downward trend could continue due to increased dollar sales by the CBN coupled with depressed foreign exchange earnings from oil and non-oil receipts. However, with oil surpassing the $50.00/bbl mark, it is possible that oil receipts will be much better in the coming year. In addition, the approval of a US$1.5 bn loan facility from the World Bank constitutes a significant FX inflow that will assist to shove up reserves.

Bonds & T-bills

Last week, the secondary market yield for an FGN Naira bond with 10 years to maturity rose by 99 basis points (bps) to 6.31% and at 7 years rose by 52bps to 4.86% while at 3 years the yield rose by 83bps to 2.77%. The annualized yield on a 314-day T-bill rose by 14bps to 0.65%, while the yield on a 312-day OMO bill rose by 17bps to 0.69%. The Nigerian Treasury Bills (NTB) market started the week on a quiet note and during the week CBN auctioned an NTB offering N7.00 billion ($14.43 million) worth of notes. The 91-day note was allotted at a 0.05%, while 182-day and 364-day tenor were allotted 0.5% and 1.14% respectively. The NTB average yield closed the week at 0.41%. The CBN also conducted an OMO auction offering N60.00billion ($123.7 million) worth of notes. 91-day, 180-day, and 362-day were allotted 1.65%, 4.50%, and 6.44% respectively. The NTB average yield closed the week at 0.47%. Given the rise in yields, increased investor participation is likely. In the bond market, the Debt Management Office conducted a bond auction offering N60bn worth of bonds, however, what was allotted at the end of the auction was N30bn worth of bonds. The 15-year and 25-year papers were allotted at 6.95% and 7.05% respectively.

Oil

The price of Brent crude rose by 4.58% last week to US$52.26/bbl. The average price, year-to-date, is US$42.96 /bbl, 32.97% lower than the average of US$64.10 /bbl in 2019. Oil closed last week at over $50/bbl as the United States began vaccinating its frontline workers, but prices are on the decline again as worry about excessive supply outweighs the positive news about the vaccines and challenges come to the surface in terms of availability and distribution. OPEC revised down its forecast for oil demand for the rest of 2020 and 2021 although oil inventories are also declining thanks to strengthening demand from Asia, adding to the general optimism about oil prices next year.

Equities

Last week, the Nigerian Stock Exchange All-Share Index (NSE-ASI) rose by 7.46% with a gain of 37.12% year-to-date to close at 36,804.75. Airtel Africa (+21.00%), Dangote Cement (+14.48%) and Guinness Nigeria (+11.24%) closed positive while International Breweries (-12.67%) and Stanbic IBTC (-0.11%) closed negative. The Model Equity Portfolio will be back next week.

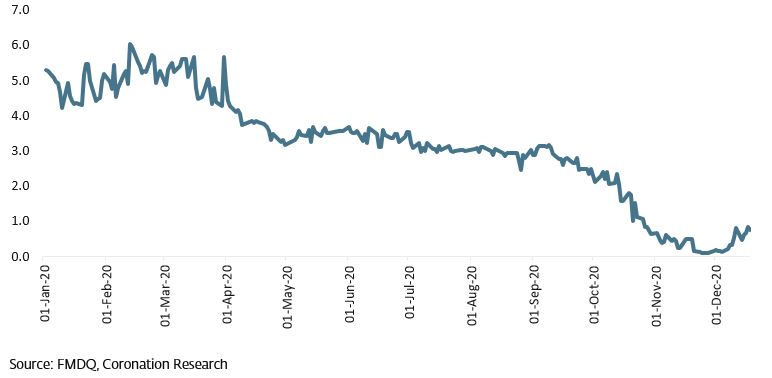

Interest rates on the rise

Two weeks ago, we asked whether the Central Bank of Nigeria (CBN) wanted to put a floor under market interest rates (Nigeria Weekly Update, Saving Interest Rates?, 7 December). Now we have an answer, namely that the effect of the CBN’s Special Bills issue (bills granted to banks in respect of their excess cash reserve ratio held by the CBN), with a yield of 0.5%, has been to support interest rates. T-bill rates have been rising for two weeks.

This is a change in the way the market sees interest rates rather than a guarantee that the CBN is in favour of raising them. The market has seen market interest rates crash this year and was wondering whether negative market interest rates would emerge. The CBN’s response was to address the liquidity issues caused by its cash reserve ratio (officially 27.5% but effectively much higher, hence the excess CRR) by issuing N4.1 trillion (US$10.5bn) of Special Bills to banks. But its 0.5% rate was, presumably, a signal to the market.

Nigerian Inter-bank Treasury Bills’ True Yield Fixings (NITTY 12M)

What options are now open to the CBN? 2021 will be another year of significant deficit financing for the Federal Government of Nigeria (FGN), with the result that, according to the draft budget, N5.2 trillion (US$13.3bn) needs to be raised. From the point of view of the government’s Debt Management Office (DMO) it is preferable to raise this at low interest rates. But, before the question of what rate is going to be achieved, it is probably advisable to ask where the money is going to come from.

In 2020 the CBN achieved effects of quantitative easing (QE) without announcing a bond-buying program. It did this (starting in October 2019) by preventing Nigerian institutions from buying new issues of its open market operation (OMO) bills, effectively reducing the size of the OMO market over time (e.g., from N9.8 trillion in January to N5.5 trillion in mid-December) and causing these funds to be diverted into the Treasury Bill and FGN Bond markets. At the same time the CRR took liquidity from the banking sector into the public sector.

This can only be done once, in our view. The OMO market cannot be run down indefinitely (part of it is foreign-owned, in any case) and the CRR cannot be raised indefinitely (the CBN has acknowledged that it causes banks liquidity problems). So, the options for financing the budget deficit in 2021 include raising interest rates to attract institutional money and, possibly, expanding the CBN’s balance sheet (as would happen in a conventional QE program). Meanwhile, while the aim of increasing bank lending has been achieved, inflation is rising, with headline inflation at 14.89% y/y and food inflation at 18.30% y/y (November). We doubt that the CBN wants to address inflation with interest rates, but it may tolerate a rise in interest rates over the coming months as a way of stabilizing public finances.