The Monetary Policy Council (MPC) of the Central Bank of Nigeria concludes its bi-monthly meeting later today. The economy may be close to exiting recession and inflation is going up (15.75% y/y in December). But we think the MPC will keep its policy rate (MPR) at 11.50%, though with increased commentary on the need to contain inflation. See details below.

FX

Last week the exchange rate in the Investors and Exporters Window (I&E Window) weakened by 0.08% to N393.79/US$1. In the parallel, or street market, the Naira depreciated by 0.42% to close last week at N477.00/US$1. The FX market remains in much the same state as it was during the last quarter of 2020, with the cash parallel market approximately 20% lower than the I&E Window and NAFEX rates. There is a prospect that rising oil prices will lead to an increase in oil-related US dollar earnings and an increase in CBN reserves, hence possibly greater liquidity in the I&E Window and NAFEX markets. However, such an outcome is several months away, in our view.

Bonds & T-bills

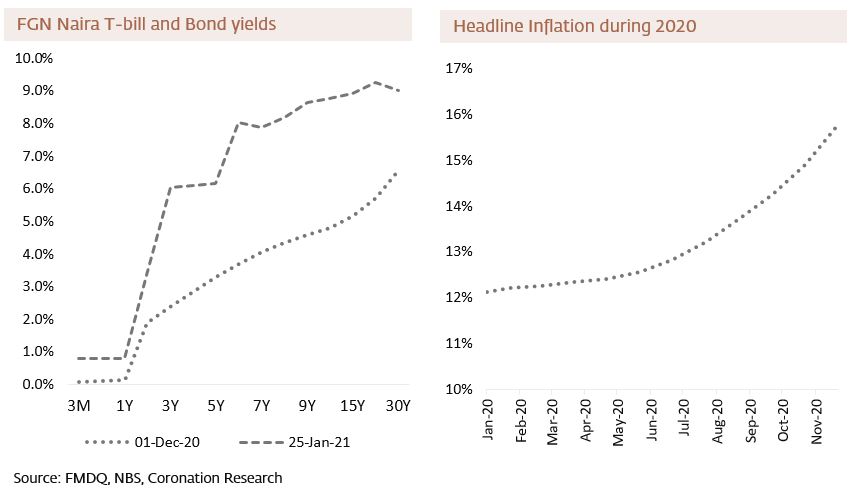

Last week, the secondary market yield for an FGN Naira bond with 10 years to maturity rose by 68 basis points (bps) to 8.38% and at 7 years declined by 28bps to 7.98% while at 3 years the yield declined by 2bps to 4.35%. The annualized yield on a 279-day T-bill declined by 4bps to 0.80%, while the yield on a 277-day OMO bill declined by 16bps to 1.39%. Last week, the Debt Management Office (DMO) offered N150bn (US$381m), attracted total bids of N238bn (US$603m), and raised N122bn (USD310m). The marginal rates on the reopened 15 and 25-year benchmarks rose for the second month, by 180bps and 195bps respectively. Although the DMO auction was oversubscribed, we sense that the market is looking for bond rates to rise further, and we think they will continue to trend up for several weeks.

Oil

The price of Brent crude rose by 1.21% last week to US$55.41/bbl. The average price to date is US$55.15/bbl, 28.2% higher than the average of US$43.22/bbl in 2020. It was reported that the OPEC+ alliance (i.e. OPEC plus Russia) achieved 99% compliance with its December (after 101% in November). In addition, Iraq plans to cut output this month, and in February, in order to make up for breaching its quotas last year. Earlier this month Saudi Arabia committed itself to reduce its own production, anticipating that the second wave of global Covid-19 infections will reduce demand. Our view is that Brent will trade in a range of between US$45.00/bbl and US$60.00/bbl during the first half of this year, but that with successful production cuts it will trend towards the upper end of this range.

Equities

The Nigerian Stock Exchange All-Share Index (NSE-ASI) fell by 0.42% last week with a gain of 1.82% year-to-date. The dominant theme was corporate activity among mid-cap listed stocks, notably Lafarge Africa and Ardova Oil. Lafarge Africa(+9.24%), PZ Cussons(+7.69%), and Ardova Oil (+3.81%) closed positive last week while MRS (-18.55%), UBA (-5.95%) and Access Bank (-5.67%) closed negative. The market remains in a bullish mood, with investors looking for reasons to buy stocks, in spite of a record 50.03% rise in the index last year and rising interest rates this year. On balance, we think the enthusiasm will endure in the short term but may wane over the coming months. See Model Equity Portfolio below.

MPC decision today

The Monetary Policy Council (MPC) of the CBN focuses on two indicators when it comes to setting interest rates. Like most central banks, it weighs economic growth against price stability. Until late 2019, and in common with many emerging nations, it also weighed the position of foreign investors in its currency, but this priority became less important as it advanced pro-growth policies from mid-2019 onwards. This leaves growth and price stability at the top of its agenda today.

Which side will it take? The argument for tackling inflation is compelling, with headline inflation not only rising consistently during 2020 but the rate of increase also rising over the year. Many central banks would be alarmed with such data. Yet the MPC has stated (in its September minutes) that it sees inflation as largely a structural issue, rather than something influenced by interest rates. And it also has expressed its belief (in its November minutes) that inflation will moderate in the first quarter of this year.

The markets are taking a different view. The huge influx of money from the redemption of CBN open market operation (OMO) bills – the key feature of Naira money markets in 2020 – is largely over. Bond investors are not the subservient price-takers that they were during 2020 and are expressing the view that rates must rise. The yield curve is much higher than two months ago and its shape is choppy, suggesting that investors are making big changes in their allocations.

At the same time, the MPC cannot be entirely sure that the economy is returning to growth. Although the rate of decline in GDP is improving, it cannot be sure that the report for Q4 2020 will be positive (we estimate that the recession continued into Q4). And the minutes of its last meeting (November) expressed satisfaction with the mix of CBN policies, attributing these with staving off a worse recession than what Nigeria has experienced. And its decision to hold rates in November was unanimous.

This is not to say that the MPC will sound relaxed about the rise in inflation. We expect it to disclose its concerns about inflation, but to stop short of a rate increase until it has more data on where inflation is heading in the first quarter.

Model Equity Portfolio

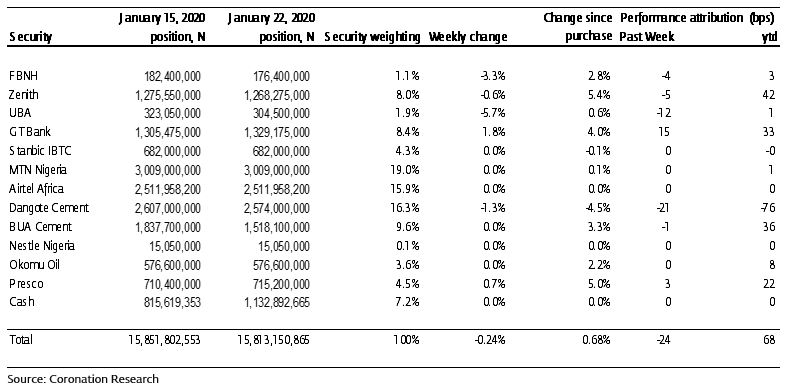

Last week the Model Equity Portfolio fell by 0.24% compared with a fall in the NSE-ASI of -0.42%, thereby outperforming it by 18bps. Year-to-date it has risen by 0.68% compared with a rise in the market of 1.82%, underperforming it by 113bps.

Model Equity Portfolio for the week ending 22 January 2021

The rally this year has been largely due to sharp rises in mid-cap stocks, notably Lafarge Africa and Ardova Oil and in these two cases the inspiration was corporate action which, necessarily, was impossible (or at least very difficult) to predict. Our sense is that the market still wants to move upwards but that, after a rally of 50.03% in 2020 which was driven by the largest index weights in the market (e.g. Dangote Cement, Airtel Africa, MTN Nigeria and BUA Cement), investors are hungry for new ideas.

Although we do not try to anticipate the overall market direction, we nevertheless are wary of the market at these levels. Last week we made small notional sales in BUA Cement and took our notional cash position up from 5.1% to 7.2%. We will continue to trim our positions in the largest index weights this week and we will search for our own mid-cap ideas.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.