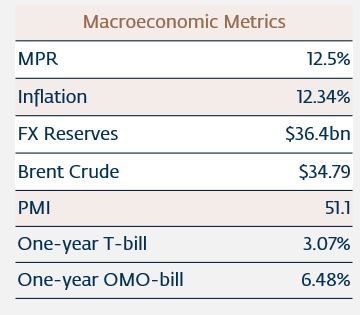

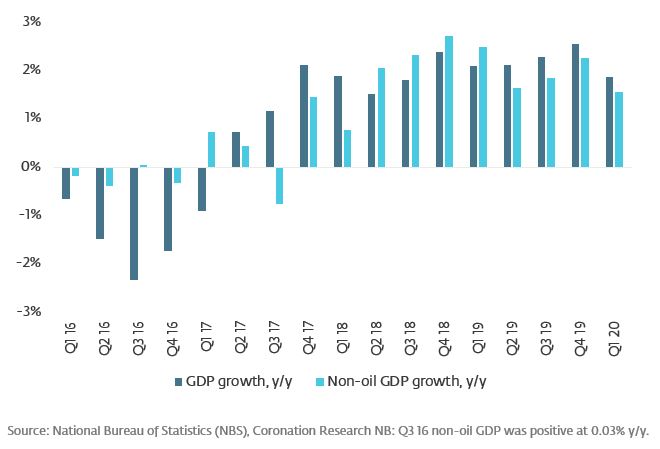

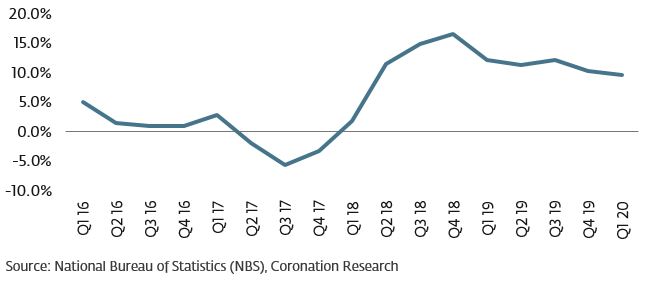

On Monday we learned about Q1 2020 GDP, up by 1.87% year-on-year (Q4 2019: +2.27% y/y) with Non-oil growth at just 1.55% y/y. The Non-oil growth drivers were Agriculture and Telecoms, but both showing slightly weaker growth than before.

Going forward, we expect the large Trade sector to continue with negative growth (-2.82% in Q1), Manufacturing to turn from 0.4% y/y to recession in Q2, and the volatile Oil & Gas sector to turn to negative growth when forward sales at old oil prices run out. The IMF’s forecasts a 3.4% recession for 2020 is realistic.

Neutral implications for equities. The stock market is undergoing a bull run, which is consistent with seeing this as a V-shaped recession with a clear exit early next year. Although this is plausible if Brent crude prices recover to US$50.00/bbl (currently US$34.79/bbl), it is less plausible if oil prices falter. The telecoms sector continues to grow with data partly replacing lost voice revenues, and both subscribers and internet subscribers sharply up in Q1.

Negative for inflation. The slowdown in Trade is associated with a steep fall in foreign exchange volumes and a rise in the parallel market exchange rate, meaning an increase in input costs. Agricultural production may not be growing as fast as population growth. April’s 12.34% y/y inflation (March: 12.26% y/y) could rise further.

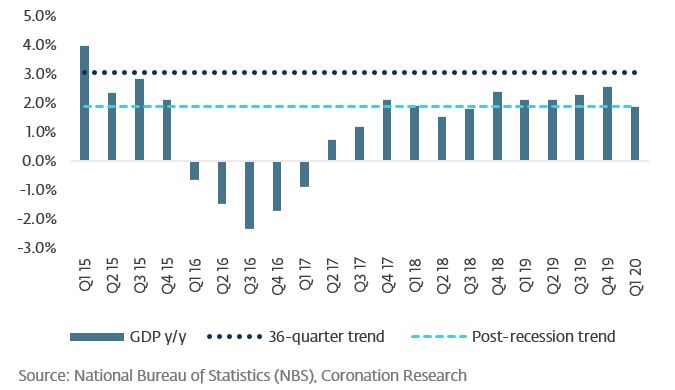

Lower-for-longer implications for interest rates. The Monetary Policy Council of the Central Bank of Nigeria cut its headline rate from 13.50% to 12.50% yesterday, a clear signal that it is happy with low market interest rates. Liquidity at Nigerian investing institutions is strong and T-bill rates at around the 3.0%pa-mark are useful for government as it finances its expanded N5.3tn (US$13.6bn) deficit.

Nigeria, y/y GDP growth

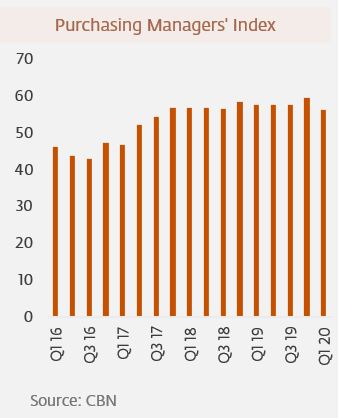

Non-oil & gas GDP

Heading for a slowdown

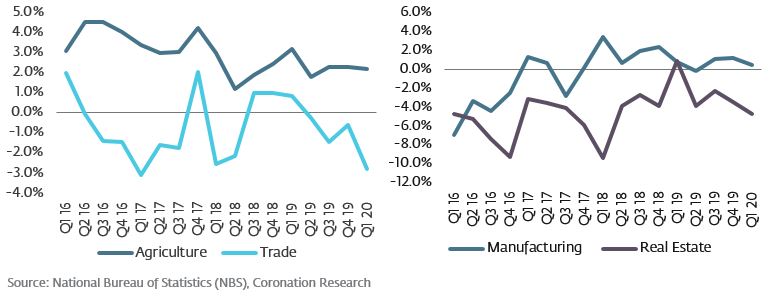

The acceleration in growth of non-oil GDP over the past three quarters has come to an end (see chart, below). Non-oil GDP contributed 90.5% of Nigeria’s GDP in Q1 2019 (92.68% in Q4 2019) and its growth in Q4 declined to 1.55% y/y after growth of 2.26% y/y in Q4 2019.

The slowdown in growth rate was largely due to slowdowns in the growth rates for: Telecoms (down from +10.26% y/y in Q4 2019 to +9.71% y/y in Q1 2020), Manufacturing (down from +1.24% y/y in Q4 2019 to +0.43% y/y in Q1 2020) and Trade (down from -0.58% y/y in Q4 2019 to -2.82% in Q1 2020).

While the slowdown in manufacturing is a concern, a larger impact is made by Agriculture (21.96% of GDP), whose rate of growth slowed from 2.31% y/y in Q4 2019 to 2.20% y/y in Q1 2020.

There are several drivers of sector change. The low purchasing power of consumers as inflation rates continues to rise amidst border closure, FX restrictions as well as reduced international trade as a result of supply chain disruption caused by the COVID-19 pandemic.

Nigeria’s GDP growth y/y, with and without oil & gas

Financial institutions posted the highest growth for the quarter (+24.00% y/y). Credit expansion drive (65.00% regulatory minimum loan-to-deposit ratio) by the Central Bank of Nigeria (CBN) since mid-2019 and decline in interest rates during the quarter were responsible for the growth. However, the availability of credit facilities didn’t spur significant growth in the following sectors – Manufacturing, Agricultural and Telecoms sector.

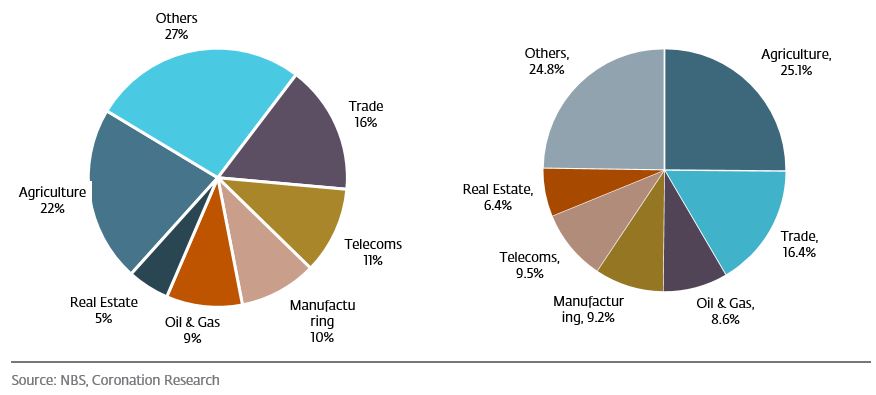

GDP breakdown

The breakdown among the major segments

The top six sectors accounted for 73.29% of the Nigerian economy in Q1 2020. In order of size, they were Agriculture, Trade, Telecoms, Manufacturing, Oil & Gas, and Real Estate.

In Q1 2020 Agriculture (21.96% of GDP) grew by 2.20% y/y. Trade (16.08% of GDP) contracted by 2.82% y/y. Telecoms (10.88% of GDP) grew by 9.71% y/y. Manufacturing (9.65% of GDP) grew by 0.43% y/y. Oil & Gas (9.50% of GDP) grew by 5.06% y/y. And Real Estate (5.21% of GDP) fell by 4.75% y/y.

Therefore, of the six largest sectors, four grew and two contracted. Agriculture grew 13bps slower than the previous quarter, but 42bps slower than its three-year average of 2.62%. Although the sector is resilient and did not go into recession with the rest of the country in 2016, the slow-down in the growth rate is a concern because of Nigeria’s population growth at approximately 2.50% per annum. The sector may show further deterioration in Q2 due to Covid-19 lockdown and restrictions on interstate travel.

The Trade sector has been in recession since Q2 2019 and fell further south to 2.82% y/y in Q1 2020. While the sector is volatile, its sensitive nature to regulatory interference makes its growth prospects uncertain. A combination of border closure, interstate lockdowns, technical devaluation of the Naira and delay in goods clearing at Nigerian ports led to the deepened decline in our view.

The high level of bank credit is due to the sharp falls in T-bill and credit rates and the enforcement of the 65% loan-to-deposit ratio (LDR) on commercial banks. We observed an increased flow of credit to a pool of high-quality obligors since H2 2019 before a widening of the credit basket to other enterprises.

The longer the policy is sustained, in our view, more businesses are likely to secure financing at low-interest costs. In our opinion, inventory build-up is therefore likely and some measure of expansion in manufacturing capacity utilisation is likely to ensue. This improves the outlook for manufacturing in FY 2020 but progress is likely to be difficult against the twin headwinds of falling consumer demand and shortage of US dollars for imported raw materials.

Real Estate, as distinct from construction and cement manufacturing, continued to contract. This sector has recorded only one-quarter of growth since 2015.

Swing sectors

Telecoms, the provider of growth

The Telecoms sector (10.88% of GDP), grew by 9.71% y/y in Q1 2020. The sector, which has grown by double digits year-on-year since Q1 2018 saw its growth rate decline by 55bps from 10.76% in Q4 2019.

Telecoms continues to record robust growth on the back of rising subscriber numbers. By subscribers, we mean the population of communication users on both voice and data services. Products designed to provide data-enabled low-cost devices to price-sensitive consumers, support high growth.

3.26m new subscribers were added to the telecommunications network in Q1 2020. Voice remains the dominant service line across the four major operators, but momentum is evident in data services. Internet subscribers grew by 12.50% y/y, characterized by re-engineered tariffs on data bundles and higher penetration of smart devices.

Potential downsides for continued growth in telecoms density are evident in increased regulatory and indirect tax obligations passed on to end-users and non-uniform patterns of coverage.

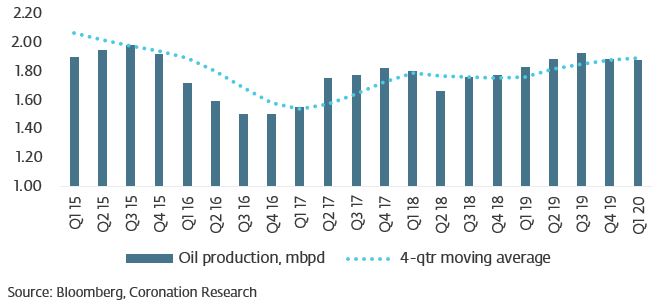

Oil Sector GDP

Nigeria, oil production, millions of barrels per day (mbpd)

Oil GDP advanced for the fourth consecutive quarter in Q1 2020, growing by 5.06% y/y. Much of the growth in the Oil sector was volume-driven rather than through price gains. Crude output was on average 45,000bpd higher than in Q1 2019.

Conclusions

Sector contributions to GDP in Q1 2020 (left) and in FY 2019 (right)

Outlook for 2020

Earlier this year, the outlook for Nigeria’s GDP was optimistic, the world bank and IMF forecasted 2.10% and 2.30% respectively. However, recent events – the decline in oil prices and the Covid-19 pandemic – has led to a review of the economic outlook and a likelihood of a recession.

It is important to note that growth in Q2 is expected to dip largely due to lockdown across major economies of the world which disrupted both supply and demand chain.

Going forward into Q2 and Q3, we expect three sectors to either continue with negative growth or to start to report negative growth. First, we expect Trade to continue with negative growth, given the fact that US dollars are in short supply and that logistical issues appear not to be fully resolved. Second, we expect Manufacturing, which was perilously close to recession in Q1, to move into recession, given – as mentioned above – the twin pressures of shortages in the supply of raw materials (in part due to shortages of US dollars) and a decline in consumer purchasing under lockdowns, furloughs and outright unemployment.

Third, as despite rising oil production, we expect the Oil & Gas sector go into recession. It is difficult to know exactly when the effects of low prices will translate into negative growth, as oil can be sold three or six months’ forward (or more). But by Q3 we would expect this volatile segment of the economy to be in recession. These three sectors account over 30% of the economy, so deep a deep slowdown in this zone points a recession overall. We think the IMF forecast of negative growth of 3.4% in 2020 is a reasonable assessment, given the various uncertainties we have highlighted.