The fixed income markets have plenty of liquidity, market interest rates are falling, and even the equity market rallied last week. The outstanding problem is weak growth, with Q1 2019 GDP economic expansion at just 2.01% y/y (Q1 2019 non-oil growth was 2.47% y/y). What better time for the Central Bank of Nigeria (CBN) to publish its five-year plan? See page 2.

FX

In June Foreign Portfolio Investment (FPI) was US$647m, down 58.8% from the previous month. Notwithstanding this, FPI inflows accounted for 68.5% of total inflows into the main FX market, the NAFEX market, for the month and the CBN’s FX reserves are currently reported at (a three-month moving average of) US$45.07bn, which is close to recent highs. We believe that the CBN’s FX reserves are sufficient to defend the Naira at current levels, close to N360.0/US$1, this year.

Bonds & T-bills

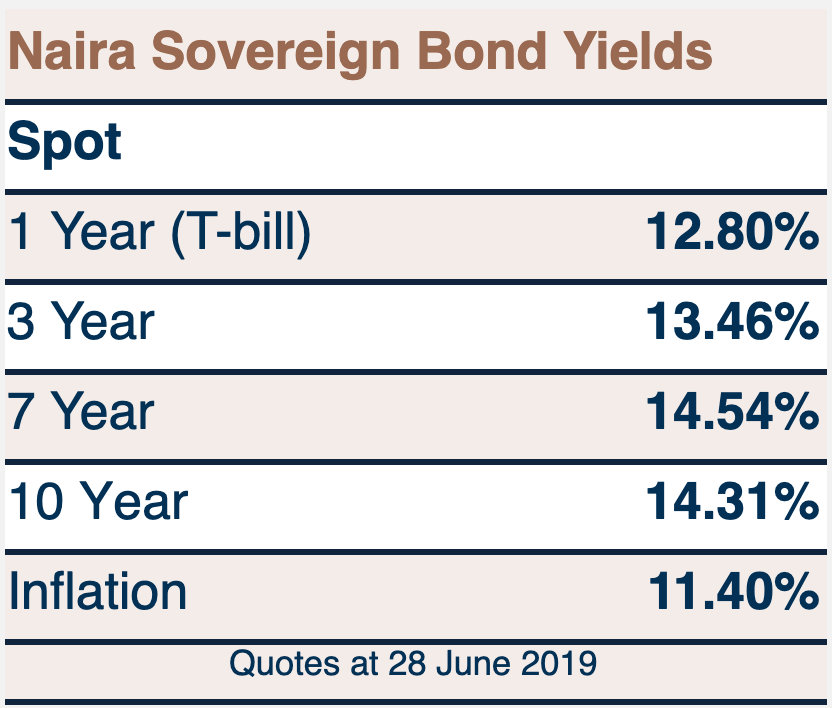

The yield on a Federal Government of Nigeria (FGN) Naira bond with 10 years to maturity fell by 24bps to 14.31%, and at 3 years declined by 45bps to 13.46% last week. The yield on a 364-day T-bill declined by 80bps to 12.80%. The yield on a T-bill with 3 months to maturity increased by 49bps to 11.65%.

Bullish sentiments characterised the bond and T-bill markets with yields contracting across the curve. The 364-day yield, at just 140bps over inflation, looks slim to us – we would expect 250-300bps over inflation. We expect the 364-day rate to nudge back up while noting that investors have a preference for 364-day paper these days. The spread of 10-yr bonds over 364-day paper has widened from 51bps to 151bps over the past four weeks.

Oil

The price of Brent rose by 2.07% last week to US$66.55/bbl. The average price, year-to-date, is US$66.21/bbl, 7.64% lower than the average of US$71.69/bbl in 2018, but 20.93% higher than the US$54.75/bbl average seen in 2017.

According to Reuters, the Organisation of the Petroleum Exporting Countries (OPEC) and its allies are set to extend oil production cuts till the end of 2019 as top producers Saudi Arabia, Russia and Iraq were joined by Iran in endorsing a policy directed at increasing the price of crude amidst a slowdown in the rate of growth of the global economy. OPEC will be meeting today and tomorrow to discuss the direction of crude oil supply for the rest of the year.

Equities

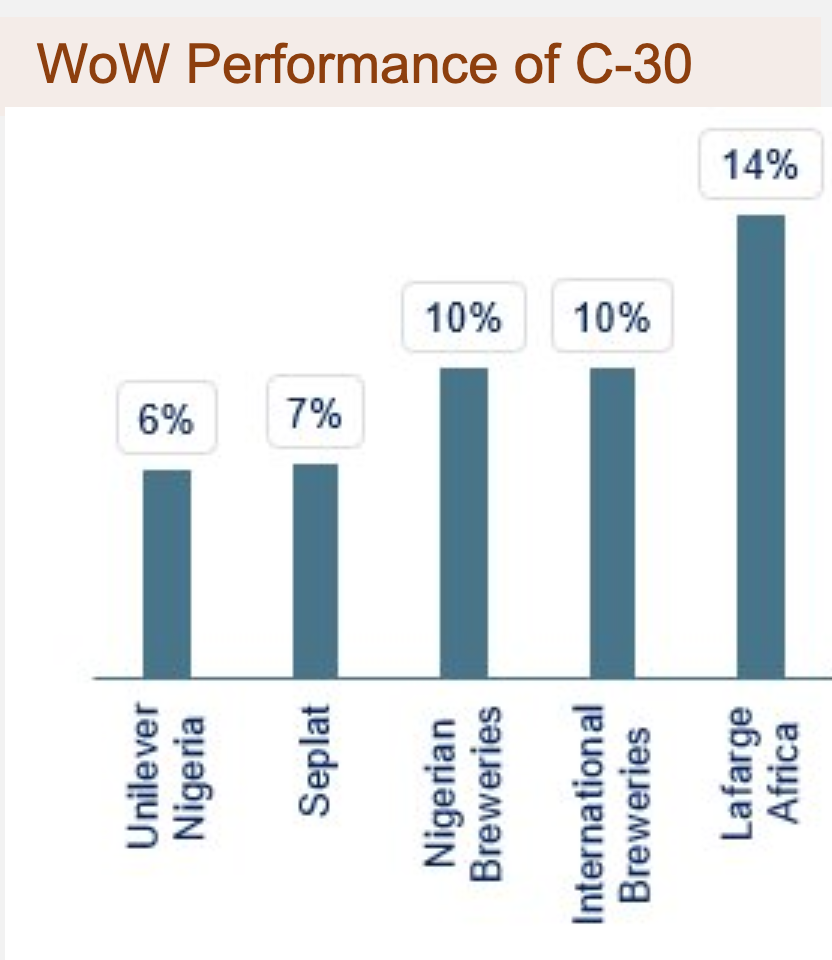

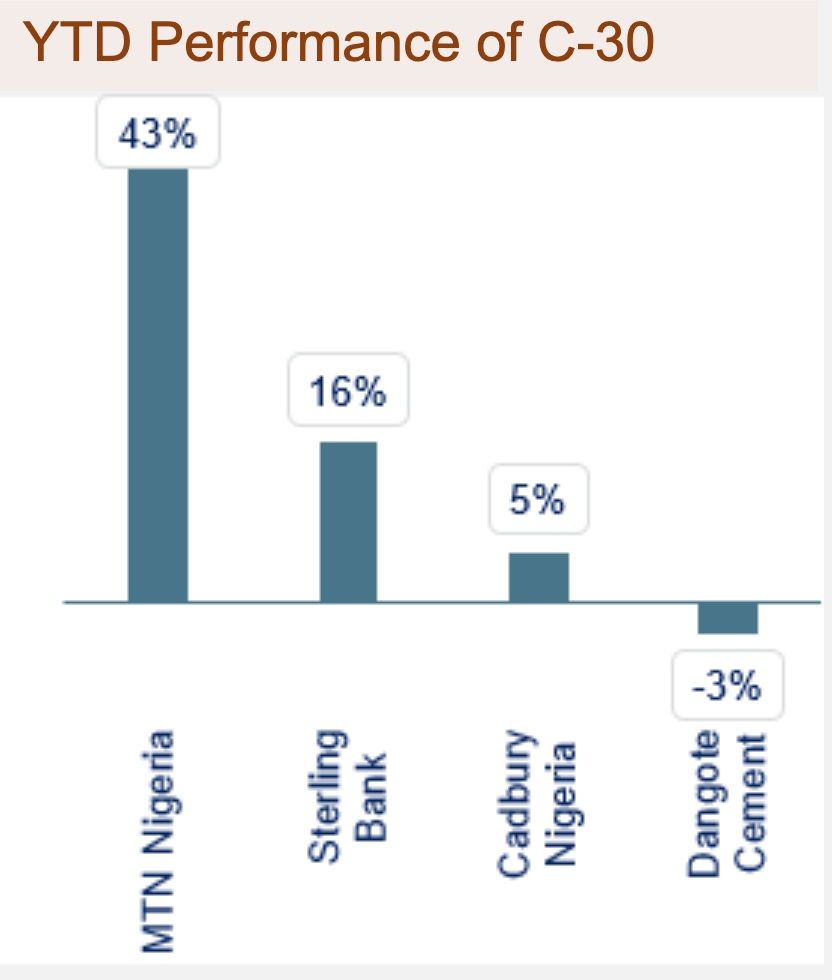

The Nigerian Stock Exchange (NSE) All-Share Index gained 0.39% last week, resulting in a year-to-date return of negative 4.66%. Last week Lafarge Africa (+14.29%), International Breweries (+9.58%) and Nigerian Breweries (+9.57%) closed positive while Forte Oil (-14.10%), Sterling Bank (-9.09%) and Dangote Sugar (-8.84%) fell.

The rally in the NSE All-Share Index was helped by the support of several consumer names, notably Unilever Nigeria (+6.45%) and Nestle Nigeria (+2.94%). Generally we are downbeat on the sector (See Coronation Research, Power to the Price Point, 20 May).

The CBN Governor’s New Campaign

Nigeria’s economy is prone to external shocks, partly a consequence of its overwhelming dependence on crude oil in generating foreign exchange revenues. The CBN attempts to shorten the duration of these shocks or reduce their impact. Tools at its disposal include: managing the nation’s exchange reserves; pursing developmental finance initiatives to stimulate domestic production and exports; controlling the money supply.

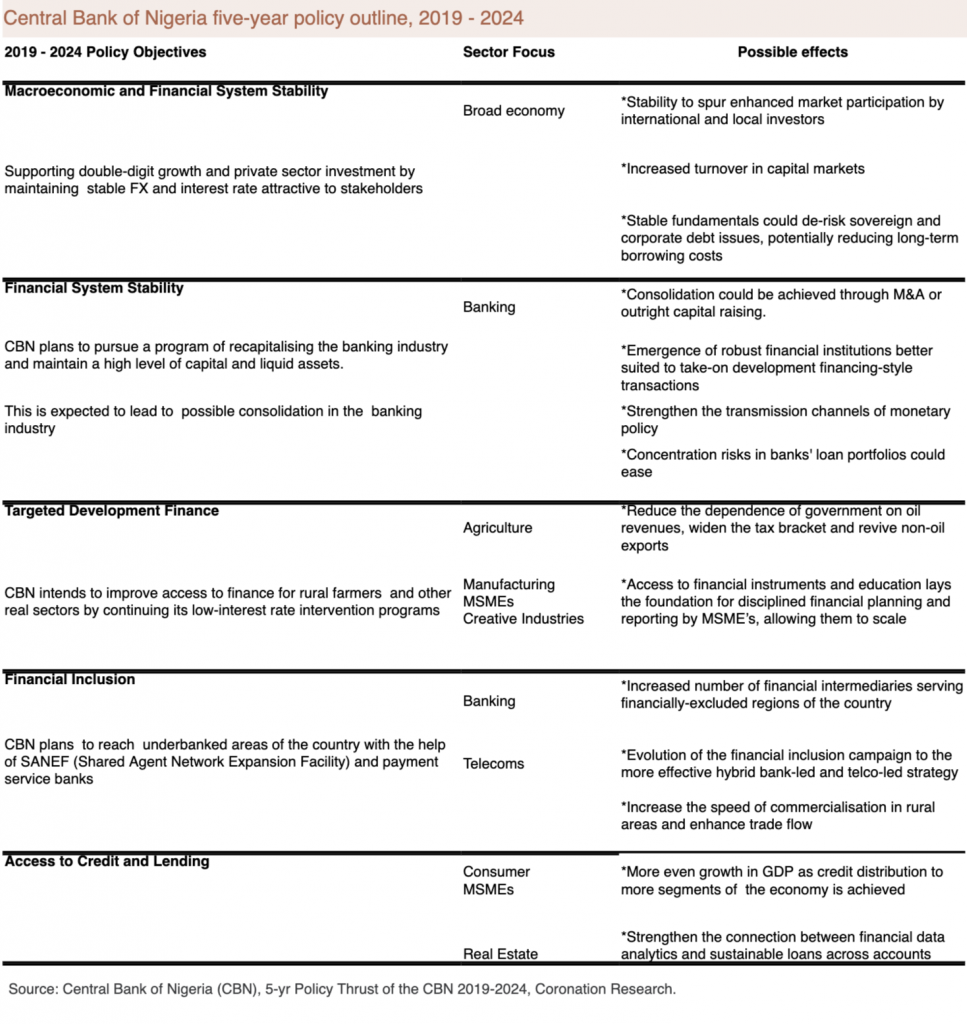

A review of the previous five-year (2014-2019) plan shows a degree of disparity between guided outcomes and actual events. Nevertheless, we highlight below some of the CBN’s policy objectives for the next five years and their likely effects, with a focus on financial inclusion and the banking system.