When the World Bank recently published its Global Economics Prospects, we were surprised to see a 4.1% recession estimated for Nigeria in 2020. In our view, the Nigerian economy is somewhat stronger than that. Even though the World Bank and the IMF have enviable track records in forecasting the Nigerian economy, we think that 2020’s recession will prove to be close to negative 3.0%. See details below.

FX

Last week the exchange rate in the Investors and Exporters Window (I&E Window) weakened by 0.21% to N393.52/US$1 compared to the 1.91% strengthening to 392.68/US$1 witnessed two weeks ago. In the parallel or street market, the Naira depreciated by 0.43% to close at N472.00/US$1 two weeks ago and a further 0.64% to close last week at N475.00/US$1. The difference between the I&E Window and the parallel market rate has been close to 20% for some time and we expect this difference to be maintained for several weeks, if not months.

Bonds & T-bills

Last week, the secondary market yield for an FGN Naira bond with 10 years to maturity rose by 12 basis points (bps) to 7.70% and at 7 years rose by 143bps to 8.26% while at 3 years the yield declined by 5bps to 4.37%. The annualized yield on a 286-day T-bill rose by 20bps to 0.84%, while the yield on a 284-day OMO bill declined by 5bps to 1.55%. On the Treasury Bills (T-bills) side, the average benchmark yield rose by 4bps, the bearish trend continuing throughout the week although on a less aggressive note than before. In the FGN bond market, it seems that investors’ expectations are for rates to increase. We expect the market to be bearish this week as investors await the Q1 bond issuance calendar.

Oil

The price of Brent crude fell by 1.01% last week to US$51.10/bbl, compared with the 9.59% increase witnessed two weeks ago. Crude oil prices recovered during the final quarter of last year, and they jumped sharply earlier this month as Covid-19 vaccine rollouts advanced in the United States and Europe. At the same time, Saudi Arabia served a pleasant surprise to oil markets by declaring it would cut an additional one million barrels per day (1.0mbpd) on top of cuts agreed with OPEC+ (OPEC plus Russia). Bolstering oil prices is the hope that the incoming Biden administration in the US will quickly push through another round of stimulus measures. Crude oil inventories in the United States were down for the second week in a row, the EIA reported on Wednesday. We believe that the recently-obtained $50.00/bbl handle is likely to be a floor price for at least several weeks.

Equities

The Nigerian Stock Exchange All-Share Index (NSE-ASI) rose by 2.63% last week with a gain of 2.25% year-to-date. Flour Mills of Nigeria (+22.85%), Ardova Oil (+20.49%), and Mobil (+9.43%) closed positive last week while International Breweries (-1.45%), Oando (-1.41%) and Sterling Bank (-0.99%) closed negative. The NSE-ASI set a level of 41,176.14 points on Friday, its highest level in almost three years, as investors sought to extend last year 50.03% rally. See Model Equity Portfolio on page 3.

Nigerian GDP better than thought

The World Bank recently published its Global Economic Prospects for January 2021, and we were surprised to find an estimate that Nigerian GDP had declined by 4.1%, year-on-year, during 2020. We think that this is too pessimistic. Recent data suggests that the Nigerian economy is stronger than this.

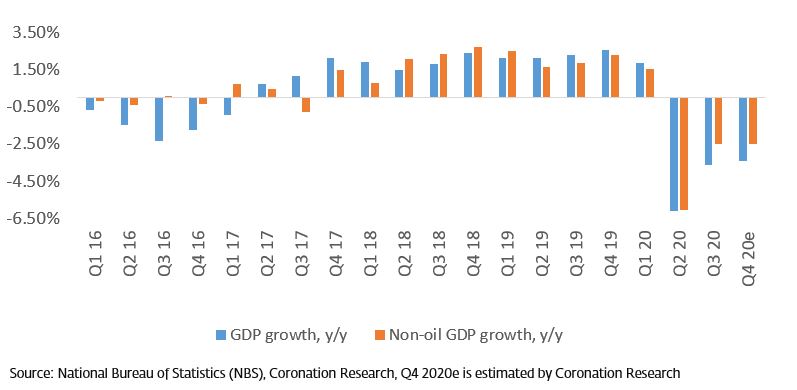

One factor that impresses us is the reduction in the rate of economic decline during Q3 2020. The headline GDP rate slowed to a negative 3.62% y/y in Q3 from 6.10% y/y in Q2. And the rate of contraction in the non-oil economy slowed to a negative 2.51% in Q3 from 6.05% in Q2. In fact, the headline rate improved despite the inclusion of the Oil & Gas sector whose development worsened from negative 6.63% y/y in Q2 to negative 13.89% in Q3.

The rate of contraction was lower in Q3 than they had been for Q2 in the following three sectors (among the major sectors): Trade; Manufacturing; Real Estates. These account for 28.4% of GDP. Two large sectors were still growing (and in fact did not go into recession last year). These were Agriculture (30.8% of GDP) and Telecoms (11.2% of GDP). They were not growing quite as quickly as they had been in Q2 but were growing nevertheless (Telecoms by 17.4% y/y/).

Gross Domestic Product 2016 - 2020

In our model of Nigerian Q4 2020e GDP growth we have made estimates for the top six sectors (Agriculture, Trade, Telecoms, Manufacturing, Oil & Gas and Real Estate) which together account for 79.1% of GDP. In essence we expect the year-on-year performance of the economy in Q4 (NB 27.0% of annual economic activity takes place in Q4) to be close to that achieved in Q3.

The implied full-year performance of the economy in 2020 then comes to 2.9% lower than in 2019. A recession of 2.9% (or, at least, close to 3.0%) seems a reasonable outcome for 2020. This would contrast with the International Monetary Fund’s estimate of negative 4.3% y/y (though this estimate was published back in October) and the current World Bank’s estimate of 4.1%. Both institutions have an excellent track record of forecasting Nigerian GDP but, on this occasion, we believe they may be too gloomy.

Model Equity Portfolio – 15 January 2021

We often write on this page that we try not to predict the direction of the market, rather that we buy the stocks we like when valuations are low. As if to demonstrate that our main skill is not to call the direction of the market we wrote, two weeks ago: “Our current concern is that the market is getting carried away.” The market then rallied, even more, the NSE-ASI closing at 41,176.14 points last Friday, its highest level in almost three years and up 2.25% year-to-date.

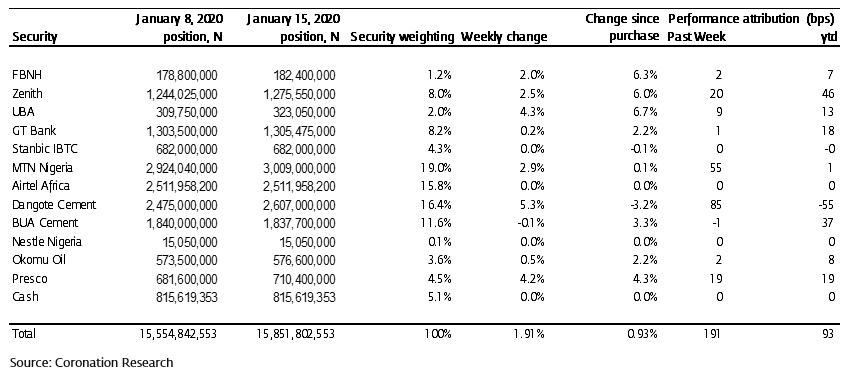

Last week the Model Equity Portfolio rose by 1.91% compared with a rise in the NSE-ASI of 2.63%, thereby underperforming it by 72bps. Year-to-date it has risen by 0.93% compared with a rise in the market of 2.25% underperforming it by 132bps. This is not a good start to the year, needless to say.

Model Equity Portfolio for the week ending 15 January 2021

The equity market is still buoyant, but investors are unwilling to buy the large-cap stocks which they were buying towards the end of last year. (Our decision, in the last week of last year, to lighten our notional holdings of the four largest index weights has only cost us 4bps in underperformance.) Investors are ‘filling in’ the market by buying mid-cap stocks, some which (like Ardova) are rising on the news of takeover activity.

Over the coming weeks, we will consider our response, hoping to find some mid-cap stocks that fit our criteria. Meanwhile, we will continue to lighten our positions in the largest index weights.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.