Last week the price of oil, Brent crude, edged up over US$50.00/bbl, the first time we had seen this level since March. This raises hopes of much stronger public finances in 2021 than we have seen in 2020 if the rally is sustained into 2021. However, a return to normal, in terms of policies, seems unlikely. See details below.

FX

Last week the exchange rate in the NAFEX market (also known as the I&E Window and the interbank market) weakened by 0.01% to N391.53/US$1. In the parallel or street market, the Naira closed the week steady at N475.00/US$1. The N391.53/US$1 NAFEX rate represents a mere 7.5% depreciation during the year to date, the only problem being that liquidity in this market fell very sharply after March. Although a proportion of demand for US dollars then shifted to the parallel market, it is notable that, for most of the time, the parallel rate has been within 20% of the NAFEX rate (the gap is 21.3% now). This is a much better situation than, for example, in late 2016 and early 2017 when the differences were much larger than this. Our sense is that pressure on the parallel market rate will not let up over the weeks ahead.

Bonds & T-bills

Last week, the secondary market yield for an FGN Naira bond with 10 years to maturity rose by 36 basis points (bps) to 5.32% and at 7 years rose by 44bps to 4.34% while at 3 years the yield rose by 12bps to 1.94%. The annualized yield on 321-day T-bill rose by 36 bps to 0.51%, while the yield on a 319-day OMO bill rose to 0.52%. The most significant event of the week was the Central Bank of Nigeria’s (CBN) issue of N4.1 trillion (US$10.5bn) of so-called Special Bills to banks in respect of sums of excess Cash Reserve Ratio (i.e. amounts of CRR held by the CBN in excess of the official 27.5% percentage applied to customer deposits). The 81-day bills carry a yield of 0.5%. It was not clear – it is still not clear – how these yields might leak into the T-bill market. But they appear to have affected market sentiment, with many participants reasoning that this marks the end of the downward march of T-bill rates over the past year. On the other hand, liquidity in the market remains high. So, the next move in short term rates at auction might be downwards, but the market sentiment could be proven correct over the coming months.

Oil

The price of Brent crude rose by 1.46% last week to US$49.97/bbl. The average price, year-to-date, is US$42.80/bbl, 33.21% lower than the average of US$64.08 /bbl in 2019. Brent hit US$50.25 /bbl last Thursday, for the first time since March, edging higher on optimism surrounding vaccinations, the OPEC+ deal and increased demand in Asia. However, the Energy Information Administration (EIA) also reported a surge in crude inventories for last week, up 15.2 million barrels. Although things aren’t fully normal yet, the positive signals are strong.

Equities

Last week, the Nigerian Stock Exchange All-Share Index (NSE-ASI) fell by 2.52% with a gain of 27.60% year-to-date to close at 34,250.74. Okomu Oil Palm (+10.00%), PZ Cussons (+4.17%) and Oando (+2.50%) closed positive while Lafarge Africa (-10.65%), Ardova OIl (-9.69%) and Dangote Cement (-8.04%) closed negative. See Model Equity Portfolio below.

Oil at US$50.00/bbl and public finances

Last week the oil price (Brent) crossed the important US$50.00/bbl mark. This reflects optimism that global GDP is recovering from the Covid-19 pandemic (thanks to vaccines: there is a spike in the number of deaths in the US and some European nations). And it reflects the ability of the Organization of the Petroleum Exporting Countries (OPEC) plus Russia (OPEC+) to enforce at least some level of collective production cuts without which the price might very well fall below US$40.00/bbl again.

Better still, the forward market is in backwardation, meaning that the long-dated future price is lower than the short-dated future price. Market wisdom holds that, under these conditions, traders have an incentive to sell short-dated contracts and buy long-dated ones; this brings financial players into the market. It also gives physical holders of oil an incentive to sell; periods of backwardation tend not to last for long.

As a rule of thumb, Nigeria’s public finances work well when oil trades consistently above US$50.00/bbl. Oil provides (in a good year), the Federal Government of Nigeria (FGN) with upwards of 60% of its revenue and supplies the country with over 80% of its export earnings. Since much of these earnings are banked by the Nigerian National Petroleum Corporation (NNPC) with the CBN, this is a crucial source of foreign exchange (FX). So, for example, the long period of low oil prices from the end of 2014 through to mid-2017 (the price of Brent averaged US$45.10/bbl in 2015 and US$56.09/bbl in 2017) led to a depressed level of CBN FX reserves. This precipitated two devaluations in the interbank exchange rate, from N199/US$1 to N316/US$1 in mid-2016 and from N316/US$1 to N357/US$1 in August 2017.

Therefore, the recent rise in the price of Brent comes at a good time for the CBN. This year the CBN has avoided the fate it suffered in 2016 and the first half of 2017, namely a level of reserves below US$30.00bn (the current reported level is US$34.97bn). The cost of this preservation has been a sharp reduction, starting in March, in the CBN’s supply of US dollars to the NAFEX market (until March the CBN had been a generous supplier, to the tune of around US$1.0bn per month). 2021, with a reasonable hope of an oil price above US$50.00/bbl, brings the prospect of improved US dollar inflows.

If an oil price above US$50.00/bbl takes root in 2021 it will be tempting to think of the nation returning to normal. Normal, in this instance, means a healthy inflow of US dollars from oil that supports the revenues of the government and allows the CBN to be the supplier of last resort to the foreign exchange markets. However, we doubt that the CBN will want to return to normal quickly, having made significant changes to its interest rate and foreign exchange management regimes in 2019 and 2020. Building a buffer in its reserve position is likely to be a top priority in 2021, in our view.

Model Equity Portfolio

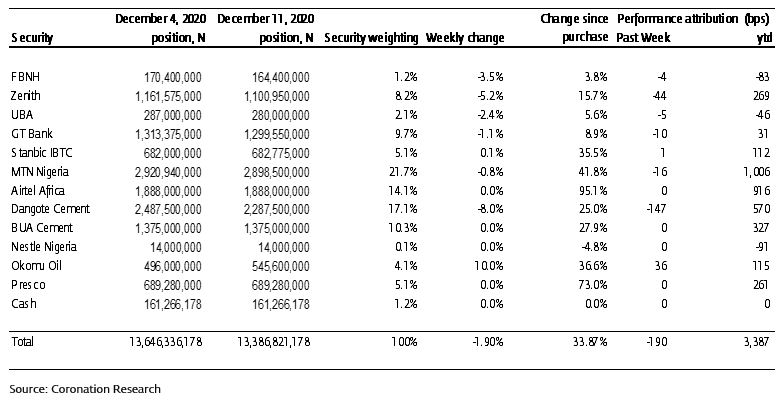

Last week the market fell by 2.53% with hefty falls in the bank sector where Zenith Bank fell by 5.2% and in the cement sector where Dangote Cement fell by 8.0%. We were braced for some underperformance, but then we noticed that on Friday our notional positions in bank stocks rallied a little bit. And our notional position in Okomu Oil rallied by 10.0%.

Last week the Model Equity Portfolio fell by 1.90% compared with a fall in the Nigerian Stock Exchange All-Share Index (NSE-ASI) of 2.53%, therefore outperforming it by 62 basis points. Year-to-date it has gained 33.87% against a gain of 27.60% in the NSE-ASI, outperforming it by 627bps.

Model Equity Portfolio for the week ending 11 December 2020

A certain amount of profit-taking in the market is understandable, given the significant rally this year. If January 2021 was to be the month of profit-taking, then it made sense to do it in December. On the other hand, and as we write on page 1, there is no certainty in the direction of interest rates, and the equity market’s attractions may endure if interest rates stay low.

In any case, we do not take on the task of predicting the direction of the market. We buy stocks which we like when their valuations are cheap relative to other stocks and relative to their own valuation histories. That is enough to keep us busy.

We plan no changes in the Model Equity Portfolio this week

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.