The confusing thing about oil prices is that, after the Organization of the Petroleum Exporting Countries (OPEC) and Russia agreed to production cuts in mid-April, prices continued to fall for a further two weeks. Since late April the price of Brent crude has more than doubled. The reason for the continued fall during April was an unprecedented build-up in inventories: the reason for the subsequent rally is the restitution of the arrangement between OPEC and Russia, an arrangement similar to the one that led to remarkable stability during the three years 2017 to 2019 inclusive. Are we heading back to normal, and a Brent crude price of above US$50.00/bbl? We discuss the prospects below…

FX

Over the past five weeks, the FX reserves of the Central Bank of Nigeria (CBN) have recorded consistent increments up to the current reported figure of US$36.60bn. The accretion comes largely from the public sector, notably IMF lending to the Federal Government of Nigeria (FGN). The recently-approved US$288.5m facility from the African Development Bank to the FGN is likely to add a little more. However, the widening current account position suggests that that pressure on the exchange rate is still evident. Beyond that, and as the economy gradually reopens, we believe that there will be renewed competition by the private sector to gain access US dollars for the importation of raw materials, and the CBN will be called upon to supply US dollars to the foreign exchange markets. The problem is not yet solved, in our view.

Bonds & T-bills

The secondary market yield for a Federal Government of Nigeria (FGN) Naira bond with 10 years to maturity declined last week by 19 basis points (bps) to 11.00%, and at 3 years fell by 70bps to 8.47%. The annualised yield on 251-day T-bill remained flat at 3.06%, while a CBN Open Market Operation (OMO) bill with similar tenure closed at 6.55%, 7bps up week-on-week. Last week a number of activities influenced yields in the fixed income market: OMO maturities worth N149.68bn (US$344.5m) entered the financial system, Cash Reserve Ratio (CRR) debits worth N459.72 billion (US$1.15bn) were made on banks; and the CBN auctioned N70.00 billion (US$175.00m) of OMO bills. Our sense is that Nigerian institutional investors are very liquid and that we will see these very low rates persist for several weeks, at least.

Oil

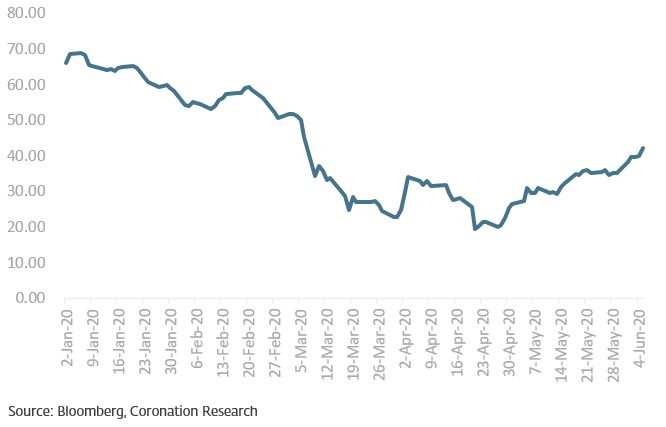

The price of Brent crude rose by 19.73% last week to US$42.30/bbl. The average price, year-to-date, is US$42.28/bbl, 34.14% lower than the average of US$64.20/bbl in 2019, and 41.03% lower than the average of US$71.69/bbl in 2018. Oil prices have been propped up by the unprecedented production cut of 9.7 million barrels per day agreed in April by OPEC, Russia and other allies, collectively known as OPEC+. A further extension of the production cuts by an additional 30 days through to the end of July spurred the recent rally. We think prices will remain firm.

Equities

The Nigerian Stock Exchange All-Share Index (NSE-ASI) declined by 0.98% last week. The year-to-date return is negative 6.79%. Last week Dangote Sugar (+15.89%), Presco (+9.04%) and FBNH (+0.93%) closed positive, while PZ Cussons (-12.73%), Cadbury Nigeria (-11.56%), Guinness Nigeria (-8.50%) and Stanbic IBTC (-7.26%) closed negative. Last week, market performance was broadly negative, as losses in the Banking (-3.7%), Oil and Gas (-0.7%) and Consumer Goods (-0.4%) sectors outweighed the positive performances in the Insurance (+2.4%) and Industrial Goods (+1.6%) sectors. However, there still appears to be interested in some of the largest market index names and some of the most liquid bank stocks, in our view.

Oil back to normal?

How global oil production policy changes. A few months ago the Organization of the Petroleum Exporting Countries (OPEC) and Russia were at daggers-drawn, each side threatening to raise production and let oil prices fall. This, inevitably, would compound the downward pressure on oil prices from the COVID-19 pandemic. For what purpose? To drive part of the US shale oil industry out of business so that OPEC and Russia could regain global market share.

Then, in mid-April, hostilities ceased, when OPEC and Russia agreed to make production cuts of some 9.7 million barrels per day (mbpd), which amounts to some 10% of normal global production. Last weekend they met again to confirm that these cuts would continue through to the end of July, this time insisting that relatively small OPEC members, including Nigeria, would have to bear their share of the burden. The US was quick to applaud the change in policy in April and to approve of the announcement at the weekend.

Brent crude, US$/bbl, spot price

What changed their minds? One likely explanation is that the effect of the slump in demand arrived much faster than most people anticipated, with the West Texas Intermediate blend being driven down to negative prices and Brent crude trading at under US$20.00/bbl amid a huge build-up of inventories. Prices continued to fall after the mid-April agreement. Then came the realisation that global demand had fallen by around 30% during the first weeks of the crisis and might fall by about 10% (from around 100mbpd) for the entirety of 2020.

So where does this leave the original strategy of driving a portion of the US shale business out of business and regaining global market share for OPEC and Russia? This is a mystery. Our opinion is that the US reaction was sufficiently accommodating (for Russia) and challenging (to OPEC’s leading producer, Saudi Arabia) to make them change their tune. Whatever the case, a rapid return to Brent crude prices above US$40.00/bbl brings the prospect of a return to normal.

This is important for Nigeria. As we consistently argue, Nigeria’s public finances (both those of the Federal Government of Nigeria and of the Central Bank of Nigeria) are on a strong footing when Brent crude trades at comfortably over US$50.00/bbl. This appears to be in prospect. However, given two big changes in global production policy over the past four months, nothing is entirely certain.

Model Equity Portfolio

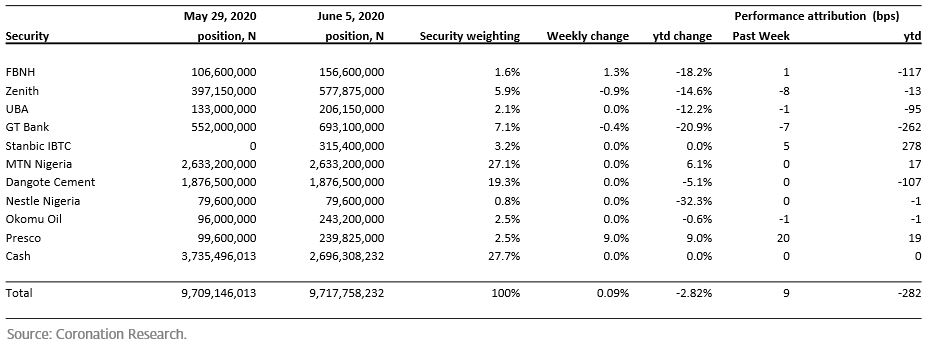

Last week the Model Equity Portfolio rose by 0.09% compared with fall in the Nigerian Stock Exchange All-Share Index (NSE-ASI) of 0.98%, therefore outperforming it by 107 basis points. Year-to-date it has lost 2.82%, against a loss of 6.79% in the NSE-ASI, outperforming it by 396bps. We did a lot of notional trading last week – only purchases – and this affected our performance. Without any trading, the Model Equity Portfolio would have risen by 0.05%. By and large, we lost a little money on some of our national bank trades but made money by increasing our notional position in Presco.

As we have been writing over the past two weeks, we carried out our intention to raise our notional positions in the principal bank stocks and added Stanbic IBTC to our collection of them. This took our position in banks to 20.1% of our portfolio. This represents a big increase over the previous week’s position (12.2%) but is actually slightly short of the neutral weight for banks in the NGSE-ASI. The neutral index weight consists of 12 banks stocks while our 20.1% is concentrated in five; five which we believe we understand.

Model Equity Portfolio for the week ending 5 June 2020

We took our combined weights in Presco and Okomu Oil up to a 5.0%, reasoning that these stocks are a hedge against currency devaluation should this take place later in the year. Both these companies sell commodities with a US dollar-equivalent price. The price of crude palm oil rose by 1.3% in US dollars last week.

We have taken our notional cash position down from 38.5% to 27.7% which still seems too conservative given the recent trend in the market. With oil prices holding up and Naira fixed-income rates likely to stay low following the strong signal from the Central Bank of Nigeria when it cut its policy rate on 28 May, it seems that equities may be the destination of at least some Nigerian institutional funds. So, this week we will look to increase our positions in the banks, again.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.