Q4 2020 GDP was reported last week and it showed Nigeria leaving recession – just. Q4 2020 growth was 0.11% year-on-year (y/y). The non-oil economy reached a respectable level of growth, up 1.69% y/y. The implications for market interest rates are that these can rise if: a) this help get inflation under control (it was 16.47% y/y in January ); b) the growing economy can support rates going higher. By contrast, equities may not be as interesting as they were during 2020. See details below.

FX

Last week the exchange rate in the Investors and Exporters Window (I&E Window) weakened by 1.08% to N408.25/US$1. In the parallel, or street market, the Naira appreciated by 1.06% to close last week at N478.00/US$1. In our view, unscheduled crawling-peg devaluations may be the norm this year and could eventually close the gap between the NAFEX and parallel market rates, which are approximately 20% apart.

Bonds & T-bills

Last week, the secondary market yield for an FGN Naira bond with 10 years to maturity rose by 36bps to 10.79% and at 7 years rose by 45bps to 10.45% while at 3 years the yield rose by 15bps to 7.94%. The annualized yield on a 342-day T-bill remained unchanged at 2.07%, while the yield on a 340-day OMO bill rose by 2bps to 9.60%. Last week, the bond market opened on a negative note, following the previous trading day’s bond auction results. Yields weakened across the benchmark curve by c.80bps on average. The 2026 and 2029 bond maturities experienced turnover with bids at 10.20% and 11.00% respectively, while limited offers were observed for mid-tenured securities. In the Treasury Bills (T-bill) market, on the other hand, there was weakened demand for long-dated papers as banks remained wary of taking on duration ahead of an expected auction of open market operation (OMO) bills from the Central Bank of Nigeria (CBN). We expect the market to trade cautiously as participants anticipate upcoming T-bill and OMO auctions. We believe that the overall direction of rates will continue to be upwards over the coming weeks.

Oil

The price of Brent crude fell by 0.62% last week, closing at US$62.91 /bbl, a 21.45% increase year-to-date. The average price to year-to-date is US$57.75/bbl, 25.16% higher than the average of US$43.22/bbl in 2020. Last week, as oil prices rose, the United States lost some 40 per cent of its oil production because of the arctic cold wave sweeping across the country, and as far south as Texas. Saudi Arabia announced that considering the recent recovery in prices, it would suspend its voluntary unilateral additional cuts that amount to 1 million barrels per day (bpd) as Russia and Iraq continue to exceed quotas, while Iran is already boosting output. As we noted last week, we are less than two months into the year and oil prices are already well outside the US$45.00/bbl to US$60.00/bbl range we have pencilled-in (which is good news for Nigeria, the CBN and the Federal budget). However, we expect friction to increase within the Organization of the Petroleum Exporting Countries (OPEC) and its partner Russia (OPEC+) as the benefits of high oil prices are being shared unequally among them. We, therefore, expect, with time, that global production will increase and cool the rise in prices.

Equities

The Nigerian Stock Exchange All-Share Index (NSE-ASI) fell by 0.63% last week with a loss of 0.21% year-to-date. Guinness Nigeria(+9.16%), Ardova Oil (+9.06%) and Oando (+7.72%) closed positive last week, while Stanbic IBTC (-14.00%), Dangote Sugar (-3.65%) and Nigerian Breweries (-3.28%) closed negative. It is noticeable that there are very few price changes among the largest stocks by index weight (Dangote Cement, MTN Nigeria, Airtel African and BUA Cement) but still quite a lot of activity among the mid-cap stocks. Our overall sense is that interest in the market is weak. See Model Equity Portfolio below.

The economy exits recession in Q4, just

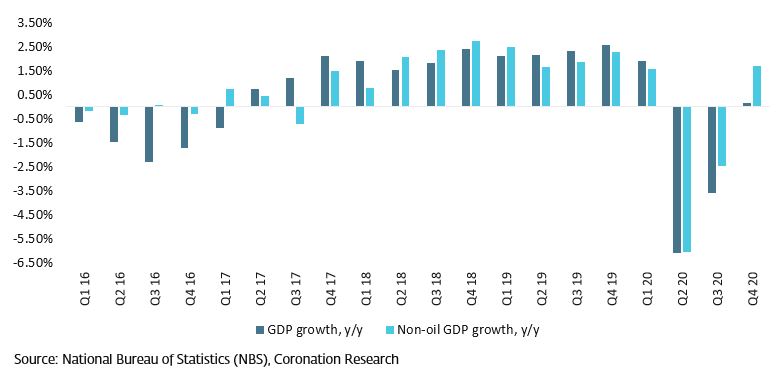

Last week the National Bureau of Statistics (NBS) reported GDP data for the fourth quarter (Q4) of 2020 and these surprised the market by showing growth, albeit a low level of growth. Q4 2020 GDP grew by a meagre 0.11% year-on-year (y/y) though non-oil growth was a respectable 1.69% y/y. This came after a 3.62% y/y contraction in the economy in Q3, with the non-oil economy contracting by 2.51% y/y at that time. For the full year 2020, GDP fell by 1.92% y/y.

What is going on? It is important to note that registering an economic recovery in Q4 2020 was close to policy makers’ hearts, key to rating the Economic Sustainability Plan (ESP) as a success, and justifying last year’s crashing of market interest rates. (1-year Nigerian Treasury bill rates fell from 5.40% at the beginning of 2020 to 0.15% at the beginning of December, and commercial bank credit expanded.) Against this, the IMF was predicting a 4.3% recession in Nigeria in a report published in the middle of last year, and as recently as January the World Bank estimated that Nigeria’s economy had contracted by 4.1% in 2020. Clearly, the data suggest that Nigeria has done far better than these estimates.

Quarterly GDP development, year-on-year

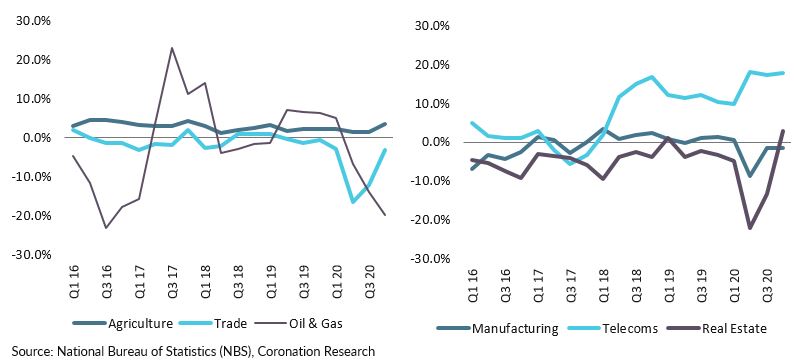

If there are questions about the data, it is difficult to point to exactly which data. For example, one eye-catching item was the 3.42% y/y growth in Agriculture in Q4, which had a significant effect on overall growth because Agriculture itself accounts for 26.95% of GDP. We can back-test this and ask what the overall Q4 growth rate would have been if Agriculture has grown by merely its average trend growth rate of 2.15% y/y over the previous eight quarters. The answer is that the entire economy would have contracted by 0.22% y/y in Q4 2020 but that non-oil GDP would still have grown at a respectable 1.33% y/y. However, it is not possible to question such data with any evidence and, in any case, the difference between the actual data and the extrapolated trend is often small. What such back-tests do show, however, is a certain robustness in the non-oil economy as opposed to the oil-related economy. In Q4, the oil & gas sector (which accounts for 5.87% of the economy) fell by 19.76% y/y, which reflects low oil prices during Q2 and Q3 (oil contracts are generally sold forward).

There was a noticeable improvement in the trend for Trade (15.46% of the economy) where the rate of contraction improved from 12.12% y/y in Q3 to 3.20% y/y in Q4. In Manufacturing (8.60% of the economy) the rate of contraction was maintained at 1.51% y/y for both Q3 and Q4. It seems that both these large segments of the economy, while still contracting year-on-year in Q4, had made significant adjustments to difficult trading conditions and had adapted to exchange rates, including the exchange rate in the parallel market. One significant effect of this, naturally enough, would have been upward pressure on inflation as import costs for traded items and raw materials were passed through to customers.

Implications for fixed income and equity markets

Top-six drivers of GDP, y/y

The least surprising development was the continued growth of Telecoms (12.45% of the economy) which maintained its rapid development, growing by 17.64% y/y in Q4. Home working and data streaming likely account for its success. The most surprising sector was Real Estate (6.38% of the economy) which ended its long recession by growing by 2.81% y/y in Q4. The six sectors mentioned so far (Agriculture, Trade, Manufacturing, Telecoms, Oil & Gas and Real Estate) together account for 75.71% of GDP and are the ones on which we concentrate our analysis.

Implications for markets

Interest rates. Policymakers are likely satisfied with their performance in 2020, as it can be argued that a combination of low-interest rates, credit-generating policies and the ESP prevented the recession (the full-year recession of 1.92% y/y) from being worse. Inflation was not a central concern of policymakers in 2020 (who saw it as more of a structural than a monetary issue), but we expect them to return to this topic in 2021. After all, if low-interest rates are needed during a recession, then we can infer that a growing economy can bear higher rates than before. We are seeing market interest rates move sharply up this year and we expect this process to continue. We expect Nigerian Treasury Bill (T-bill) rates of 10.0% by mid-year.

One important note to make here is that commercial banks may find it difficult to adjust their savings rates upwards, as a large proportion of their funds are still tied up by the Cash Reserve Ratio (officially 27.5% but, according to the recent Article IV report from the IMF, closer to 46.0% in practice), earning very low rates. Savers wishing to earn interest income are likely to head for Money Market Mutual Funds, in our view, as these do not bear such reserves.

Equities. Equities performed extremely well in 2020, the Nigerian Stock Exchange All-Share Index (NSE-ASI) recording a gain of 50.53%. This, in our view, was closely related to the significant decline in market interest rates. As rates rise we would expect the attractions of equity investments generally (but not all equity investments) to wane. At the same, the growth in the economy is not necessarily enjoyed by listed companies and we have argued for a long time (see Coronation Research, Power to the Price Point, May 2019) that consumers on moderate incomes buy products from predominantly unlisted food manufacturers (and most of their food purchases are of basic commodities, anyway).

In conclusion, the resumption of growth signals a move away from the radical and heterodox policies of 2020 towards a more conventional policy mix in 2021. Though market interest rates are a long way from the rate of inflation (16.47% y/y in January) we expect them to move in this direction. Savers in Money Market funds look to be the winners of this process.

Model Equity Portfolio – 19 February 2021

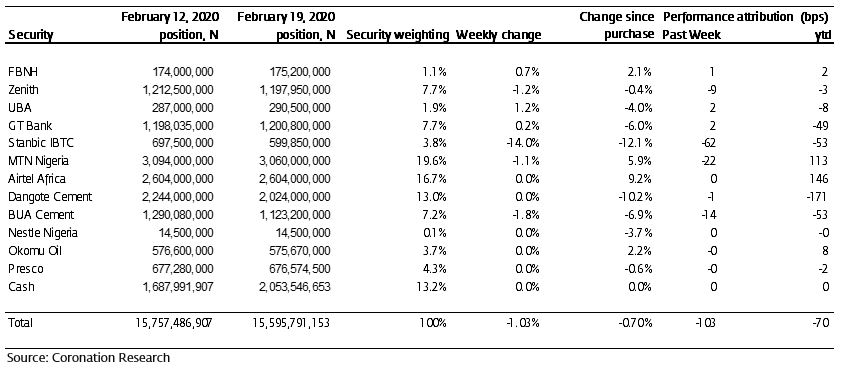

Last week the Model Equity Portfolio fell by 1.03% compared with a fall in the Nigerian Stock Exchange All-Share Index (NSE-ASI) of 0.63%, therefore underperforming it by 40 basis points. Year to date it has lost 0.70% against a loss in the NSE-ASI of 0.21%, underperforming it by 49bps.

The culprit last week was our notional position in Stanbic IBTC which fell by 14.0% and cost us 62bps. Although we like our bank names and think that they will report good results for the full-year 2020, as well as proving capable of reporting profits in 2021, their stocks are volatile (GT Bank fell by 6.2% the week before, for example). We just have to accept this: volatility is not the same thing as risk. We remain confident in our notional positions in the banks.

Model Equity Portfolio for the week ending 19 February 2021

As forewarned last week, we made notional sales in several industrial stocks in order to increase our cash position and make the Model Equity Portfolio more defensive than before. We made, mid-week, small sales in Dangote Cement and BUA Cement and very small notional sales (they are not very liquid) in Presco and Okomu Oil. We raised the level of notional cash from 10.7% to 13.2%. We will continue with these tactics this week with the aim of raising notional cash by up to a further five percentage points.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.