Nigeria needs help to tide it through the coronavirus lock-down. Without the kind of financial penetration and large government of developed countries, it is very difficult for it to inject liquidity into its financial system effectively. In fact, the crisis underlines the limited size of the Nigerian government and of central bank resources. Therefore help must come from abroad. As expected, the International Monetary Fund (IMF), the World Bank and the African Development Bank (AfDB) are in the line-up. What is the thinking of the biggest potential lender, the IMF? See below for details.

FX

The FX reserves of the Central Bank of Nigeria’s (CBN) are currently reported at US$34.9bn (which represents a one-month moving average), the lowest level since November 2017. The Naira remained under pressure, weakening by 0.4% week-on-week to N383.00/US$1 in the NAFEX market (also known as the I&E Window and the rate quoted by Bloomberg). It weakened by 3.6% to N415.00/US$1 in the parallel market. We think the recent adjustment might not be substantial enough ease the pressure on the currency. The CBN recently suspended the sale of foreign exchange to Bureaux de Change, arguing that the decline in demand for service-related payments due to the closures of borders across the globe justifies the action.

Bonds & T-bills

The secondary market yield for a Federal Government of Nigeria (FGN) Naira bond with 10 years to maturity declined by 44bps to 12.58%, and at 3 years rose by 5bps to 10.60% last week. The annualised yield on 314-day T-bill, the longest duration available in the secondary market, declined by 1bp to 4.68%, while a CBN Open Market Operation (OMO) bill with similar tenure closed at 17.35%, 113bps down week-on-week. We expect to see further compression of yields on T-bill instruments as Open Market Operation (OMO) maturities worth N130.9bn are due this week.

Oil

The price of Brent rose by 38.43% last week to US$34.11/bbl after the President of the United States tweeted that a deal on cutting global production was in the offing. The average price, year-to-date, is US$49.88/bbl, 22.31% lower than the average of US$64.20/bbl in 2019, and 30.46% lower than the average of US$71.69/bbl in 2018. Although the US is talking about a co-ordinated 10mbpd day cut in production, it appears that co-opting Russia and Saudi Arabia into the deal will take time. While the recent correction to below US$30.00/bbl may have be over-done, further upside from here is unlikely to come quickly, in our view.

Equities

The Nigerian Stock Exchange All-Share Index (NSE-ASI) declined by 3.51% last week, the year-to-date return is negative 21.41%. Last week Cadbury Nigeria (+12.00%), Mobil (+9.83%), PZ Cussons (+8.64%) and Honeywell Flour Mills (+8.43%) closed positive while Nigerian Breweries (-26.67%), Unilever Nigeria (-14.16%), Lafarge Africa (-11.39%) and Dangote Sugar (-11.00%) fell. In our view, the trend witnessed last week is likely to persist, as the economic impact of shutdowns deepens further. However, we think the low prices of fundamentally-justified stocks may be an entry point for investors.

IMF to the rescue?

In medieval Europe besieged cities would fire distress flares high into the air in the hope of attracting help from allies. Modern nations do much the same thing during times of financial stress, only their methods have become more sophisticated over the past 600 years. Thus we read today of Nigeria’s attempts to put together a package of nearly US$7.0bn to tide it over the current crisis. According to the report, US$3.4bn is to come from the International Monetary Fund (IMF), US$2.5bn from the World Bank (WB), US$1.0bn from the African Development Bank (AfDB), and a further US$150.0 million from the Nigerian Sovereign Investment Authority (NSIA).

One question hangs over this line-up. The IMF? The IMF exists for interventions in times like these: but it is not famous for treating Nigeria with kid gloves. It usually likes countries to float their exchange rates and to introduce deep supply-side reforms. So it is important to review recent IMF thinking on how to react to the crisis.

A recent IMF paper states that roughly one third of the outstanding debt of emerging markets is overvalued, with the result that – given repatriation of private-sector funds to safe havens – many countries will experience problems financing themselves. In fact, the IMF notes, the investor appetite for emerging market risk is not driven by country-specific factors but by common external factors. And many countries will face problems servicing their debt, let alone raising more of it. Therefore, from the outset, there appears to a strong case for intervention regardless of country-specific circumstances.

Another argument from the IMF is that pumping liquidity into the US banking system is of limited use in the global context. This looks like a paradox when one considers the size and reach of the global US dollar network. But the problem is that a lot of hard currency lending, including US dollars, takes place from outside the US, in particular from Europe. And Europe has not seen – yet – the kind of liquidity surge seen the US. (Indeed, the European Union appears to be divided by the familiar fault line running between the Mediterranean countries and the more prosperous ones in the north.) So a large increase in US dollar liquidity in the US is not the answer to emerging countries’ problems. This again looks like a case for intervention.

Nigeria might make market-friendly reforms even though the IMF seems not to be demanding them. It has been announced that fuel subsidies will be cut, though it remains open to question whether this would still hold if oil prices rose back above US$50.00/bbl. In this regard is seems odd that the first move was to cut the regulated price of petrol (known locally as Petroleum Motor Spirit, PMS) as keeping the price up would have created a buffer between oil prices and the consumer. Another move was the Central Bank of Nigeria’s decision, on 20 March, to move its reference rate in the principal foreign exchange market, the NAFEX market (also known as the Importers and Exporters Window), from N366/US$1 to N380/US$1. But this only a small degree of liberalisation, in our view, and maintains the managed exchange rate as opposed to a free float. So Nigeria’s liberalising moves are a few seeds in the air, so far.

And the IMF, and the World Bank and the AfDB, are addressing the threat posed to emerging markets in general, and Nigeria in particular, by the coronavirus pandemic. They are not addressing the problems caused by the associated fall in oil prices. If oil prices do not recover to a comfortable level – for Nigeria’s public finances – of over US$50.00/bbl, there is no reason to think that Nigeria’s funding allies will treat it a crisis. There can be no distress flares sent up into the sky to solve that problem.

Model Equity Portfolio

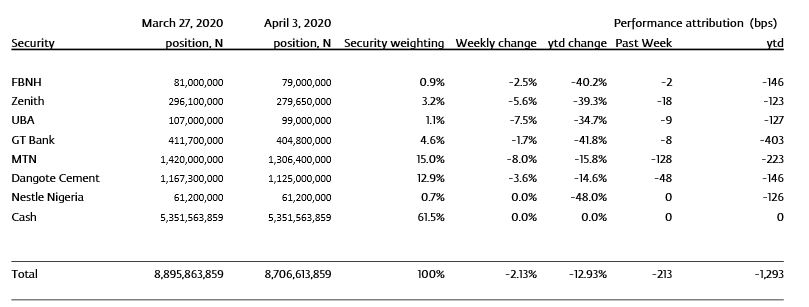

Last week the Model Equity Portfolio lost 2.13%, compared with a loss in the Nigerian Stock Exchange All-Share Index (NSE-ASI) of 3.51%. Year-to-date it has lost 12.93%, against a loss of 21.41% in the NSE-ASI. Our out-performance year-to-date reflects a very high notional cash position, which we organised at the beginning of March, and we recognise that most equity funds would be unable to replicate this, given the rules governing the proportion of equities which they must hold at any given time.

The dynamic of the market these days consists, in our view, of foreign institutional investors which continue to reduce their exposure to the market and domestic investors, both institutional and retail, which sense that there are buying opportunities at these levels. In addition, there are some domestic investors that capitulate when prices drop too fast for comfort. Stocks with high foreign ownership, therefore, move the fastest, notably banks.

Model Equity Portfolio for the week ending 03 April 2020

Last week we wrote that we were happy with our selection of MTN Nigeria, reasoning that telecoms companies will perform well during this period of enforced remote working and lock-downs. We spoke too soon, as it fell 8.0% during the week, presumably as foreign investors sold positions. And yet we do not think the fundamental argument has changed, so we will persevere.

Last week we wrote that we intended to correct our small underweight MTN Nigeria, but we neglected to make notional purchases. We will do this week; to first bring it up to a neutral weight, and then to a small overweight position.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.