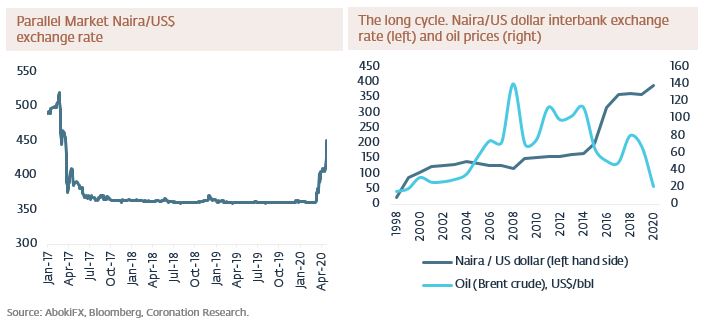

Last we noted that the Central Bank of Nigeria (CBN) is in no hurry to raise market interest rates and that – most of the time – Nigeria’s commercial banks are liquid, usually reporting over N500.0bn (US$1.3bn) in total closing balances. This situation is consistent with a pro-growth policy, and indeed all market interest rates (see side table) are below inflation. The problem is that the parallel market exchange rate (the bid rate for US dollars) slipped last week, reminding us of the situation in early 2017. We must assess where we are in terms of short and long-term FX cycles.

FX

Last week the US dollar strengthened against the Naira, closing at N450.00/US$1 in the parallel market and at N383.00/US$1 in the I&E market. Liquidity in the I&E market has been falling, driving episodes of depreciation of the Naira in the parallel market. Overall, the pattern of exchange rates is reminiscent of Q1 2017, when parallel market premiums over interbank rates rose to above 50% before the creation of the I&E window in April. However, after three years of operation, the I&E market still leans on the CBN as its back-stop supplier of US dollars. The CBN’s FX reserves are 13.2% down y-t-d at US$33.5bn.

Bonds & T-bills

The secondary market yield for a Federal Government of Nigeria (FGN) Naira bond with 10 years to maturity declined by 48bps to 11.38%, and at 3 years contracted by 50bps to 8.76% last week. The annualised yield on 293-day T-bill, contracted by 85bps to 3.19%, while a CBN Open Market Operation (OMO) bill with similar tenure closed at 11.48%, 18bps down week-on-week. We observed significant growth in Non-deliverable currency forwards (NDF) demand in April as foreign portfolio investors reassigned liquid Naira positions to short-duration paper. The aim, in our view is to optimize Naira cash positions given the uncertainties in the FX market. Market rates could stay low for several weeks.

Oil

The price of Brent declined by 23.65% last week to US$21.44/bbl. The average price, year-to-date, is US$47.58/bbl, 28.39% lower than the average of US$64.20/bbl in 2019, and 35.87% lower than the average of US$71.69/bbl in 2018. A worst-case scenario in the crude oil market came to pass last week, as US crude prices plunged below zero, with the WTI crude benchmark closing the day at negative $37.63/bbl and the Brent benchmark hitting an 18-year low. Our view is that Brent prices may not stabilise around US$35.00/bbl until Q3 2020.

Equities

The Nigerian Stock Exchange All-Share Index (NSE-ASI) declined by 1.41% last week, the year-to-date return is negative 15.81%. Last week Cadbury Nigeria (+18.25%), Nigerian Breweries (+6.65%), Stanbic IBTC (+3.64%) and MTN Nigeria (+2.46%) closed positive, while Guinness Nigeria (-15.63%), Oando (-12.21%), Fidelity Bank (-10.78%) and Access Bank (-7.46%) fell. Equity risk remains on the horizon following the increasing number of COVID-19 cases in Nigeria and as economic fortunes remain wary. All the same, we think it makes sense to increase portfolio weights in stocks with deep value.

Short and long currency cycles

The Naira is not a petro-currency. There are other factors that influence its long-term exchange rate with the US dollar. In our view, the best explanation for exchange rate changes lies in the difference between US dollar inflation and Naira inflation (we explain this in Coronation Research, Year Ahead 2020, 16 January). This has been a good guide to long-term Naira/US dollar exchange rates over the past 10 years.

But these underlying pressures on the Naira also need short-term events to set them in motion. One was the emerging market debt crisis of 1997/1998, which unsettled the Naira back then. Another was an oil-related event, the crash in oil prices in 2015, which precipitated falls in the Naira/US dollar rate in 2016 and 2017. Note that the short-term trigger can precede what happens in the currency market by a year or more.

Any dislocation seen in the parallel exchange rate (also known as the street rate) is not a cause of pressure on the Naira, but a symptom of it. Buying US dollars on the street is an inefficient way of transacting, and there exist restrictions on how these US dollars may be used. Spreads are large enough to make a currency trader blush (or at least very happy). Cash deposits of US dollars at Nigerian banks are not eligible for foreign transfers. So the parallel market has a lot of limitations.

One limitation was evident in early 2017 when it over-reacted. US dollars were bid higher than N500/US$1 but, after the introduction of the Nigerian Autonomous Foreign Exchange Fixing (NAFEX) in April 2017, the parallel rate swiftly converged with the NAFEX rate, settling at around N357/US$1 by August that year. For almost three years after the parallel market rate had stayed close to the NAFEX rate. Only recently has it moved away from the NAFEX rate.

Model Equity Portfolio

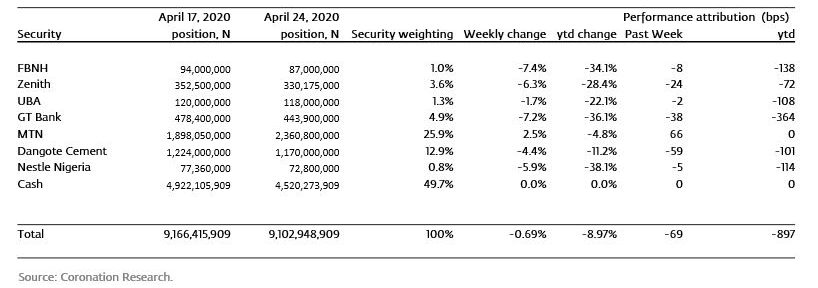

Last week the Model Equity Portfolio lost 0.69%, compared with a decline in the Nigerian Stock Exchange All-Share Index (NSE-ASI) of 1.33%, outperforming by 64 basis points. Year-to-date it has lost 8.97%, against a loss of 15.74% in the NSE-ASI, outperforming it by 677bps.

We actually sighed relief when we saw the market fall last week. The rally of the previous two short previous weeks (four trading sessions each) had returned 8.66% and we were poorly-orientated to participate in a rally with such a large notional cash position, currently at 49.7%. We do not like chasing stocks – it almost never pays – and were reticent about making further notional purchases of equity, though we determined to buy more MTN Nigeria and Dangote Cement.

Model Equity Portfolio for the week ending 24 April 2020

The problem with the 8.66% rally around the Easter holiday period was that it could have been – and it still could be – the rally that signals the end of the current downturn, a future resolution of the Naira/US dollar exchange rate, and a return to economic growth. This happened in April 2017, after all, and the rally was sustained for the rest of the year. But, in the current cycle, it seems too early for this kind of resolution to play out. On balance, therefore, we think that the recently rally does not signal a sustained market rebound.

Last week we made notional purchases, in the middle of the week, to take our notional position in MTN Nigeria up to 26.0% of the portfolio. We also intended to raise our notional position in Dangote Cement to close to a neutral weight of 19.0%, but we saw such weakness in the stock that we thought it better to defer that notional purchase to this week.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.