Q1 2021 GDP was reported on Sunday evening and showed the growth rate at 0.51% year-on-year (y/y). This was better than the 0.11% y/y growth of Q4 but Q1 2021’s non-oil growth was actually slower than Q4 (+0.79% y/y against +1.69% y/y). Although the Monetary Policy Committee (MPC) of the Central Bank of Nigeria (CBN) is increasingly vocal about the need to combat inflation, we think that, in view of weak growth, it will stop short of raising its 11.50% Monetary Policy Rate (MPR) at the conclusion of its meeting tomorrow afternoon. See details below.

FX

Last week, the exchange rate in the Investors and Exporters Window (I&E Window) weakened by 0.08% to close at N412.00/US$1, the highest level since March 9. In the parallel (or street) market, the Naira weakened by 0.21% to close at N485.00/US$1. Elsewhere, the CBN’s FX reserves fell slightly, by 0.44%, in the week to US$34.35bn. Amidst persisting FX illiquidity in the I&E Window and continued weakness in the parallel market rate, we expect pressure on both rates to continue.

Bonds & T-bills

Last week, trading in the secondary bond market opened on a quiet note as investors anticipated the bond primary market auction (PMA). The market turned bearish following the auction’s outcome, wherein stop rates trended higher than in the previous auction. Compared with last week, the yield for an FGN Naira-denominated bond with 10 years to maturity rose by 11bps to 13.36%, the yield on the 7-year bond rose by 13bps to 13.15%, and the yield on a 3-year bond rose by 16bps to 12.21%. Thus, the overall average benchmark yield increased by 15bps w/w to close at 12.44%. At the PMA, the Debt Management Office (DMO) offered a total of N150 billion (US$366m) worth of bonds, and the subscription was about 88% more than the volume offered. Stop rates for the 2027 bonds closed at 13.10%, the 2035 bonds closed at 14.00%, and the 2049 bonds closed at 14.20%. Amidst tight liquidity conditions and still negative inflation-adjusted returns, we maintain our view that bond yields are likely to continue trending upwards.

The Nigerian Treasury Bills (T-bill) market was mixed as the annualised yield on a 342-day T-bill in the secondary market declined by 19bps to 9.06%, while the yield on a 298-day OMO bill rose 54bps to 10.42%. The average benchmark yield for T-bills rose by 70bps to close at 5.76%, while OMO bills rose by 61bps during the week to close at 9.23%. The CBN sold N20bn worth of OMO bills with stop rates unchanged from the previous sale – 89-day bills at 7.00%, 180-day bills at 8.50%, and 355-day bills at 10.10%. We expect secondary market yields to trend higher over the coming weeks amidst the continued squeeze on system liquidity.

Oil

The price of Brent crude fell by 3.30% last week, closing at US$66.44/bbl, meaning a 28.26% increase year-to-date. The average price year-to-date is US$63.19/bbl, 46.21% higher than the average of US$43.22/bbl in 2020. Last week, oil prices fell after getting caught up in the broader selloff in commodities. However, talks of an imminent return of Iranian oil to official oil markets was the primary drag on prices as talks progressed on the Iran nuclear deal. Overall, the supply and demand balance remains supportive as increased demand is expected in the summer as the widespread vaccine rollout continues and international travel resumes. Our view is that oil prices are likely to remain well above the US$60.00/bbl mark for several weeks, and quite possibly several months.

Equities

The NGX All-Share Index (NGX-ASI) dipped by 2.93% last week, bringing the year-to-date loss to -4.83%. Sterling Bank +12.84, MRS +11.01%, Seplat +10.00%, and Honeywell Flour Mills +3.54% closed positive last week, while Airtel Africa -10.00%, BUA Cement – 4.69%, and Dangote Sugar -4.18% closed negative. Negative performance characterised most sectors as the NGX Oil and Gas Index was the only gainer for the week, rising by +7.39%. The NGX Industrial Goods Index led the losers with a decline of -3.34%, while the NGX Banking Index fell by -1.53%, the NGX-30 Index by -1.48%, the NGX Insurance Index by -0.74% and the NGX Consumer Goods Index by -0.03%. We expect investors to be cautious, given that fixed-income yields and yields on bank deposits have improved considerably over the past few weeks. And we expect investors to react to the fact that many bank stocks have gone ex-dividend (at least, the full-year dividend) recently. See Model Equity below.

Slow GDP points to MPR rate hold

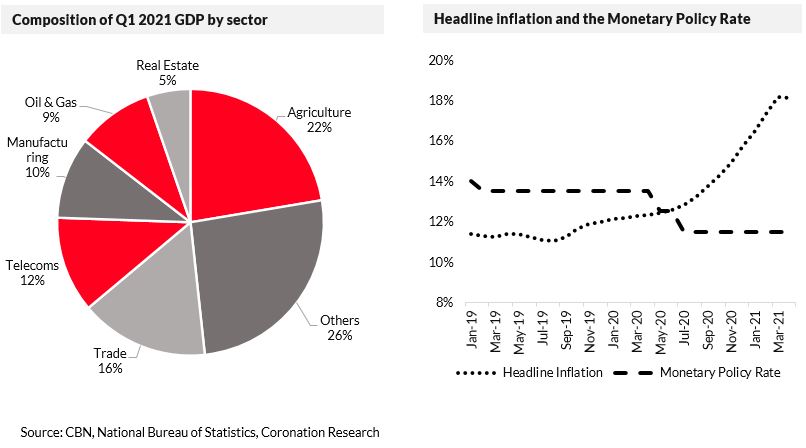

On Sunday evening the National Bureau of Statistics (NBS) released GDP data for Q1 2021. It shows a continued weak recovery from the recession of 2020 and is likely to influence the Monetary Policy Council (MPC) of the CBN to hold its headline policy rate at 11.50% when it concludes its two-day meeting on Tuesday afternoon.

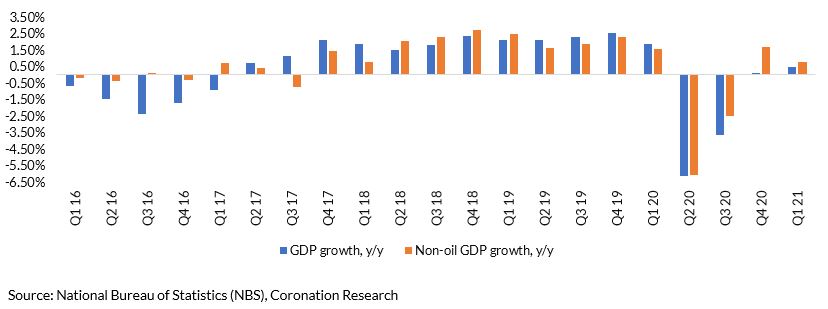

Quarterly GDP development, year-on-year

Q1 2021 GDP grew by 0.51% year-on-year (y/y) which is better than in Q4 2020 (+0.11% y/y) but lower than a Bloomberg survey of forecasts (albeit just three of these) which put it at 0.80% y/y. The headline number for Q1 is the growth of 0.51% y/y but the non-oil GDP performance is the growth of 0.79% y/y, which is actually lower than in Q4 2020 when non-oil growth was at 1.69% y/y. This is almost certain to be seen as disappointing.

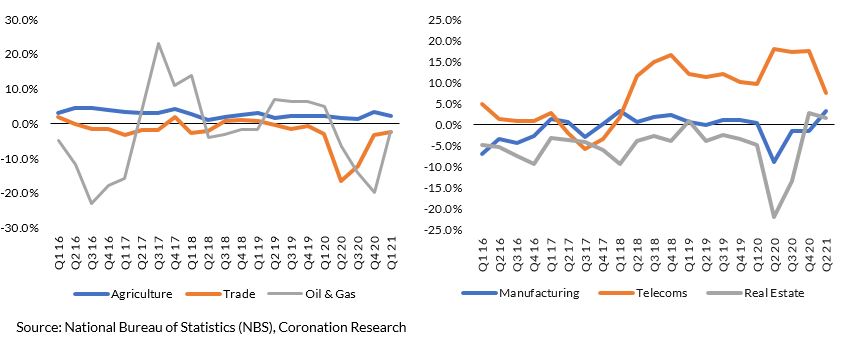

Top-six drivers of GDP, y/y growth rates

Agriculture grew at 2.28% y/y in Q1 2021, which is close to its trend growth rate but lower than the 3.42% y/y recorded in Q4 2020. Trade contracted at 2.43% y/y in Q1 2021, but this is better than the 3.20% y/y/ contraction in Q4 2020. Oil & gas contracted by 2.21% y/y in Q1 2021, but this was much better than the 19.76% y/y contraction in Q4 2020. Note that oil is usually sold three to six months forward, so the full benefits of recovering oil prices were not felt in Q1, but are likely to be evident in Q2 and Q3. Telecoms grew at 7.69% y/y in Q1 2021, but this was much lower than the 17.64% y/y growth in Q4 2020. Manufacturing grew at 3.40% y/y in Q1 2021 which is much better than the 1.51% contraction in Q4 2020. Real Estate grew at 1.77% which is not quite as good as the 2.81% y/y growth recorded in Q4 2020. The overall picture is mixed. Clearly, it is likely that the GDP growth rate will speed up, especially as the Oil & gas sector begins to enjoy strong prices later in the year. For the economy to reach the IMF’s forecast of 2.5% growth in 2021, in our view, it would be important for agricultural growth and telecoms growth to accelerate going forward from Q1.

Slow GDP points to MPR rate hold

This puts the MPC in a difficult position. Several members took a tough line on inflation at the last meeting in March and voted to raise the Monetary Policy Rate. There may be more voices to raise rates now. However, to do so when the recovery remains weak may seem premature, so we think the MPC will stick with an MPR of 11.50%.

This is not to say that market interest rates are likely to be put on hold. The MPR is, in large measure, a signal of the CBN’s stance, while the action takes place in the money markets. The re-balancing of market interest rates (a recent 364-day T-bill auction was sold at 10.80%, annualised) with inflation (April inflation was 18.12% y/y) appears to be ongoing. As we wrote last week, we still expect Naira 1-year risk-free rates of 15.00% to emerge on a three-month view.

Model Equity Portfolio

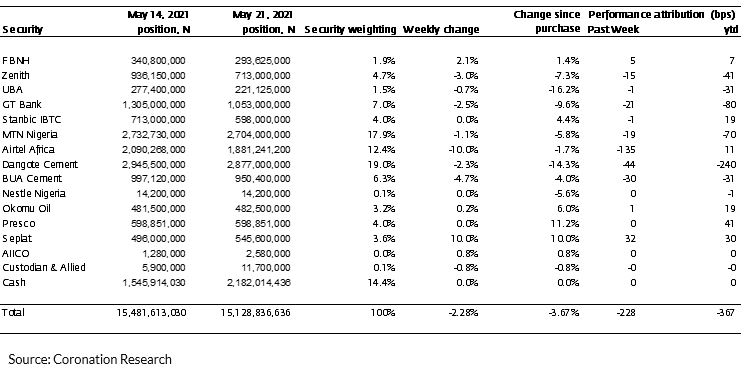

Last week the Model Equity Portfolio fell by 2.28% compared with a fall in the Nigerian Stock Exchange All-Share Index (NSE-ASI) of 2.96%, therefore outperforming it by 69 basis points. Year to date it has lost 3.67% against a loss in the NSE-ASI of 4.83%, outperforming it by 116bps. We have made back the exceptional underperformance of two weeks ago, which is gratifying, but we are faced with absolute losses in a falling market, which we must address (although we do not want to take a majority cash position unless there is a clear loss of confidence in the market).

Model Equity Portfolio for the week ending 21 May 2021

Our 6.3% notional position in BUA Cement cost us 30bps last week. However, if we had held an index-neutral position of some 16.7% it would have cost us 58bps. Our new (two weeks old) notional position in Seplat earned us 32bps last week. We have a double notional overweight (3.6% versus an index-neutral 1.8%) position in this stock, and although were late to the party we are happy with the notional position.

It was interesting to see Airtel Africa fall from N930/s to N837/s but, alas, there was still low liquidity. We would take an opportunity to realise notional cash here if the liquidity is sufficient this coming week, ideally shaving off one-third of our index-neutral notional position.

Our total notional position in banks continued to cost us, 33bps last week and 126bps year-to-date, so we were happy to make notional sales in each of the five notional positions to realise 4 percentage points of cash last week. We advised our readers that we would do this last week. We are still overweight in the banks (a total notional position of 19.0% as opposed to an index-neutral position of close to 16.0%) and so we will continue to make notional sales this week, with the intention of realising a further four percentage points of notional cash. Now that full-year dividend entitlement dates are mostly past, we are happy to take a somewhat underweight stance in the sector. We will continue to pick up AIICO and Custodian & Allied shares when we can, as building notional positions with such low liquidity is clearly going to take time.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.