Last week the Monetary Policy Committee (MPC) of the Central Bank of Nigeria (CBN) held its Monetary Policy Rate (MPR) at 13.50%, thus becoming one of the few central banks in the world not to signal (and the MPR is to some extent a signal – see the actual market rates listed on this page) loosening of monetary conditions. In fact it had already announced an injection of liquidity into the economy one week earlier, an injection over which it will exercise oversight.

FX

The pressure on the CBN’s gross reserves appears to have abated, but not completely. Month-to-date the published number (which represents a one-month moving average) has declined by US$671.1m to US$35.59bn, compared with a reported outflow of US$1.58bn in February. The CBN recently moved the foreign exchange rate in the main foreign exchange market from N366/US$1 to N380/US$1, a move that was welcomed for showing a degree of flexibility. However, the foreign exchange markets are tight, and this is indicated by the US dollars being quoted for sale at up to N410/US$1 in the parallel, or street market. Given low oil prices and disruption to global markets, we think that foreign exchange conditions will remain tight for a while.

Bonds & T-bills

The secondary market yield for a Federal Government of Nigeria (FGN) Naira bond with 10 years to maturity rose by 23bps to 13.02%, and at 3 years declined by 23bps to 10.55% last week. The annualised yield on 321-day T-bill, the longest duration available in the secondary market, declined by 121bps to 4.69%, while a CBN Open Market Operation (OMO) bill with similar tenure closed at 18.48%, 245bps down week-on-week. Last week activity in the T-bill market was bullish, spurred by demand as local investors were caught between managing liquidity and yield in their portfolios.

Oil

The price of Brent declined by 8.64% last week to US$24.64/bbl. The average price, year-to-date, is US$51.73/bbl, 19.42% lower than the average of US$64.20/bbl in 2019, and 27.84% lower than the average of US$71.69/bbl in 2018. The oil price war between Saudi Arabia and Russia shows no sign of relenting despite attempts by the US to intervene in the matter. We think oil prices will remain suppressed for a few months at least. The effect of the coronavirus pandemic is to weaken demand just when two of the world’s three largest producers are increasing supply.

Equities

The Nigerian Stock Exchange All-Share Index (NSE-ASI) declined by 1.52% last week, the year-to-date return is negative 18.55%. Last week Honeywell Flour Mills (+18.07%), Sterling Bank (+13.46%), Access Bank (+9.40%) and PZ Cussons (+8.64%) closed positive while Nigerian Breweries (-15.00%), Dangote Sugar (-10.00%), Nestle Nigeria (-10.00%) and Unilever Nigeria (-10.00%) fell. In our view, the trend witnessed last week is likely to persist, as market sentiment weakens in the face of the fast-spreading coronavirus pandemic and weakness across global markets continues. However, investors can take positions in fundamentally-justified stocks where dividend yields are generous, valuations are low in historic terms, and the outlook is reasonable.

Stimulus in a time of austerity

Most central banks across the world, from the US Federal Reserve to the Bank of Ghana, have cut interest rates in response to the economic threat posed by the coronavirus pandemic. In some cases central bank rates are symbolic percentages that describe central bankers’ intentions, in many cases they set actual market interest rates. None of the world’s central banks have been able to stop equity markets from falling, or unemployment rising, by cutting interest rates, however. Perhaps the MPC of the CBN had this phenomenon in mind when it met last week.

So, while most analysts (ourselves included) forecast a cut in the CBN’s MPR, the CBN held it at 13.5%. However, a week before this it had announced a N1.1 trillion (US2.9bn) stimulus package for the economy together with a set of policy measures, including: an extension of the moratorium on principal payment on its intervention loans (typically to agriculture); a reduction of its interest rates on these facilities from 9.00% to 5.00%; a new N50 billion (US$131.6m) credit facility for small and medium-sized entreprises; credit support for the healthcare industry; guidance for commercial banks to introduce time-limited restructuring of loans to businesses affected by the coronavirus pandemic; a reiteration of the loan-to-deposit ratio requirement (of 65.00%) on commercial banks, together with encouragement to make more long-term loans.

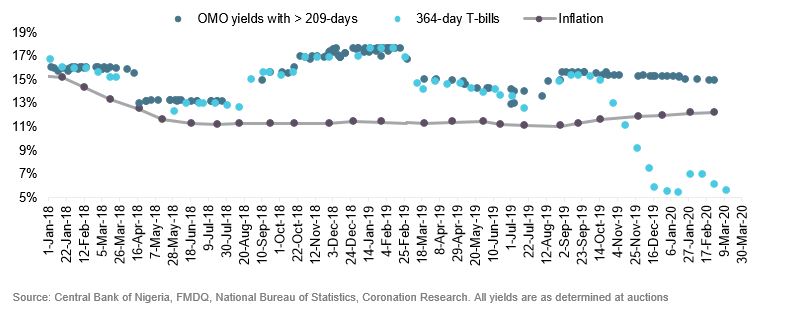

OMO yields, T-bill yields and inflation

What this amounts to, in our view, is a carefully-targeted stimulus in place of interest rate cuts. And, when it comes to market interest rates, the CBN can argue that its imposition, last year, of the minimum loan-to-deposit ratio (LDR) on commercial banks, and of the separation of the T-bill market from the market in its own open market operation (OMO) bills, have together brought down market interest rates in any case. In view of this, what point would there have been in bringing down the MPR?

There is no doubt that the LDR has increased the volume of private sector credit in the economy (which stubbornly refused to rise when the economy was growing in 2018 and the first half of 2019, even in nominal terms). On the other hand, one can look at market interest rates and wonder why the economy was not growing faster recently. After all, one-year rates at 4.69%, when inflation is 12.20%, is surely an encouragement to growth? The problem, in our view, is that with private sector credit roughly equivalent to 15.00% of GDP, far less than in developed and some developing countries, the stock of credit requires multiplying rather than just expanding.

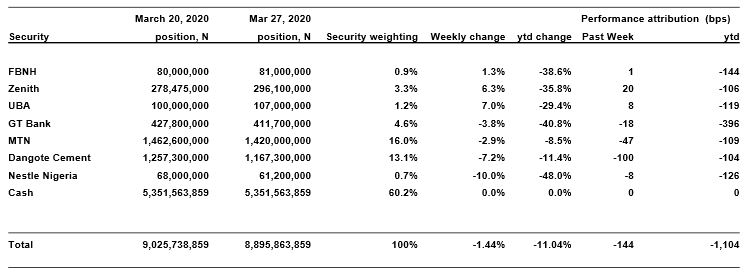

Model Equity Portfolio

Last week the Model Equity Portfolio shed 1.44% compared with the Nigerian Stock Exchange All-Share Index (NSE-ASI) which lost 1.52%. Year-to-date it has lost 11.04% compared with a loss of 18.55% for the NSE-ASI. It alarms us that, despite having a 60.2% cash position, the portfolio tracked the NSE-ASI so closely last week, outperforming it by a miserly eight basis points. The reason is easy enough to see in the year-to-date column (“ytd change”) of the table. We are invested (notionally, in our case) in large and liquid stocks like the banks, and these have fallen by much more than the NSE-ASI this year, most likely as foreign institutional investors have sold down (the stocks with the greatest level of foreign holding falling the most).

However, this does not fully explain the problem. Another factor is that the NSE-ASI represents every listed stock, and many of these do not trade very much and, in some cases, this means that their prices change very little. This acts as a brake on the index overall. An index concentrated on the large and liquid stocks would do worse than the broad index. Indeed, the Nigerian Stock Exchange 30 Index, which is precisely this, has fallen by 20.94% this year compared with the NSE-ASI’s 18.55% loss.

Model Equity Portfolio for the week ending 27 March 2020

Assessing where we stand, we are gratified by the relatively (relative to the banks) strong performance of MTN Nigeria. Although it has a lot of foreign owners, it has not sold off much this year. As this edition of Nigeria Weekly Update is being written remotely, rather than in our office, it is obvious that Nigerian telecom companies will be supplying more services to their customers than before, and this in an industry which is growing at over 10% per annum in real terms to begin with. So MTN Nigeria is something of a defensive stock during this lock-down, in our view. We are a little bit underweight MTN Nigeria and intend to make notional purchases; to first bring it up to a neutral weight (18.4%), and then to a small overweight (20.0%) position this week.

We will watch our notional bank positions closely. Some domestic institutional investors are buying these stocks for their high dividend yields, one reason we made notional purchases in some of them two weeks ago. On the other hand, business conditions are deteriorating. Banks are ingenious at preserving their spreads in times like these, but nevertheless there are headwinds.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.