Last week the fixed income markets received two important indicators as to the likely direction of market interest rates. One was the fact that a few members of the Central Bank of Nigeria’s (CBN) Monetary Policy Committee voted to raise the Monetary Policy Rate, even though a majority voted to keep it at 11.50%. The second was that the Debt Management Office’s auction of bonds achieved slightly higher rates than what the market had priced in earlier. We think that 1-year T-bill rates are on course to reach around 10.00% by mid-year. For our reasoning, see below…

FX

Last week the exchange rate in the Investors and Exporters Window (I&E Window) closed at N410.00/US$1 with no change from the previous week. In the parallel, or street market, the Naira also closed flat, at N485.00/US$1. Although restoring FX liquidity to the levels achieved before the pandemic might seem herculean, the CBN is said to be recording some success in its bid to attract foreign remittances. According to sources within the CBN, it received circa $40 million last week in remittances, up from about $6 million before the policy was introduced. At $40 million a week the CBN could be attracting $1.9 billion per annum. When it comes to sales of foreign exchange, the CBN has charged Nigerians to report any bank withholding forex, saying the country has not changed from its foreign exchange management policies, whereby Nigeria remains on a managed float.

Our view is that foreign exchange turnover in the I&E Window and NAFEX rates remain well below pre-crisis (i.e. pre-March 2020) levels and that, as such, the gap between the I&E and NAFEX rates and the parallel market is likely to remain for some time. This suggests to us continued pressure on the I&E Window and NAFEX rates.

Bonds & T-bills

Last week, the secondary market yield for an FGN Naira bond with 10 years to maturity increased by 13bps to 10.72%, the 7-year bond yield increased by 37bps to 10.50%, and the 3-year bond yield decreased by 49bps to 7.51%. After the conclusion of the monthly bond auction, the market ended the week on a mixed note as we saw rotation from the long end of the curve to the short end of the curve. This week we expect the market to trade range-bound.

By contrast, last week the annualised yield on a 335-day T-bill increased by 249bps to 6.65% in the secondary market while the yield on a 340-day OMO bill fell by 51bps to 8.06%. We continue to think that T-bill rates are on an upward trend.

Oil

The price of Brent crude rose by 0.06% last week, closing at US$64.57/bbl, a 24.65% increase year-to-date. The average price to year-to-date is US$61.17/bbl, 41.55% higher than the average of US$43.22/bbl in 2020. It appears the unease in the market about the fresh Covid-19 related restrictions is not going away for a while. Poland has joined the list of European countries, such as France and Germany, that are imposing tough measures to curb the increasing number of cases. This is likely to stifle demand and the impact was felt as oil prices fell during the early part of the week. Prices picked up by about 6.00% on Wednesday after a large container vessel blocked the Suez Canal, creating a traffic jam.

The Organization of the Petroleum Exporting Countries (OPEC) will meet on 1 April 2021 and it is expected that the cartel will hold production steady in its bid to keep output and prices at optimal levels. We see Brent crude prices holding up above US$60.00/bbl for several weeks.

Equities

The Nigerian Stock Exchange All-Share Index (NSE-ASI) rose by 2.17% last week with a loss of 2.62% year-to-date. Stanbic IBTC (+30.00%), Guinness Nigeria (+18.58%), and Sterling Bank (+13.42%) closed positive last week, while MRS (-9.70%), UBA (-4.90%), and Lafarge Africa (-4.87%) closed negative. The Banking sub-index (+0.21%), however, was left behind by the rest of the market and would have fallen had it not been for the exceptional performance of Stanbic IBTC. Last week also saw advances in MTN Nigeria (+1.91%), Dangote Cement (+2.27%) and BUA Cement (+5.08%). As these three are index heavyweights it seems that market sentiment is improving. See Model Equity Portfolio on page 4 for our reaction.

The CBN and interest rates

It is one thing to say that interest rates should go up and another thing to predict that they will go up. In general, we ban the word ‘should’ from our published research, because we are not in the business of giving instructions. We are in the business of managing our clients’ liquidity and advising on the likely direction of market interest rates (among other things).

Last week the market received two indicators as to the likely direction of market interest rates. The first came from the Monetary Policy Council (MPC) of the CBN, about which more later. The second came from the monthly bond auction by the Debt Management Office (DM0). These were auctions of 6-year, 14-year and 24-year Federal Government of Nigeria (FGN) bonds.

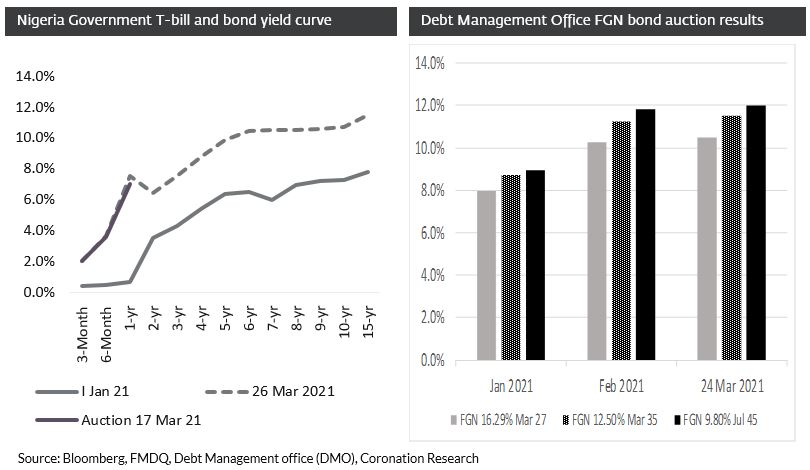

The background to these auctions was that the FGN bond yield curve, which measures secondary market yields, had barely moved since mid-February. Therefore, this year’s average 345 basis points (bps) expansion in the average yield of 10 bonds (with durations of 2-years to 15-years, see chart) took place mainly during the first six weeks of the year. But how well does the secondary market reflect investor demand?

We found out last Wednesday. The auction of the March 2027 bond was sold at 10.50%, 50bps higher than the secondary market yield on the day. The March 2035 bond was sold at 11.50%, 18bps higher than the secondary market yield on the day. And the July 2045 bond was sold at 11.29%, 71bps higher than the secondary market yield on the day. In other words, secondary market bond yields (at least, for these durations) were a fairly good guide to the market but, when tested with volumes at auction, understated the required yield. The secondary market prices of all three bonds corrected after the auction.

At the short end of the yield curve (i.e. durations of less than one year) the regular auctions of FGN T-bills give a clear picture. The stop rates for 364-day maturities increased from 4.0% on 10 February to 7.0% on 17 March, representing a steep increase in short-term market interest rates (at least, those achieved at auction: secondary market yields can be lower). For a while now we have been pointing to the T-bill market reaching rates of around 10.0% by mid-year, but how do we reach this view?

At this point, we need to discuss the MPC of the CBN. We do not envy its job. On the one hand, it needs to have low market interest rates to prevent a sustained recession (and it can argue, with considerable justification, that it achieved this last year): on the other hand, it needs to set interest rates that act, in conjunction with several other factors (e.g. structural factors, foreign exchange rates, commodity rates and government spending) to contain inflation. In February inflation was 17.33% y/y, with food inflation at 21.79% y/y, far above its upper target of 9.00% y/y. Clearly, and given that several other emerging markets – Russia, Brazil and Turkey – have raised rates in the direction of inflation this year, there is an argument for putting rates up.

However, it is as well to remember that we are in the hands of the CBN and its MPC. If they want to lower market interest rates (as they did towards the end of 2019 and throughout 2020) then, in all probability, they will make this happen. So, it is significant that some members of the MPC are voting to raise rates in 2021. At January’s meeting of the MPC, all members voted to keep the Monetary Policy Rate (MPR) at 11.50%: but at last week’s meeting, three members voted to raise it. Against this, we believe, the CBN will have to balance the threat posed by rising rates to the economic recovery. This is why we think the CBN will allow the market to reprice interest rates this year, but not so fast as to reach the rate of inflation within a few months.

Model Equity Portfolio – 26 March 2021

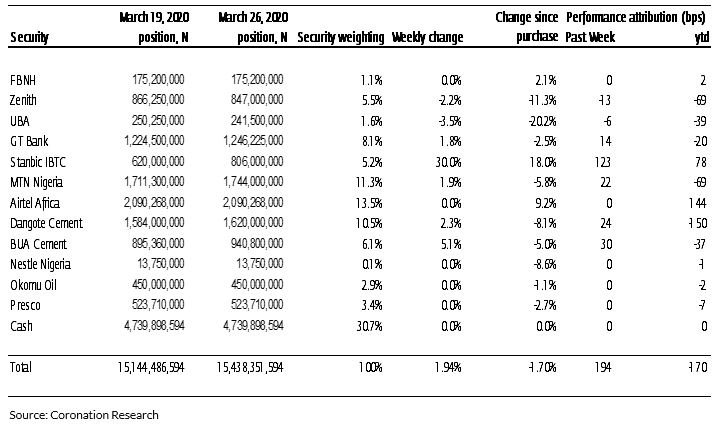

Last week the Model Equity Portfolio rose by 1.94% compared with a rise in the Nigerian Stock Exchange All-Share Index (NSE-ASI) of 2.17%, therefore underperforming it by 23 basis points. Year to date it has lost 1.70% against a loss in the NSE-ASI of 2.62%, outperforming it by 91bps.

As often published on these pages – though in fact, we do not always follow this principle – we do not try to predict the direction of the market (it is very difficult) but instead buy stocks that we like (which have good RoE, sales momentum and earnings momentum) when their valuations are low. However, at the beginning of this year, we started selling the market as a whole, sensing that it would be weak. To an extent, we were right.

What has been the result? A simple back-test of our performance attribution model provides the answer. In the first quarter of 2021 the portfolio would have been down 2.72% y-t-d against a market down by 2.62% y-t-d, therefore underperforming it by 10bps, if we had made no notional sales. In the event, and thanks to our notional sales (which took the notional cash position from 1.1% to 30.7%) the portfolio only fell by 1.70% y-t-d, outperforming the index by 91bps. We made notional sales into a strong market during January and were repaid as the market corrected in February and early March.

Model Equity Portfolio for the week ending 26 March 2021

However, a 30.7% notional cash position carries with it risks, and last week taught us a lesson. The market turned upwards. If it had not been for our large (5.2%) notional position in Stanbic IBTC we would have lost all our outperformance so far this year. So, we will re-set the model equity portfolio to a more neutral position by making notional purchases in selected stocks, notably MTN Nigeria and Dangote Cement, this week in order to make our exposure to them neutral relative to their index weights. There is sufficient notional liquidity to do this.

Stanbic IBTC is a perfect example of the kind of stock in which we should have a significant overweight position, given its high long-term RoE and earnings momentum. We wish there were more stocks like it.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.