Economic growth; inflation; foreign exchange. These are three of the Central Bank of Nigeria’s key responsibilities, yet prioritising one at the expense of the others can prove costly. Yet how – with what tools – does the CBN manage them? We provide answers below.

FX

Last week, the exchange rate in the Investors and Exporters Window (I&E Window) remained unchanged to close at N412.00/US$1. In the parallel (or street) market, the Naira weakened by 2.06% to close at N495.00/US$1, the lowest level since end-Nov 2020. The parallel market appeared to be following the CBN’s earlier change in the official rate, at around N379.00/US$1, to be in line with the I&E Window and NAFEX market rates at around N411.00/US$1. The move implied a 7.79% devaluation of the official rate. The CBN Governor stated that the change was necessitated by the fact that government transactions were no longer conducted at the official exchange rate and he reiterated that the country still runs a managed float exchange rate regime. Elsewhere, the CBN’s FX reserves fell slightly, by 0.25%, over the week to US$34.24bn. Amidst persisting FX illiquidity in the I&E Window and NAFEX markets, we expect the parallel rate and the I&E Window rates to continue to be under pressure over the months to come.

Bonds & T-bills

Last week, trading in the secondary market for FGN bonds was mixed, with some gains on benchmark durations but losses elsewhere. Tight system liquidity persists. The yield of an FGN Naira-denominated bond with 10 years to maturity fell by 15bps to 13.21%, the yield on the 7-year bond was unchanged at 13.15%, and the yield on a 3-year bond fell by 1bp to 12.20%. However, the overall average benchmark yield increased by 8bps w/w to close at 12.52%. We sense that there is a slight pause in the movement of rates upwards but that, over the coming weeks and months, yields are likely to continue to climb in view of the challenges from inflation and exchange rates.

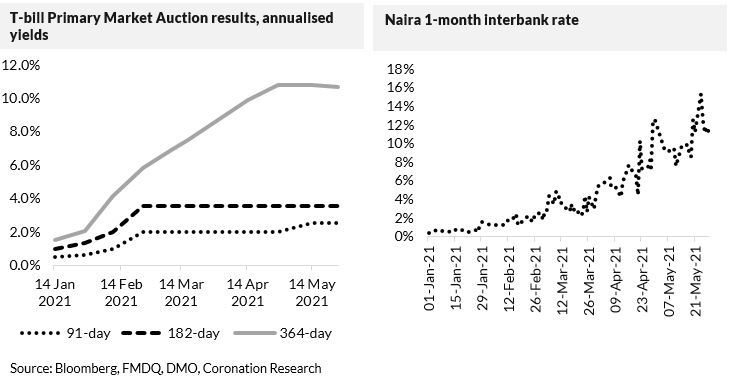

Activity in the Nigerian Treasury Bill (T-bill) secondary market was bearish. The annualised yield on a 335-day T-bill in the secondary market rose by 51bps to 9.57%, while the yield on a 291-day OMO bill fell by 2bps to 10.40%. The average benchmark yield for T-bills rose by 34bps w/w to close at 6.10%, while the average yield for OMO bills rose by 36bps w/w to close at 9.59%. In the T-bill Primary Market Auction (PMA), the CBN offered a total of N63.18 billion (US$153.72m), which was oversubscribed by 369%. The stop rate for the 91-day (2.50%) and the 181-day (3.50%) bills remained unchanged, while the stop rate for the 364-day (9.75%) bill decreased by 10bps. The CBN mopped up liquidity via OMO auction, selling a total of N41.00 bn in bills. The stop rates for the 96-day (7.00%), 180-day (8.50%) and 348-day (10.10%) bills remained unchanged from recent auctions. We expect secondary market yields to trend upwards over the coming weeks amidst the continued squeeze on system liquidity.

Oil

The price of Brent crude rose by 4.80% last week, closing at US$69.63/bbl, showing a 34.42% increase year-to-date. The average price year-to-date is US$63.47/bbl, 46.86% higher than the average of US$43.22/bbl in 2020. As the widespread vaccine rollout continues and international travel resumes, expectations of a strong rebound in global fuel demand (back to 100 million barrels per day) in the third quarter saw Brent move close to the US$70.00/bbl mark. OPEC+ (i.e. the Organization of the Petroleum Exporting Countries plus Russia) are scheduled to meet this week to discuss the further easing of their scheduled cuts (an 840,000-barrel-a-day increase is planned for July), as well as discussing the potential impact of an imminent return of Iranian oil to official markets. Our view is that oil prices are likely to remain well above the US$60.00/bbl mark for several months.

Equities

The NGX All-Share Index (NGX-ASI) dipped by 0.18% last week, bringing the year-to-date loss to -5.00%. Lafarge Africa +6.19%, Nigerian Breweries +4.46%, Honeywell Flour Mills +4.27% and Oando +3.45% closed positive last week, while Flour Mills of Nigeria -5.08%, MRS -4.96%, and GTBank -4.27% closed negative. Sectoral performances were mixed as the NGX Insurance index led the gainers, rising by +1.01%, followed by the NGX Oil and Gas index +0.85%. Conversely, the NGX Banking index led the losers, declining by 1.80%, followed by the NGX Industrial Goods index -0.43%, the NGX-30 index -0.34% and the NGX Consumer Goods index -0.07%. Although there could be a relief rally this week, as fixed-income yields did not climb much last week, we continue to expect investors to remain cautious, given the continued and overall upward trend in fixed-income yields and the shortage of positive catalysts. See Model Equity Portfolio below.

The CBN’s box of tools

On these pages two weeks ago we expressed our view that 1-year risk-free Naira interest rates can get to 15.0% in three months. We are looking for rates of around 15.0% for 1-year T-bills and OMO bills by mid-August. Part of our argument is that conditions are ripe for a rise in rates (conditions like inflation and foreign exchange rates): part of our argument is about how the monetary authorities are likely to act.

For example, the Naira was weak last year and inflation was rising. This did not cause the monetary authorities to engineer a rise in market interest rates: instead, they allowed rates to crash (via the release of money held in the OMO market into the T-bill market) to ward off the effects of recession during the Covid-19 pandemic and the associated fall in oil prices. This year the economy is growing but inflation is still high (18.12% y/y for April, double the CBN’s upper target range of 9.00%), so the response is different. Market interest rates are being allowed to rise.

All the same, the performance of the economy in Q1 2021 (growth of just 0.51% y/y) argues for caution, something that likely influenced last week’s decision to keep the Monetary Policy Rate (MPR) on hold at 11.50%.

What are the mechanics of allowing market interest rates to rise (or making them fall)? It comes down to managing Naira liquidity and here the monetary authorities have some powerful tools at their disposal, one of them being the Cash Reserve Requirement (CRR). This is is the percentage of customer deposits banks must place with the CBN. The base level is 27.5% but it is acknowledged that the excess CRR amounts to at least N5.0 trillion, hence the issue of Special Bills of that amount by the CBN to the banks late last year.

Applying the CRR reduces the liquidity of the banking system, which this year is evidenced by rising 1-month interbank yields and rising rates at T-bill auctions. Successive auctions of T-bills this year have been concluded at rising rates (although the auction rate of 364-day paper actually declined by 10 basis points during May). Depending on which way the authorities want market interest rates to develop, they can either tighten or loosen liquidity via the CRR.

(The strangely low rates on 91-day and 182-day T-bills at auction can be explained by the need, on the part of many participants, to hold readily-tradeable short-term paper rather than holding short-term bank deposits. This is a – very expensive – liquidity premium.)

The weak GDP growth data for Q1 2021 suggests being cautious about the further tightening of liquidity. However, market interest rates are not just about growth: they affect inflation and foreign exchange rates. Inflation is stabilising somewhat but April’s print at 18.12% y/y was only 5 basis points lower than March’s number at 18.17% y/y (and 578 basis points higher than a year earlier and 165 bps higher than in January). Moreover, as seen in the unofficial parallel exchange market last week, the Naira remains under pressure.

Economic growth; inflation; foreign exchange rates (FX). The CBN must manage these three, putting them in order of priority with each inflection in the underlying data. Information on FX appears daily; inflation monthly; GDP every quarter. We sense that as soon as the CBN is happy about growth (and it may not have to wait for the next GDP print three months from now) then it will feel comfortable about allowing rates to continue rising. After all, inflation remains a significant challenge to the economy.

Model Equity Portfolio

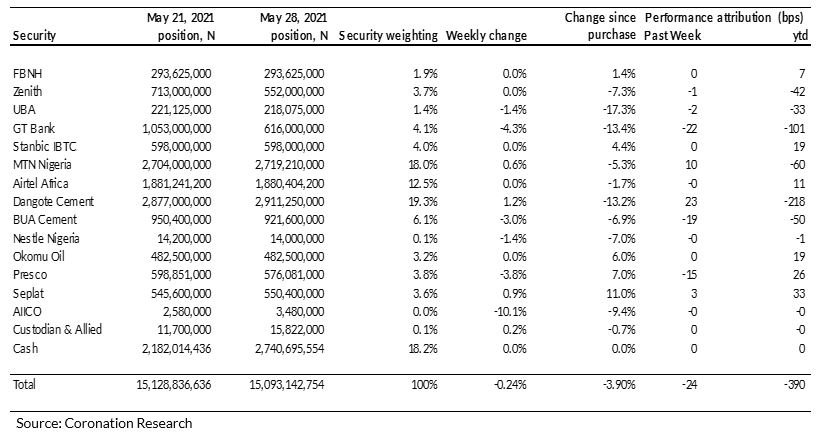

Last week the Model Equity Portfolio fell by 0.24% compared with a fall in the Nigerian Stock Exchange All-Share Index (NSE-ASI) of 0.18%, therefore underperforming it by 6 basis points. Year to date it has lost 3.90% against a loss in the NSE-ASI of 5.00%, outperforming it by 110bps.

Model Equity Portfolio for the week ending 28 May 2021

Once again the big culprit last week was our notional overweight positions in banks, which together cost us 25bp (and 150bps year-to-date). As we forewarned our readers last week, we made notional sales of bank stocks during the week to take our total bank’s exposure to nearly in line with the index, and our notional cash position up from 14.4% to 18.2%. This notional cash position now seems rather large, given the lack of strong direction, either way, in the market.

We continued to make notional purchases in insurance companies AIICO and Custodian & Allied, but liquidity (which we respect, even in a notional portfolio like this) is really very low. We shall be patient but cannot build the kind of meaningful positions we would like.

Last week’s Monetary Policy Council meeting left the policy rate at 11.50% and a T-bill auction achieved a rate 10 basis points lower (10.68% annualised versus 10.80%) than a similar auction mid-month. This does not mean that market interest rates are flat-lining (we think they will continue to climb over the coming months) but it may mean a short period of relief for the equity market. We will make some of our positions in cement stocks neutral this week, spending up to five percentage point of our notional cash, with a view to protecting ourselves against underperformance if the market rallies.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.