Until recently, the behaviour of the parallel exchange rate this year has been a mystery. Why did it not respond to pent-up demand for US dollars by adjusting rapidly? The answer is a very weak economy. Learn more below…

FX

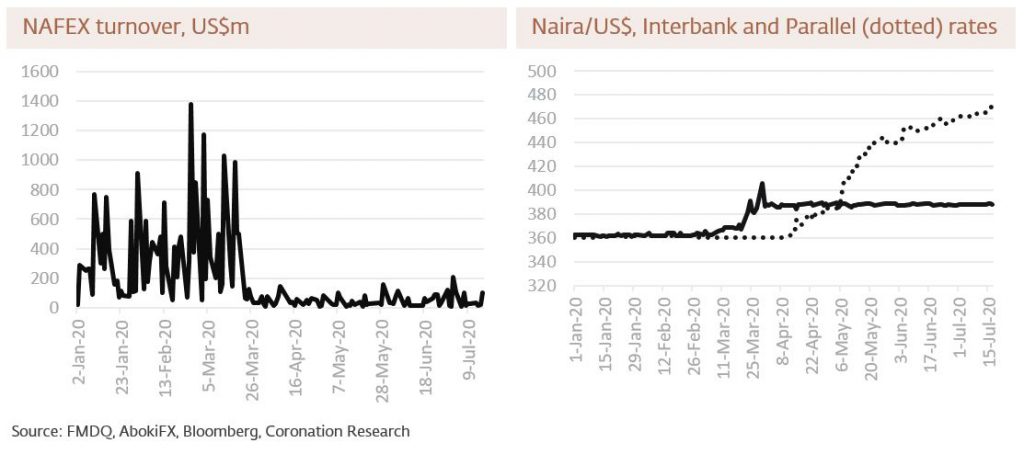

As we wrote last week, there is downward pressure on the Naira in the parallel (or street) market, and by the end of the week, it has declined a further 1.1% to N470/US$1. This contrasts with the NAFEX market (also known as the I&E Window) where it was broadly stable on the week, closing at N388.13/US$1, though turnover continued to below. The Central Bank of Nigeria (CBN) recorded a minuscule decline in its FX reserves last week, which fell by US$13.78 million to US$36.12 billion, suggesting that it is parsimonious when it comes to supplying FX markets with its US dollars. The result, we believe is likely to be more pressure on the parallel exchange rate.

Bonds & T-bills

The CBN’s Monetary Policy Council meeting concluded today with no change in its 12.50% policy rate, with the CBN signalling satisfaction with the 100bps cut back in May. The rally in the bond market continues. Last week the secondary market yield for a Federal Government of Nigeria (FGN) Naira bond with 10 years to maturity declined by 21 basis point (bps) to 8.84%, and at 3 years declined by 8bps to 4.03%. The annualised yield on 328-day T-bill remained flat at 2.96%. This week we expect investors’ focus to shift to the primary market, where the Debt Management Office (DMO) will offer N150.00bn (US$394.74m) worth of instruments to investors across four maturities. We think that the market will absorb the offers easily.

Oil

The price of Brent crude decreased by 0.23% last week to US$43.14/bbl. The average price, year-to-date, is US$42.19/bbl, 34.28% lower than the average of US$64.20/bbl in 2019. Last week, the OPEC + group of countries agreed to ease output restrictions, arguing that global demand for oil is beginning to recover. Starting in August, they will lower their collective output cuts to 7.7mbpd (millions of barrels per day) from the previous 9.7mbpd that took effect in May. While some parts of the global economy are recovering (e.g. China grew by 3.2% y/y in Q2) there is sufficient uncertainty in other large economies that we doubt oil prices will take off significantly.

Equities

The Nigerian Stock Exchange All-Share Index (NSE-ASI) declined by 0.08% last week. The year-to-date return is negative 9.52%. Last week Presco (+9.28%), Ardova Oil (+7.73%), Cadbury Nigeria (+7.41%) and Dangote Sugar (+3.45%) closed positive, while Nigerian Breweries (-11.89%), Mobil (-9.97%), Zenith Bank (-5.69%) and Flour Mills of Nigeria (-5.56%) closed negative. Sectoral performance reflected the market’s negative performance, with the Banking (-3.9%), Oil & Gas (-1.9%), Consumer Goods (-1.9%) and Insurance (-1.9%) indices all recording weekly losses. The Industrial Goods (+0.5%) index was the sole gainer for the week. See Model Equity Portfolio on below…

The mystery of the parallel FX market

Last week marked the point at which the Naira in the parallel market traded at more than 20% lower than the NAFEX market. Until last week the difference had been less but N470/US$1 measure a 21.1% difference from the NAFEX rate at N388/US$1. Whereas a monetary authority can, in our view, tolerate a difference of up to 20.0%, it becomes more difficult to ignore when it is greater than that.

Traders and manufacturers buy US dollars for purchases of traded goods and raw materials, and often source them from the NAFEX market (also known as Importers and Exporters Window, as well as the Interbank FX market). The problem with this market is that it does not live up to its name, the Nigerian Autonomous Foreign Exchange Market. It is not truly autonomous because the CBN usually provides a back-stop of US dollar liquidity, sometimes providing hundreds of millions of US dollars per month. That is, until recently. Since March turnover on the NAFEX market has slumped as the CBN has husbanded its precious US dollar reserves.

So, where has the demand for US dollars gone? It would normally go the parallel market, or ‘street market’. Back in early 2017, when the Interbank FX market rate (quoted on Bloomberg) was N316/US$1, the parallel market rate was N500/US$1 (a 58.2% difference). Yet the pressure on the parallel market rate in 2020 has been slow to arrive, and so far appears to be moderate. If the normal volume of US dollar demand were to appear in the parallel market, we would expect a bigger adjustment than this.

The World Bank’s and the IMF’s forecasts for Nigerian GDP in 2020 are negative 3.2% and negative 5.4%, respectively. Given that the recession in 2016 was negative 1.6%, this implies a very significant slowdown now. And, given that we expect agriculture (22.0% of the economy) and telecoms (10.9% of the economy) not to suffer much, this implies that the trade sector (16.1% of the economy) and the manufacturing sector (9.7% of the economy) are currently losing around 20% of their activity. This likely explains the lack of demand for US dollars overall.

However, as the trade and manufacturing sectors themselves adjust to the easing of lockdown restrictions, and as they take on new stock and attempt to pass on their foreign exchange costs to customers, we would expect demand for US dollars to rise (though not actually recover to levels seen earlier in the year). This suggests that there will be further pressure on the parallel market exchange rate over the coming weeks and months.

Model Equity Portfolio

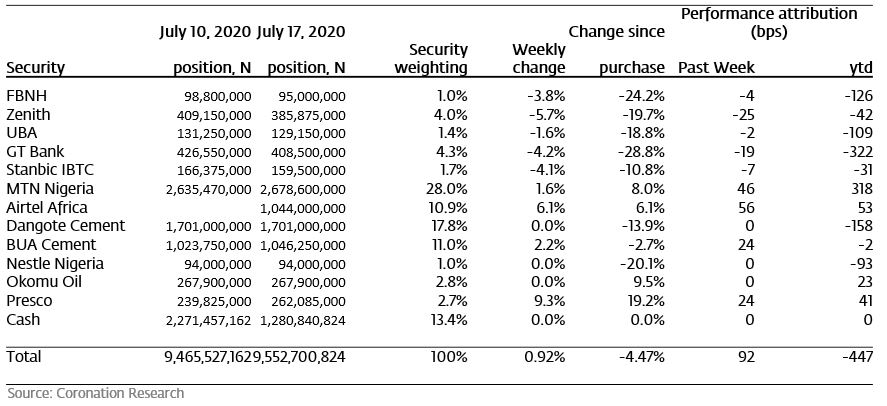

Last week the Model Equity Portfolio rose by 0.92%, compared with a fall in the Nigerian Stock Exchange All-Share Index (NSE-ASI) of 0.08%, therefore outperforming it by 100 basis points. Year-to-date it has lost 4.47%, against a loss of 9.52% in the NSE-ASI, outperforming it by 504bps.

Our underweight notional position in the banks fared well last week as there was some profit-taking in the sector, so we avoided some downside. Our strategy to reduce bank exposure, which we did by reducing their share of the portfolio from a neutral-weight 19.8% to 12.9% during the week of 22 June to 26 June has saved us 24bps so far. However, given the fundamental value in the sector, this strategy may be worth reviewing in future.

Model Equity Portfolio for the week ending 17 July 2020

We built up a neutral position in Airtel Africa last week, as we had forewarned readers in the last three editions of Nigeria Weekly Update. This brings our positions in three large components of the NSE-ASI, namely Dangote Cement, BUA Cement and Airtel Africa, to close to their neutral weights in the index. We have a significant overweight position in the other large component of the NSE-ASI, MTN Nigeria, at 28.0% against an index weight of 19.2%. This is because we believe it will benefit from continued growth in the telecom sector in general and of data usage in particular, and its valuation does not appear stretched.

We have a combined position of 5.5% in the palm oil and rubber producers Presco and Okomu Oil. As the currency in the parallel market adjusts (it fell by 1.1% last week) their ability to earn a US dollar-related commodity price becomes more interesting, in our view.

For the week ahead we do not plan any purchases or sales.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.