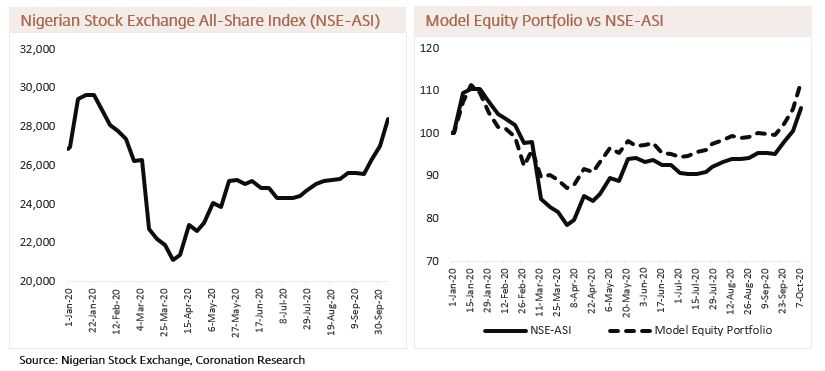

During the two weeks to 9 October, the Nigerian Stock Exchange All-Share Index (NSE-ASI) rose by 7.96%, bringing its year-to-date return to 5.86%. To what can we attribute the popularity of equities during a recession? The answer, we believe, was the cut in the monetary policy rate on 22 September, signalling that we are not returning to a high-rate environment. Nigerian investors are learning to diversify. Read below for me details.

FX

Last week the foreign exchange rate held essentially flat, with the Naira up by just 0.01% against the US dollar at N385.81/US$1. This was the situation in the NAFEX market (also known as the I&E Window). In the parallel, or street market, the Naira gained 1.72% to close at an offer price of N457/US$1. The two rates are now within 19% of each other. We attribute recent strength in the parallel market rate to the Central Bank of Nigeria’s (CBN) supply of US dollars to Bureaux de Change (BDC). The result is to support the parallel exchange rate, but we doubt that this action alone will unify the two exchange rates soon. At the same time, the two rates are not as far apart as they were in early 2017, for example, so a resolution may be much easier to achieve today than it was then.

Bonds & T-bills

Last week the secondary market yield for an FGN Naira bond with 10 years to maturity decreased by 63 basis points (bps) to 7.23%, and at 7 years fell by 149bps to 5.76%, while at 3 years the yield declined by 3bps to 3.10%. Very significant levels of redemption from the Open Market Operation (OMO) market are due this month and downward moves in bond yields reflect the reinvestment of these funds, in our view. The annualised yield on 342-day T-bill fell by 100bps to 2.14% while the yield on an OMO bill with similar tenure rose by 23bps to 2.20%. Our sense is that liquidity in the money markets remains high and is likely to exert further downward pressure on rates over the coming weeks.

Oil

The price of Brent crude rose by 9.14% last week to US$42.85/bbl and we attribute this to the shock of Hurricane Delta causing disruption to rigs in the Gulf of Mexico. The average price, year-to-date, is US$42.50/bbl, 33.79% lower than the average of US$64.20/bbl in 2019. The Organization of the Petroleum Exporting Countries (OPEC) is meeting next Monday, and the cartel appears unsure as to how soon global oil demand will recover to 2019 levels. We think that oil prices will remain in a range between US$40.00/bbl and US$46.00/bbl over the coming weeks.

Equities

The Nigerian Stock Exchange All-Share Index (NSE-ASI) rose by 5.30% last week, with a gain of 5.86% year-to-date, as Nigerian institutional investors returned to the equity market in high volumes. Last week International Breweries (+21.03%), FBN Holdings (+19.23%) and Access Bank (+16.24%) closed positive, while Oando (-2.62%), Nigerian Breweries (-0.82%) and Unilever Nigeria (-0.74%) closed down. See equity market commentary and Model Equity Portfolio below.

The return of the equity market

Last week, the Nigerian Stock Exchange All-Share Index (NSE-ASI) rose by 5.30% to bring its year-to-date return up to 5.86%. From its low point this year on 6 April, the equity market has risen 37.48%. High trading volumes have returned thanks to the return of Nigerian institutional investors, notably funds managed by Pension Fund Advisers (PFA).

The factor that prompted Nigerian institutional investors finally to return to the equity market, in our view, was the cut in the Monetary Policy Rate (MPR) on 22 September, from 12.50% to 11.50%. As we explained last week, the Monetary Policy Council’s communique opined that interest rates are not the means of lowering inflation (August: 13.22% y/y). In other words, do not expect the CBN to increase market interest rates to a level equal to or above inflation.

In reality, the CBN’s stance on inflation has been evident for much of this year, but institutions continued to buy Treasury bills and government bonds rather than equities until very recently.

On our part, we have been running a Model Equity Portfolio and publishing it, forewarning our readers of changes we are about to make.

Most of the time we avoid timing the market, i.e. we avoid predicting when the market is going to go up or down. It is just too difficult. What we do is make notional purchases (this is a model and not a real portfolio) of stocks when they are cheap relative to their valuation history and when their earnings prospects are either good or likely to return to trend over the medium term (two years). We try to keep it as simple as that.

The exception to these rules came in early March when our underperformance (see chart) prompted us to make notional sales of most of our positions in banks, taking our notional cash position from 15.4% to a highly defensive 64.8%. It worked. Note that most funds, in the real world, cannot do anything so radical.

What of the Nigerian equity market’s prospects? As we explained in Coronation Research, Navigating the Capital Markets, 14 July, there are at least some stocks with adequate long-term return on equity that are worth holding. And, as we explain in Shifting the Appetite of Nigerian Investors: From Savings to Mutual Funds, 2 October, investors need to diversify their holdings when inflation-beating Treasury bills are no longer available.

Model Equity Portfolio

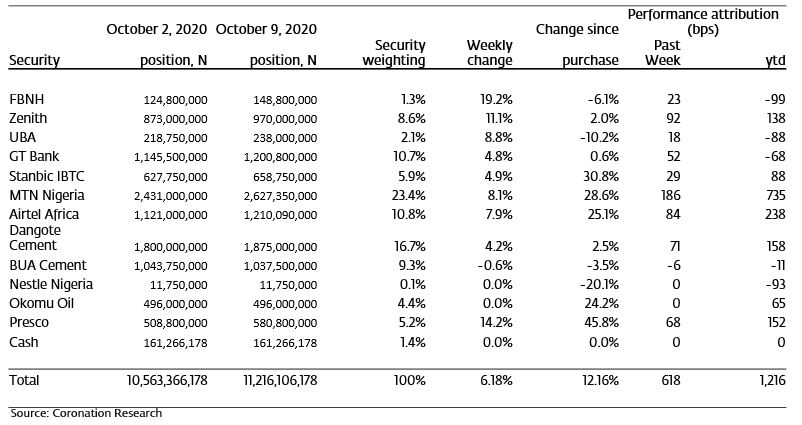

Last week, the Model Equity Portfolio rose by 6.18% compared with rise in the Nigerian Stock Exchange All-Share Index (NSE-ASI) of 5.30%, therefore outperforming it by 88 basis points. Year-to-date it has gained 12.16% against a gain of 5.86% in the NSE-ASI, outperforming it by 630bps.

The past two weeks have seen exceptional outperformance from the Model Equity Portfolio, with a total 167bps gain ahead of the market. However, this needs to be set against our total 143bps underperformance against the market in the six weeks prior to that. There is something to be said for not panicking when things are going wrong.

Model Equity Portfolio for the week ending 9 October 2020

Three weeks ago we made a significant change to the portfolio by selling off most the notional position in Nestle Nigeria and trimming Airtel Africa and Dangote Cement in order to have enough cash to make notional purchases of banks. Our reasoning was that, despite the fact we like bank stocks (or some of them), we only had a neutral weight. Our performance attribution model tells us that, if we had not done this, the Model Equity Portfolio would be up 11.45% year-to-date with 45bps outperformance last week.

Our sense is that Nigerian institutional investors have come back into the equity market and that they may provide a degree of support going forward. Although we do not like to make market calls – we could not have predicted the 7.96% rally over the past two weeks – we are not minded to make radical changes in the portfolio now and plan no changes this week.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.