Talking with clients about our report ‘Navigating the Capital Market; the Investors’ Dilemma’, 14 July 2020 we sometimes hear back that Federal Government of Nigeria bonds are safe while equities are risky. Is this entirely true? Buying long-dated FGN bonds have been profitable this year, but what if interest rates were to rise? Bondholders might experience mark-to-market risk that reminds them of equities. Learn more below …

FX

The foreign exchange reserves of Central Bank of Nigeria (CBN) registered a very slight decline last week, dipping by US$59.86m to US$35.92bn. However, a recently-reported forward sale of oil revenues suggests a possible inflow of up to US$1.5bn in future. In the NAFEX market (also known as the I&E Window) the Naira appreciated 0.06% to N389.25/US$1, but it weakened by 0.70% to N475.00/US$1 in the parallel (or street) market. We think that downward pressure in the parallel market is likely to continue as long as turnover in the NAFEX market remains low.

Bonds & T-bills

Last week the secondary market yield for a Federal Government of Nigeria (FGN) Naira bond with 10 years to maturity increased by 19 basis point (bps) to 8.03%, and at 3 years decreased by 44bps to 3.92%. The annualised yield on 316-day T-bill remained flat at 2.96% while the yield of a CBN Open Market Operation (OMO) bill with similar tenure decreased by 132bps to 4.55%. The primary market auction of Nigerian Government T-bills was oversubscribed by N202.3bn (US$520.0m), with N265.00bn (US$683.69m) worth of T-bills was sold into a total subscription of N468.00bn (US$1.20bn). We see no let-up to in market liquidity in the weeks ahead.

Oil

The price of Brent crude decreased by 0.09% last week to US$43.30/bbl. The average price, year-to-date, is US$42.29/bbl, 34.39% lower than the average of US$64.20/bbl in 2019. Last week, the Energy Information Administration (EIA) reported a decline in US crude supply of 10.6million barrels for the week, but the resulting rally was tapered by worries of slow demand and of anticipated supply increases by OPEC countries. We see oil supported at US$40.00/bbl but unlikely to reach US$50.00/bbl in the short term.

Equities

The Nigerian Stock Exchange All-Share Index (NSE-ASI) increased by 1.09% last week. The year-to-date return is negative 8.00%. Last week Lafarge Africa (+7.31%), Okomu Oil Palm (+6.31%), Dangote Cement (+5.66%), Zenith Bank (+5.16%) and GT Bank (+3.93%) closed positive, while Seplat (-10.71%), Cadbury Nigeria (-8.97%), PZ Cussons (-7.87%), Guinness Nigeria (-6.47%) and Honeywell Flour Mills (-3.85%) closed negative. The sectoral performance was positive with the exception of the Banking sector (-0.48%). The Oil & Gas (+4.58%), Insurance (+1.40%), Industrial (0.27%) and Consumer Goods (0.01%) indices all recorded weekly gains. See Model Equity Portfolio below…

The risk in the duration trade

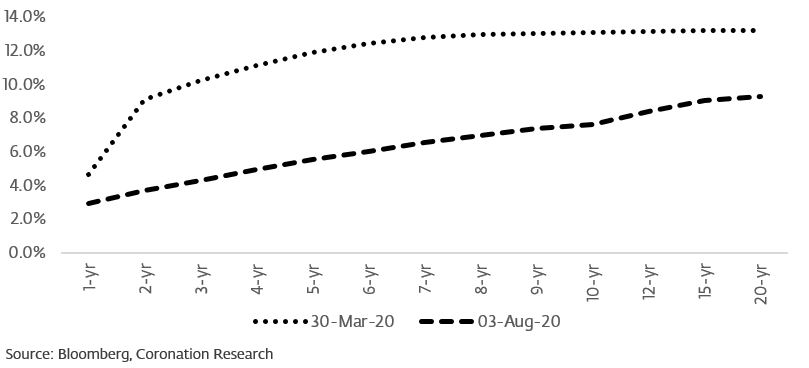

This year has been the year of the Naira duration trade. As short-term interest rates have fallen, Nigerian institutional investors have bought Federal Government of Nigeria (FGN) bonds at progressively longer durations in order to obtain yield. This activity has forced down the yields on long-dated FGN bonds, causing the entire FGN yield curve to compress, as the chart shows. At this point, no FGN bond of any duration yields more than inflation at 14.56%.

Federal Government of Nigeria T-bill and bond yield curve

What is the risk of doing this? In our view, it is significant. To be fair, we need to distinguish between two types of risk, one of which is not an issue. The risk of not being paid back, in Naira, by the FGN is low enough to call FGN bonds risk-free. However, for those investors which are required to mark-to-market the value of their investments, the risk is large.

Take the FGN Naira-denominated bond which matures in mid-2016, currently yielding close to 6.00%. If short-term rates were to suddenly rise to 14.50% the value of the bond might go to par, implying a mark-to-market loss of nearly 30%. This, of course, is hypothetical: Central Bank of Nigeria policy is to keep rates low and we see no change in its stance in the short term. However, over the long term, it seems reasonable to think that interest rates will approximate to the rate of inflation.

Different investors would be affected differently. Pension funds may reason that low market interest rates lower their liabilities, so low-yielding assets do not present a problem. Managers of funds which mark-to-market are exposed to significant price risk if short-term rates rise. Those who take short-term deposits to finance long-term bonds may also be running significant risks.

The strange thing, we observe, is that investors dislike equities because they are ‘risky’. But there is plenty of mark-to-market risk in bonds, too. As we argue in Coronation Research, ‘Navigating the Capital Market: the Investors’ Dilemma‘, 14 July 2020, the ability to recognise and manage risk is the key to investment management in Nigeria today. Investors need to weigh up the risks of investing in bonds and compare these other asset classes.

Model Equity Portfolio

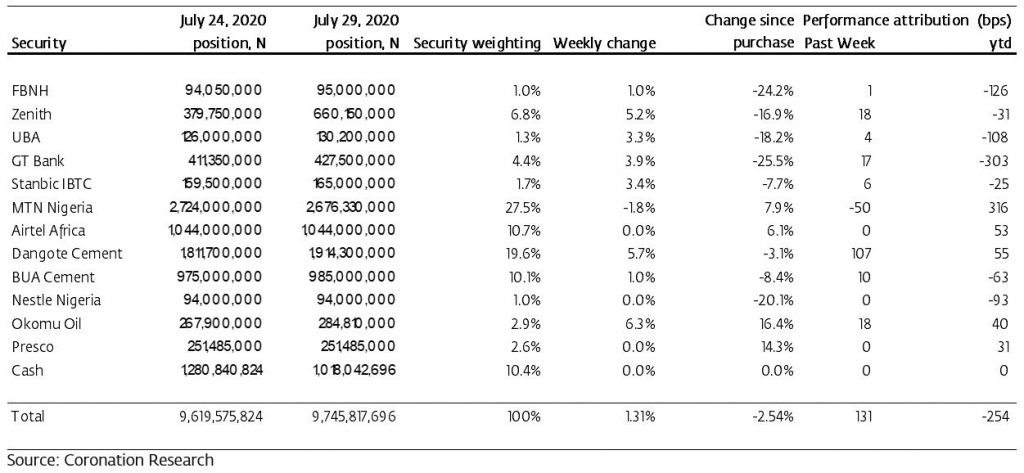

Last week the Model Equity Portfolio rose by 1.31%, compared with a rise in the Nigerian Stock Exchange All-Share Index (NSE-ASI) of 1.09%, therefore outperforming it by 22 basis points. Year-to-date it has lost 2.54%, against a loss of 8.00% in the NSE-ASI, outperforming it by 546bps.

Our outperformance last week was largely due to the performance of Okomu Oil, which delivered 18bps. We also have notional positions in the more actively-traded and volatile bank stocks, notably Zenith Bank and GT Bank, and these also contributed to our outperformance.

We have now outperformed the index for five straight weeks in a row, which: a) is odd, given that we have a lot of nearly-neutral weights (e.g. Airtel Africa, Dangote Cement and BUA Cement); b) makes us anxious enough to start wanting to adjust the portfolio again. The question is how.

Model Equity Portfolio for the week ending 29 July 2020

At the end of June (six weeks ago) we reduced our notional bank’s position from a total of 19.5% of the portfolio (close to a neutral weight) to 12.9%. How much has this saved us? Our performance attribution model tells us that it saved us just 4bps in the following five weeks. In other words, what we gained was a slight reduction in volatility (the down and up movement in the bank stocks) rather than any meaningful performance.

We were already aware of this problem last week when we wrote that we would take our notional position in Zenith Bank from 3.9% to close to 7.0%. We did this with notional trades on Tuesday 28th (which was mid-week since the market was closed on Thursday and Friday), losing 3bps through notional commission costs and a slightly negative price movement. Our total notional bank’s position is now 15.2%.

We will continue to review, with a view to increasing them, our positions palm oil and rubber producers Okomu Oil and Presco. We like the story but the catalyst of devaluation has not arrived (certainly not in the NAFEX market and only slowly in the parallel market) so we are not in a hurry to make more notional purchases. We have no notional sales or purchases planned for this week.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.