For the past 10 weeks we have documented the flow of liquidity back into the Nigerian Treasury Bill (T-bil) and FGN bond markets, and the resulting fall in yields. Yet inflation has not fallen as quickly, and so stays well ahead of the yields available on risk-free Naira investments. Yields are now so low that the dividend yields of some equities actually exceed those of T-bills and short-dated FGN bonds. Read below for more details

FX

Last week, the exchange rate at the Investors and Exporters Window (I&E Window) depreciated by 0.17% to close at N411.80/US$1. Similarly, the Naira weakened by 0.98% in the parallel (or street) market to close at N515.00/US$1. The gap between the I&E window rate and the parallel market rate stands at 25.37%. Elsewhere, the Central Bank of Nigeria’s FX reserves rose by 0.05% to US$33.58bn. Our view is that the FGNs potential Eurobond issuance and the US$3.3bn allocation from the International Monetary Fund’s (IMF) Special Drawing Right (SDR) is like to help shore up the external reserves. Amidst these developments, we expect the parallel rate and the I&E Window rates to trade range-bound in the near term.

Bonds & T-bills

Last week, the bullish trend in the secondary market for FGN bonds persisted buoyed by the fall in the stop rate of the 1-year T-bill at the primary auction and the expectations of a further slowdown in inflation. The yield of an FGN Naira-denominated bond with 10-years to maturity fell by 24bps to 12.17%, the yield on the 7-year bond fell by 46bps to 11.90%, and the yield on the 3-year bond fell by 20bps to 10.60%. The overall average benchmark yield fell by 38bps w/w to close at 11.56%. The Debt Management Office (DMO) will be offering instruments worth NGN150.0 bn (US$364.9m) at Wednesday’s auction through re-openings of the 13.98% FGN February 2028, 12.40% FGN March 2036, and 12.98% FGN March 2050 bonds. Our expectations for yields remains the same, namely that the rise, if any, will not be sharp during the coming three months due to unaggressive borrowing as the Debt Management Office tries to manage its debt service costs.

Similarly, the Treasury Bill (T-Bill) secondary market maintained its bullish trend as market players also reacted to the fall in the stop rate at the primary auction, reflecting a high level of market liquidity. As a result, the annualised yield on a 335-day T-bill in the secondary market fell by 41bps to 7.94%, while the yield on a 214-day OMO bill fell by 2bps to 8.93%. Overall, the average benchmark yield for T-bills fell by 96bps on the week to close at 4.67%, while the average yield for OMO bills fell by 12bps on the week to close at 7.65%. At the primary market auction (PMA) held on Wednesday, the CBN allotted N156.33bn in instruments across all tenors. The stop rates on the 91-day bill (2.50%) and the 182-day bill (3.50%) remained unchanged from the previous auction, while the stop rate on the 364-day bill fell by 85bps to 7.35%. The auction recorded a total subscription of N398.4bn, with a bid-to-cover ratio of 2.5x (1.7x at the previous auction).

Oil

The price of Brent crude fell by 0.16% last week to close at US$70.59/bbl, showing a 36.27% increase year-to-date. The average price year-to-date is US$66.88/bbl, 54.74% higher than the average of US$43.22/bbl in 2020. OPEC revised down its forecasts for crude oil demand in its monthly report on Thursday, by 0.2 mbpd, from last month’s forecast, to stand at 27.4 mbpd as COVID-19 cases climbed in the U.S. and China. Nevertheless, we reiterate our view that the price of Brent oil is likely to remain well above the US$60.00/bbl mark for several months.

Equities

The NGX All-Share Index (NGX-ASI) was up 1.83% last week to close at 39,522.34 points. The performance marked the index’s second consecutive weekly gain and the largest weekly rise since the week ended 23 July 2021. Consequently, the year-to-date return rose to -1.86%. Honeywell Flour Mills +28.13%, Airtel Africa +15.38%, Unilever Nigeria +7.24%, and Fidelity Bank +4.60% closed positive last week, while Dangote Cement -2.62%, FCMB Group -2.58%, and Seplat -1.34% closed negative. Sectoral performances were mixed: the NGX Banking index gained +0.49%, followed by NGX Oil & Gas +0.43% and NGX Consumer Goods +0.30% indices, while the NGX Insurance -2.37% and the NGX-Industrial -1.37% indices declined. See Model Equity Portfolio below.

The role of dividends in total return

Last week we showed the difference between the return of the NGX All-Share Index and the total cumulative return when adjusted for dividends received and reinvested. Which stocks, among the major stocks on the exchange, pay those dividends, and are they worth having? And what would motivate Nigerian investors to hold them?

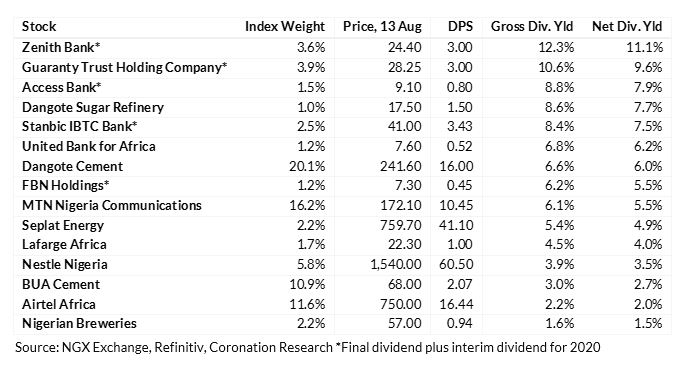

Top 15 Stocks on the NGX Exchange by Market Capitalisation (sorted by net yields)

The second question has become easy to answer over the past 18 months. Since late 2019 it has been impossible for investors in the Nigerian Treasury Bill (T-bill) market to earn a yield higher than the rate of inflation. So, instead, investors have learned to look at risk assets, such as equities and credit solution funds. Even though T-bill rates have risen sharply this year, they still do not match inflation. However, some of the gross dividend yields, and even one or two of the net dividend yields, of the stocks in the above table, beat the current 1-year T-bill yield.

The gross dividend yield is the dividend return on a stock before any expenses, taxes or deductions are considered. Calculating gross dividend yield is a simple matter of dividing the dividend amount by the stock price. However, the net dividend yield is the unvarnished truth about how much an investor actually earns from an equity investment. When a stock pays a dividend the Federal Inland Revenue Service (FIRS) steps in and levies Withholding Tax (WHT) tax. For both individuals and corporates, the tax is 10%. Interestingly, pension assets are exempt from WHT. Therefore, vis-à-vis Pension Fund Administrators (PFAs), gross and net dividends are one and the same.

Holding a portfolio of high-dividend stocks is advantageous as dividends are an unambiguous objective measure and can provide support in down markets. It is also quite beneficial that most of the high-dividend stocks are also some of the most liquid on the exchange. For example, Zenith Bank and Guaranty Trust Holding Company, the two most traded stocks on the local bourse, offer net dividend yields superior to the current 1-year T-bill yield. In our view, these are must-haves in the current climate, especially as banks earnings continue to grow.

Naturally, owning an equity instrument as opposed to a government-guaranteed T-bill exposes one to price risk, but evidently investors are learning to live with this. The demand for a guaranteed return is becoming less powerful when no genuinely risk-free instrument (i.e., a T-bill or a Federal Government of Nigeria bond) yields as much as inflation.

Finally, if we back-test the performance of the high-dividend stocks, do they outperform the market and do they provide a satisfactory return? Our studies suggest that they outperform the market (not surprisingly) but have not provided an inflation-beating return over the past five years, most likely because the entire market has de-rated (i.e., it is cheaper on a spot-multiple basis such as price-to-book) over this period. However, as yield continues to be scarce in Nigeria, investors may appreciate high-yielding stocks again, even though they carry price risk. This underscores our positive view on some of the bank stocks (see ‘Nigerian Banks: resilience built in’, 25 June).

Model Equity Portfolio

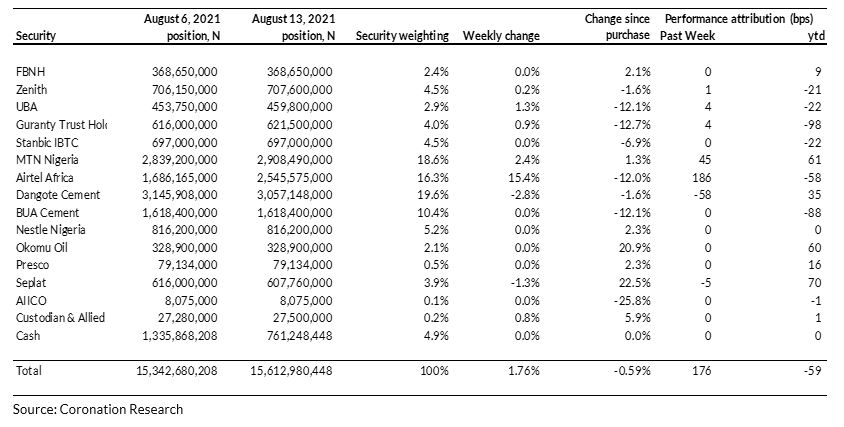

Last week the Model Equity Portfolio rose by 1.76% compared with a rise in the NGX Exchange All-Share Index (NGX-ASI) of 1.83%, therefore underperforming it by 7 basis points. Year to date it has lost 0.59% against a loss in the NGX-ASI of 1.86%, outperforming it by 127bps.

Model Equity Portfolio for the week ending 13 August 2021

The big performer last week was Airtel Africa which rallied by 15.4%. The good news is that its valuation seems to be more in line with its peer MTN Nigeria these days than it was when its share price was up at N950, and liquidity picked up last week. For much of 2020 and this year the stock has been cursed with a high valuation and low liquidity, which was at odds with its high index weight. MTN Nigeria itself continued to provide support last week. The two telecoms’ stocks, in aggregate, have provided much more support than our notional positions in the banks so far this year.

However, in early July we built a notional overweight position in our favorite bank stocks in anticipation of H1 earnings statements to be published in August, because our published research (see ‘Nigerian Banks: resilience built in’, 25 June) indicates that they may be strong. We are waiting for those results to be announced over the coming weeks.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.