As of Friday, the Nigerian Stock Exchange was the world’s best-performing equity market in local currency terms and its second-best performer in US dollar terms. The market was up 30.53% year-to-date in Naira and up 24.60% in US dollars (translating at the NAFEX rate). Since 6 April it rose by 69.51% in Naira terms. The question is why? On page 2 we explain how this has been caused by the year-long fall in Naira fixed income rates.

FX

Last week, The Naira appreciated by 0.08% against the US dollar to N385.61/US$1 in the NAFEX market (also known as the I&E Window). In the parallel or street market, the Naira fell by 1.29% to close at an offer price of N470/US$1. Hopes of convergence between the two rates are waning, although they are within 22% of each other. We see continuing pressure on the parallel exchange rate.

Bonds & T-bills

Last week, the secondary market yield for an FGN Naira bond with 10 years to maturity increased by 39 basis point (bps) to 4.70% from 4.31%, and at 7 years rose by 46 bps to 4.15% from 3.69%, while at 3 years the yield dropped by 79 bps to 1.89% from 2.68%. The annualised yield on 307-day T-bill fell by 24 bps to 0.15% from 0.39% while the yield on a 298-day OMO bill remained flat at 0.28%. In the bond, market demand waned as local pension funds were asked to realign their portfolios with the four-month deadline as directed by a PENCOM circular. The market closed the week on a bullish note, however as average yields on all instrument declined by 5bps with significant participation at the short and mid-end of the curve. The bullish trend is expected to continue. As expected, activity in the T-bill secondary market was quiet as investors focused on the primary market auction (PMA) held on Wednesday. The Central Bank of Nigeria (CBN) offered bills worth N147.82bn (US$378.98M) and the PMA result was strong with stop rates printing at 0.04%, 0.15%, and 0.30% on the 91-day, 182-Day, and 364-day maturities, respectively.

Oil

The price of Brent crude rose by 8.44% last week to US$42.78/bbl. The average price, year-to-date, is US$42.39/bbl, 34% lower than the average of US$64.17/bbl in 2019. Oil prices skyrocketed on Monday 9 November when the US pharmaceutical company, Pfizer announced that its vaccine has an efficacy of 90% against Covid-19. However, the price steadied later in the week on fears that sharp rises in the level of Covid-19 infection in the US would negatively impact economic growth and on fears that the Organization of the Petroleum Exporting Countries (OPEC) would be unable to agree sufficient production cuts going into 2021. We expect oil prices to be range-bound and not to exceed US$50.00/bbl for several weeks ahead.

Equities

The Nigerian Stock Exchange All-Share Index (NSE-ASI) rose by 12.97% last week, with a gain of 30.53% year-to-date. Last week, Oando(+48.15%), Dangote Sugar(+34.55%) and Honeywell Flour Mills (+29.29%) closed positive, while there were no losers. See Model Equity Portfolio below

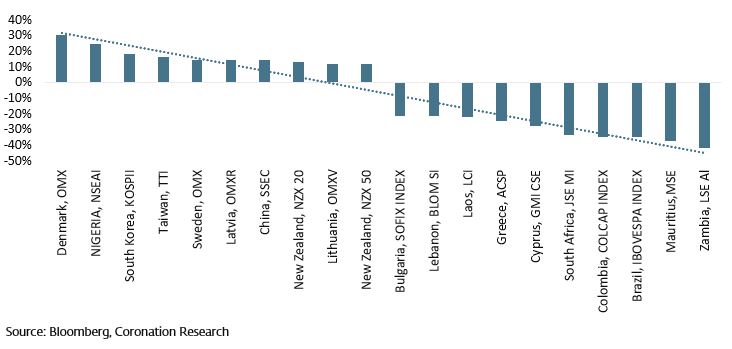

The Second-best equity market in the world.

How has the Nigerian equity market become the second-best performing equity market in the world, in US dollar terms, so far this year? On Friday, the Nigerian Stock Exchange All-Share Index (NSE-ASI) closed at 35,037.46 points, up 30.53% in Naira terms and up 24.60% in US dollars, year-to-date.

The simplest explanation is probably the best. Nigerian investors face a shortage of things to invest in. The problem comes from the risk-free fixed income market (i.e. securities issued by the Federal Government of Nigeria, FGN), where yields have crashed. At the beginning of the year a 1-yr T-bill yielded 5.20%, a 7-yr FGN bond yielded 11.45% and a 10-yr FGN bond yielded 11.40%. Inflation was 11.85% year-on-year.

By contrast, by the end of last week a 307-day T-bill yielded 0.15%, a 7-yr FGN bond yielded 4.15% and a 10-yr FGN bond yielded 4.70%. Inflation is recorded at 14.23% year-on-year. An investor who bought a range of FGN bonds last January would have seen significant price appreciation since then. Bloomberg’s Nigeria Local Sovereign Index (which admittedly holds very long-dated FGN bonds, as opposed to the four-to-five-year benchmark of many of Fixed Income Mutual Funds) is up 63.18% this year. However, an investor starting today with a portfolio of FGN bonds with four-to-five-year maturities cannot hope to make this much money, unless interest rates become much lower or negative in future.

So, Nigerian investors have put more money into equities in recent months, switching from risk-free assets (FGN securities) to risky assets (equities). Our benchmarks for risk-taking and diversification are described in Coronation Research, Navigating the Capital Markets: the Investor’s Dilemma, 14 July. In an era of low Naira interest rates, renewed risk-taking comes after a long period, from 2010 to 2019, when the yield of Nigerian T-bills exceeded inflation by 2.57 percentage points, on average. Investing used to be straightforward and now it has become complex.

Global Primary Equity Indices (Best and Worst Performing), in US dollars, year-to-date

Of course, the size of these returns depends on your base currency, and the way you invest depends on how you think exchange rates will move. The Naira began the year at N364.70/US$1 in the NAFEX market but has since weakened to N385.61/US$1. But liquidity in that market has declined this year and the Naira has moved to N470/US$1 in the parallel market. Foreign investors look at the performance of the NSE-ASI completely differently from local investors.

The equity market does not look overvalued, in our view. Some of the major bank stocks trade at close to their average long-term price-to-book ratios at this point, suggesting that they were undervalued earlier in the year, but are fairly valued now. For industrial stocks, it is important to remember that the economy is likely to resume growth in the second quarter of next year. The search for value does not end here.

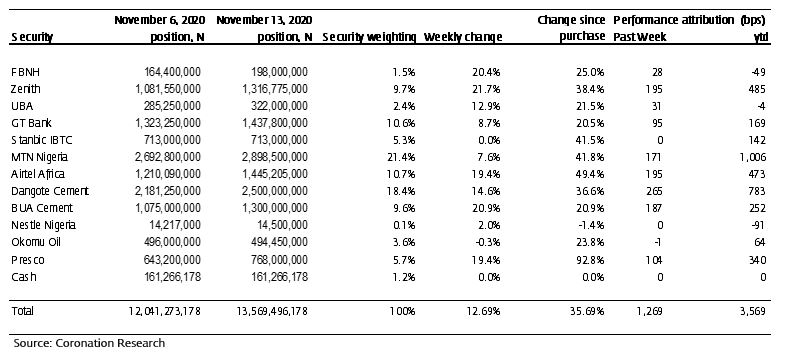

Model Equity Portfolio

Last week was an extraordinary week on the NSE. At one point the NSE implemented its circuit breaker procedure, whereby trading is suspended for 30 minutes while traders re-set bids and offers. The market was up 6.3% on Thursday alone. Volumes were far higher than in recent months.

Last week the Model Equity Portfolio rose by 12.69% compared with a rise in the Nigerian Stock Exchange All-Share Index (NSE-ASI) of 12.97%, therefore underperforming it by 27 basis points. Year-to-date it has gained 35.69% against a gain of 30.53% in the NSE-ASI, outperforming it by 516bps.

Our underperformance last week is attributable to the fact that there were some very high price increases in a few stocks – generally with small index weights – in which we do not have notional positions. At the same time, there were strong moves in several stocks with large index weights, notably BUA Cement (+20.9% on the week), Airtel Africa (+19.4%) and Dangote Cement (+14.6%). We are happy to have at least index-neutral positions in these stocks.

Our overweight position in MTN Nigeria did not rise very much last week (+7.6%) but has provided almost one third (28%, to be precise) of our cumulative performance year-to-date.

Model Equity Portfolio for the week ending 13 November 2020

Some of our notional positions in banks enjoyed the strong performance last week with Zenith Bank (+21.7%) providing a useful contribution. Another significant contribution came from our notional position in Presco (+19.4%).

We are relieved that, broadly speaking, our Model Equity Portfolio has remained resilient in the face of significant market volatility (upwards, on this occasion). We attribute this to not only owning stocks that we like (such as banks, MTN Nigeria and the palm oil producers) but also holding notional positions matching most the major index weights. We do not plan any changes this week.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.