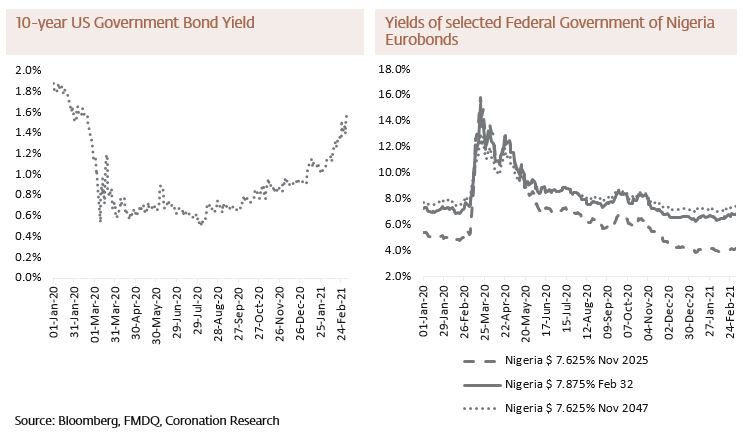

Nigerian markets are famous for not correlating with global markets, but recently it has been wise to pay attention to global bond markets. The rise of the US government 10-year bond yield has attracted a lot of attention over the past few weeks and led to nervousness in certain equity markets. The wisdom of taking on emerging market risk in order to escape low US bond yields is being questioned. This affects Nigerian Eurobond yields. See details below.

FX

Last week the exchange rate in the Investors and Exporters Window (I&E Window) weakened by 0.18% to N411.00/US$1. In the parallel, or street, market the Naira appreciated by 0.41% to close last week at N480.00/US$1. In a bid to incentivise the inflow of diaspora remittances the Central Bank of Nigeria (CBN) in its “Thinking-outside-the Box” strategy announced, in a recent circular to all Deposit Money Banks (DMOs) and International Money Transfer Operators (IMTOs), that recipients of diaspora remittances shall receive N5 for every US$1 received. We recall that, in November 2020, the CBN asked IMTOs to release US dollars to recipients of remittances and this resulted in the parallel exchange rate strengthening. There are worries that this is a temporary devaluation in disguise, however, due to the N5 incentive. In our view, such tactics may deliver short-term gains but do not overcome the fundamental difference between the I&E and NAFEX rates on the one hand and the parallel rate on the other. We expect pressure on the currency to continue over the coming weeks and months.

Bonds & T-bills

Last week, the secondary market yield for an FGN Naira bond with 10 years to maturity declined by 37bps to 10.40% and at 7-years declined by 23bps to 10.10% while at 3-years the yield increased by 108bps to 7.92%. The was the opposite to the trend seen during the last two weeks of February when investors were rotating their long-dated bonds for short-dated ones (maturities under 5-years): clearly, some investors now believe that long-dated bonds have value. The annualized yield on a 328-day T-bill remained unchanged at 2.07% in the secondary market while the yield on a 326-day OMO bill rose by 76bps to 9.72%. On Monday last week, the CBN announced a roll-over of its N4.1 trillion (US$9.9bn) of Special OMO bills paying 0.5% interest to banks in respect of their excess Cash Reserve Ratio (CRR) held by the central bank, the excess being the sums over the official 27.5% ratio. One effect of this is to keep the overall CRR position high, in our view, with a question mark over overall liquidity in the private-sector system. Overall, we think that bond and T-bill rates are likely to continue trending upwards over the coming weeks and months.

Oil

The price of Brent crude rose by 4.88% last week, closing at US$69.36/bbl, a 33.90% increase year-to-date. The average price to year-to-date is US$59.52/bbl, 37.73% higher than the average of US$43.22/bbl in 2020. The Organization of the Petroleum Exporting Countries and Russia, known as OPEC+, met last week to discuss the progress of its production limitation agreement. OPEC+ agreed to stick, broadly speaking, with its scheduled output cuts despite rising crude prices which themselves are encouraging marginal players to step up production. Over the weekend Houthi forces in Yemen fired drones and missiles at Saudi Arabian installations, including a Saudi Aramco facility at Ras Tanura that is vital to petroleum exports. The terminal is capable of exporting about 6.5 million barrels a day, almost 7% of global demand. It is the most serious attack on Saudi oil installations since a key processing facility and two oil fields came under fire in September 2019. Our view is that the OPEC+ agreement will keep oil prices above US$65.00/bbl over the coming weeks.

Equities

The Nigerian Stock Exchange All-Share Index (NSE-ASI) fell by 1.18% last week with a loss of 2.33% year-to-date. BUA Cement (+3.82%) and Seplat (+1.87%) closed positive last week, while Ardova Oil (-25. 21%), Oando (-23.19%) and Sterling Bank (-14.04%) closed negative. Our view is that investor sentiment continues to be weak and we note that in certain major stocks there is quite a low turnover, although turnover remains strong in the banks. Certain mid-cap stocks, that performed well in the first part of this year, are losing their lustre now. See Model Equity Portfolio below.

The US 10-year bond and Nigeria

The US 10-year government bond yield is unsettling global markets. The yield on this normally obscure instrument rose from 0.72% per annum six months ago to 1.57% at the end of last week. This may not appear to be a profound change, but it is having effects – sometimes dramatic – on markets around the world. The market in Eurobonds issued by the Federal Government of Nigeria (FGN) is no exception.

For over a decade, investors in risky assets have enjoyed the benefits of low US, Yen and Euro interest rates, not only in terms of lowering their cost of funds (if they borrow) but in terms of the implied valuations of equities. In developed countries, policymakers have treated inflation as being too low, rather than too high. And yet US President Joe Biden’s introduction of a US$1.9 trillion (N779.0tn) stimulus package has, finally, awakened fears that renewed economic growth will increase inflation. Hence the rise in US bond yields.

Global equity markets are jittery. For example, the Nasdaq index of technology stocks fell by 6.9% in the second half of February and has fallen a further 1.5% so far in March. These are not large falls in the context of the huge rally in this market over the past five years (the Nasdaq rose 178.7% over this period), but they are corrections, nevertheless. There have also been price falls in FGN-issued Eurobonds. The yield of the FGN 2032 Eurobond has risen from 6.44% to 6.86% over the past three weeks.

The narrative behind emerging market Eurobonds, until recently, has been one of rising prices and yield compression. The argument was that, with low interest rates in the US, there were so many US dollars looking for yield that investors would have to buy assets like Nigerian Eurobonds. Indeed, it was frustrating for Eurobond analysts that, whatever the fundamental features of Nigeria and of similar countries, yields just kept on coming down. The exception to this, of course, was the panic-induced sell-off of almost exactly a year ago (see chart, above) when yields shot up during the first wave of the Covid-19 pandemic. But wise investors knew not to sell at this time.

The situation is different now. If US bond yields are rising then difference between US dollar yields and FGN Eurobond yields is getting less, which weakens the justification for buying and holding them. Another effect has been the reduction in the spread, which has narrowed over the past few years, between FGN Eurobond yields and the corresponding (in terms of duration) US government dollar bond yield, the so-called Z-spread.

The US 10-year bond and Nigeria

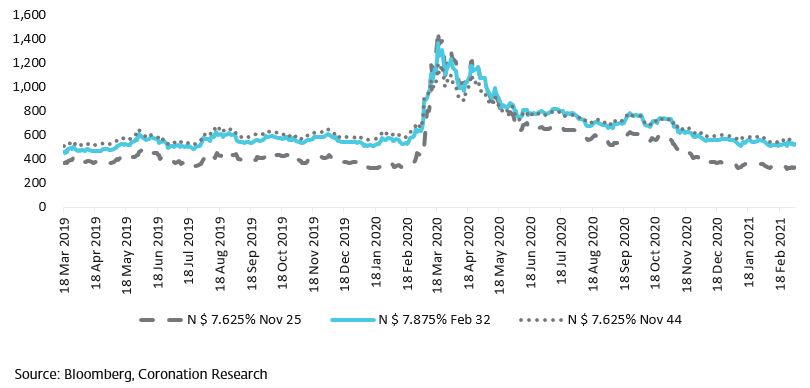

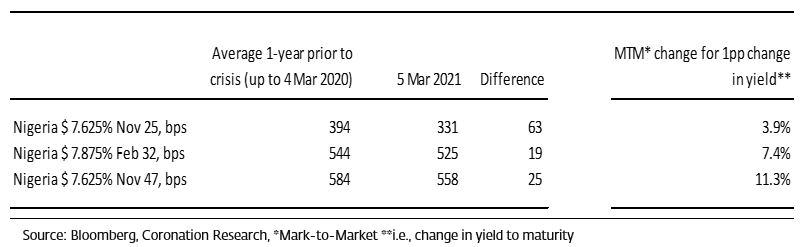

In fact, it is possible to look at these two factors separately. In the chart below we present the Z-spreads over the past two years for selected FGN Eurobonds. In the table, we present the average Z-spread during the year leading up to the crisis (we identify the start of the crisis on 4 March 2020) and present this as a target Z-spread for each bond. Then we present the Z-spread at the end of last week. The difference between the two shows the potential for the current Z-spread to revert to its average, in terms of additional yield expressed in basis points.

Z-spreads for selected Nigerian Government Eurobonds

What this shows is that for one of our three selected bonds, the FGN November 2025, the Z-spread has tightened a lot (63 basis points) over its average, suggesting some potential yield rises if the Z-spread reverts to its average. But, for the other two bonds, the FGN February 2032 and the FGN November 2047, the Z-spread compression is less of a problem. In other words, investors should worry less about the tightening of the spread of FGN Eurobonds over US government bonds and worry more about the direction of US bond rates themselves.

Nigeria Sovereign Eurobond Z-spread analysis

The final column in the table presents Bloomberg’s assessment of the potential mark-to-market change in the value of each bond for a one percentage point change (1pp, or 100bps) change in its yield to maturity. As one would expect, the longer the duration, the more potential for change. For some investors, who hold the bond for yield, the mark-to-market price is of little consequence (unless they intend to trade). For other investors, the mark-to-market price must be reported regularly, and the implications of rising US rates could be quite severe on portfolio valuations.

As a final point, we look at this situation not from the point of the investor, but from the point of view of the issuer, the FGN. The FGN was absent from new-issue market in 2019 and in 2020. If US government bond rates continue to rise it may not want to issue in 2021, either. This could result in the FGN not issuing Eurobonds for three straight years 2019-21. This would be exceptional and, ultimately, could make Nigerian Eurobonds scarce in the market.

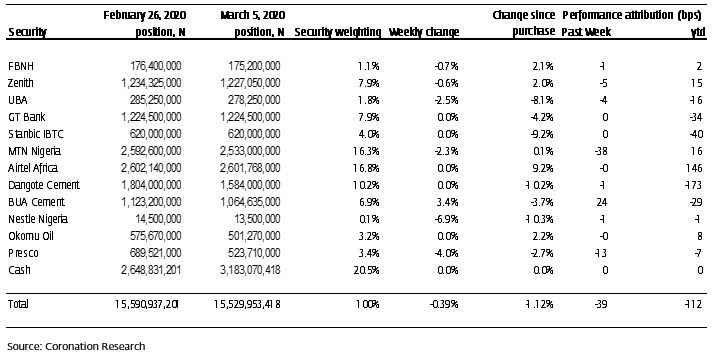

Model Equity Portfolio – 5 March 2021

Last week the Model Equity Portfolio fell by 0.39% compared with a fall in the Nigerian Stock Exchange All-Share Index (NSE-ASI) of 1.18%, therefore outperforming it by 79 basis points. Year to date, it has lost 1.12% against a loss in the NSE-ASI of 2.33%, outperforming it by 121bps.

Last week our notional positions in five bank stocks took back a combined 10bps from the 49bps which they had earned the previous week. Bank stocks are not entirely the safe haven they have been for much of the year, take note.

Model Equity Portfolio for the week ending 5 March 2021

As we forewarned our readers last week, we made notional sales of industrial stocks last week in order to take our notional cash position up to just over 20.0%. While doing this we noticed that, even for a small model portfolio such as ours, it was very difficult to find liquidity in Airtel Africa, despite this stock being 16.9% of the NSE-ASI. So, if we encounter liquidity this week we intend to make use of it.

For most of the time, we try not to predict the overall direction of the market, unless we have a very strong idea of its next move. However, the equity market does seem weak at the moment, partly as a result of market interest rates rising, and we think it is reasonable to take more of our notional equity positions off the table. Our notional sales of equities this year have saved us 60bps so far. This week we intend to add a further 5 percentage points to our notional cash position and will make notional sales among banks stocks as well as industrial stocks to achieve this.