The World Bank does not leave a stone unturned when it comes to examining Nigeria. Many of its recommendations come as no surprise: full harmonisation of foreign exchange markets; removal of all tariffs; and trade liberalisation, for example. But who would read the entirety of this authoritative report and summarise it? We would. See details below.

FX

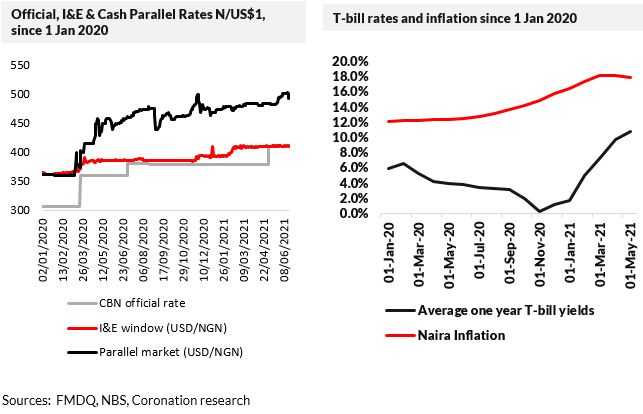

Last week, the exchange rate at the Investors and Exporters Window (I&E Window) weakened by 0.05% to close at N411/US$1. However, in the parallel (or street) market, the Naira strengthened by 0.08% to close at N498.00/US$1. Last week the Central Bank of Nigeria (CBN) announced that it would increase the amount of foreign exchange allocated to banks to meet legitimate needs, adding that Nigerian travelling abroad can access a maximum of US$4,000 for personal travel allowances and a maximum of US$5,000 for business trips. The announcement is a part of the CBN’s efforts towards reducing pressure in the parallel market and was likely the driver of the rate’s appreciation. Elsewhere, the CBN’s FX reserves fell by 0.51% over the week to US$33.79bn, the lowest level since October 2017. Despite these efforts, and due to persisting FX illiquidity in the I&E Window, we expect the parallel rate and the I&E Window rates to remain under pressure over the months to come.

Bonds & T-bills

Last week, trading in the secondary market for FGN bonds was bullish. The yield of an FGN Naira-denominated bond with 10 years to maturity fell by 59bps to 12.51%. Conversely, the yield on the 7-year bond was unchanged at 12.78%, and the yield on a 3-year bond rose by 22bps to 11.83%. The overall average benchmark yield fell by 27bps w/w to close at 12.01%. At the FGN bond primary auction scheduled for June 23, the Debt Management Office (DMO) plans to offer N150bn (US$365m) in bonds, comprising N50bn apiece of the Mar 2027 (10-Year), Mar 2035 (15-Year), and Mar 2050 (30-Year) bonds. We maintain our view of an upward trend in bond yields over the coming months amidst still negative inflation-adjusted returns.

Activities in the Nigerian Treasury Bill (T-bill) secondary market were mixed, with a bullish tilt, as investors reacted to primary auction results amid still thin system liquidity. The annualised yield on a 314-day T-bill in the secondary market fell by 1bps to 9.76%, while the yield on a 270-day OMO bill rose by 15bps to 9.93%. The average benchmark yield for T-bills fell by 1bp to close at 6.35%, while the average yield for OMO bills rose by 2bps w/w to close at 9.66%. The DMO sold N30.56bn worth of T-bills across three maturities, with stop rates on the 91-day (2.50%) and 182-day (3.50%) bills remaining unchanged. Conversely, we saw a further decline on the 364-day bill, by 24bps, to 9.40%. We expect secondary market yields to trend upwards over the coming months amidst the continued squeeze on system liquidity.

Oil

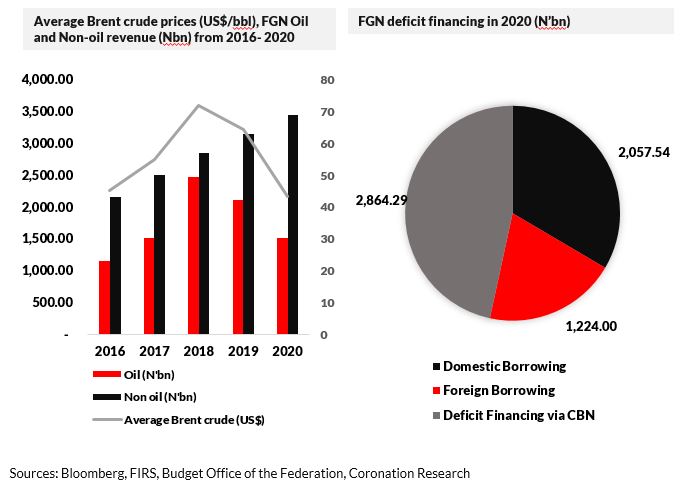

The price of Brent crude rose by 1.13% last week, closing at US$73.51/bbl, showing a 41.91% increase year-to-date. The average price year-to-date is US$64.58/bbl, 49.43% higher than the average of US$43.22/bbl in 2020. Oil posted a fourth successive weekly gain and hit a new high of US$74.39 on Wednesday, 16 June, on the back of investor optimism about the global demand recovery and supply discipline among producers. Our view is that oil prices are likely to remain well above the US$60.00/bbl mark for several months.

Equities

The NGX All-Share Index (NGX-ASI) was down by 1.30% last week, following a sell-off of market heavyweight Airtel Africa. Consequently, the year-to-date loss rose to 4.03%. Honeywell Flour Mills +6.06%, Access Bank +4.27% and Unilever Nigeria +3.12% closed positive last week, while Airtel Africa -10.00%, Okomu Oil Palm -9.44% and Stanbic IBTC -4.88% closed negative. Sectoral performances were broadly positive as the NGX Banking index led the gainers, rising by +1.09%, followed by the NGX Oil Gas index +1.05%, the NGX Insurance index +0.76%, the NGX Pension index +0.61%, the NGX 30 index +0.29%, and the NGX Consumer Goods index +0.25%. Conversely, the NGX Industrial Goods index was the sole loser, declining by 0.05%. See Model Equity Portfolio below.

The World Bank blueprint

In its June 2021 development report on Nigeria titled “Resilience through reform,” the World Bank (WB) acknowledged the reforms undertaken by the Federal Government of Nigeria (FGN) to mitigate the economic fallout from the Covid-19 pandemic. However, it reiterated the need for more reforms and highlighted the risks associated with half-hearted or incomplete measures and the dangers they pose for Nigeria’s development goals. The report proposes short- and medium-term policy actions that have the potential to stabilise prices, improve GDP growth rates and ensure economic development. Key takeaways from the report are summarised as follows.

FX Management

Before the unification of the official and the Nigeria Autonomous Foreign Exchange (NAFEX) rates in May 2021, the limited interventions in the I&E window and the restriction of access to foreign exchange (FX) for the 45 items on the CBN’s restricted list created a surge in demand for FX in the parallel exchange market. This was estimated to cater for nearly 90% of manufacturers’ FX needs. The existence of these rates (official, NAFEX and parallel) negatively affected investor confidence and create opportunities for speculation and arbitrage.

While the CBN’s official rate has been merged with the I&E Window rate and the NAFEX rate (all three are around N411/US$1), and this was lauded by the World Bank, it was clear that it would not be enough to solve all FX challenges. The unofficial cash parallel market rate stands at N498/US$1. In the medium term, the WB expects that the priority is to merge all exchange rates. The WB believes that flexibility is the key to driving this, for example by allowing oil companies to sell FX receipts to I&E window bank participants. This would strengthen the dollar interbank market, making banks go beyond taking buy/sell orders to act as market makers, while the CBN would only intervene at times of large FX fluctuations.

In the near term, the WB expects the CBN to:

- enhance transparency in terms of communication of all the specifics on FX auction schedules;

- allow the market to gain credibility by regulating the auction process, adjusting FX rate bands when necessary; and

- limit FX intervention to cases of extraordinary market volatility.

Monetary Policy

With inflation reaching a four-year high in March 2021 (12.26% y/y in March 2020 to 18.17% y/y in March 2021) – the seventh-highest inflation rate in Sub-Saharan Africa – driven by surging food prices (14.98% y/y in March 2020 to 22.95% y/y in March 2021), the WB re-emphasises the CBN’s role of ensuring monetary and price stability. The steady rise in inflation is attributed to

- supply-side factors i.e. restricted access to markets and declining crop yields;

- demand-side aspects as expectations of a rise in inflation have been factored into investment and consumption decisions.

According to the monthly Nigeria Covid-19 National Longitudinal Phone Survey (NLPS), between July 2020 and December 2020, 82.7% of households saw a steady erosion of their purchasing power due to price shocks. Negative coping mechanisms have been adopted, such as consuming less food (58.3% of households) and reducing non-food consumption (26.3% of households). In light of these challenges, the WB, in its long-term policy options, suggests that a Monetary and Fiscal Policy Coordination Council is formed in order to harmonise the objectives of both policies towards advancing Nigeria’s development priorities.

In the near term, the WB recommends that monetary policy objectives committed to achieving price stability are clearly defined with a focus on bringing down inflationary pressure. It suggested that Naira-denominated OMO (Open Market Operation) bill issues are resumed in order to mop up local currency liquidity alongside other short-maturity securities. The WB has also urged the CBN to reduce its direct lending facilities to corporates under its subsidised funding schemes, in order to enable commercial banks to stay competitive at a risk-adjusted lending rate. It was also recommended the CBN do away with reliance on the Cash Reserve Ratio (CRR) debits in funding its quasi-fiscal operations.

The World Bank blueprint

Fiscal Policy

On fiscal policy, Nigeria’s low revenue mobilization, with the lowest tax-to-GDP ratio in Africa, is highlighted as a key hindrance to achieving sustainable and inclusive growth. Non-oil revenues currently have the potential to be double their current numbers, and key tax reforms in excise, EMT levy, VAT, incentives, removing loopholes in tax laws, as well as improving tax compliance by building up revenue administration would likely boost receipts for the government.

Mechanisms need to be established to monitor the FGN’s stock, flow and servicing costs of CBN overdrafts which currently stand at N10.0 trillion (US$24.4bn)—creating flexibility in the FGN’s borrowing options to finance the deficit while improving the accuracy of budgetary revenue forecasting with the aim of further reducing the FGN’s recourse to CBN financing. And the report calls for the total elimination of fuel and electricity subsidies, which in 2019 rose to N524 billion (US$1.7 billion), according to the WB. The WB believes that 80% of the spending on tariff shortfalls benefits the wealthiest 40% of the population who have access to the grid: only 8% benefits the bottom 40%.

Trade

On trade, the WB recommends the full reopening of land borders, a review of the list of FX restrictions to allow for the importation of staple foods and medicines, as well as lifting the import bans currently applied to non-food goods. Examining the implications of replacing these import bans with tariffs, the WB believes will result in increased revenues, improved domestic prices, and reduced smuggling and criminality along borders.

In addition, the WB recommends that the FGN finalises plans to implement the African Continental Free-Trade Area Phase 1 protocols, as well as creating mechanisms to reduce trade and transportation costs by addressing delays in border and port clearance.

Social Protection

In terms of social protection for already poor, the newly poor, and vulnerable Nigerians with income eroded by inflation, the WB recommends leveraging the National Social Safety Nets Program 1 (NASSP I) and the proposed NASSP II, which is under discussion, with a plan to provide cash transfer support to additional households in the NSR in rural areas and possible expansion of the Rapid Response Register (RRR) of vulnerable beneficiaries in urban and peri-urban areas to include another 7.2 million households, in addition to the two million already targeted by the Covid-19 response effort. These proposed measures would allow the program to cover 16.2 million already poor, newly poor, and vulnerable households in all 36 States and the Federal Capital Territory.

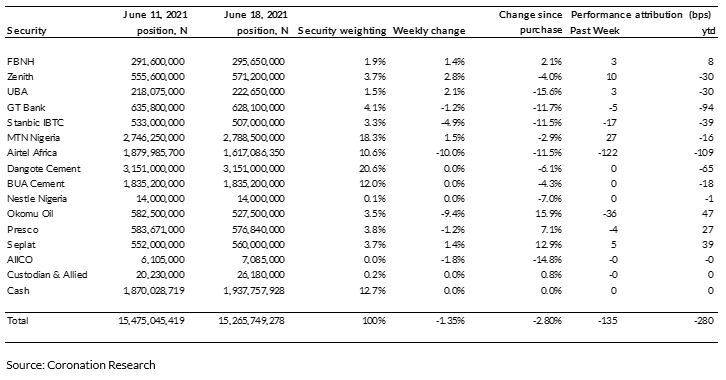

Model Equity Portfolio

Last week the Model Equity Portfolio fell by 1.35% compared with a fall in the NGX Exchange All-Share Index (NSE-ASI) of 1.30%, therefore underperforming it by 5 basis points. Year to date it has lost 2.80% against a loss in the NSE-ASI of 4.03%, outperforming it by 122bps.

Model Equity Portfolio for the week ending 18 June 2021

The culprit last week, rather obviously, was our notional position in Airtel Africa which cost us 122bps. We are underweight in this stock and would like to be more underweight than we are. However, despite taking every opportunity to unload stock since March (we respect market liquidity), we have not been able to sell as much as we would like. Even for a small model portfolio like ours, this is a problem. Such a large index weight but so little liquidity.

Our satisfaction with the performance of Okomu Oil two weeks ago was tempered last week by a significant correction last week, but our notional overweight position in the stock has provided us with more performance year-to-date (47bps) than any other notional position. With only four positive positions on the board, year-to-date, we have to be content with that.

Once again we made notional purchases of insurance companies AIICO and Custodian & Allied but liquidity was, as ever, low. We will continue this week.

The suspension of GT Bank shares, while it re-lists as a holding company, means that we will not be able to make notional trades in these shares for a while. In the meantime, we are content with our 12.7% notional cash position. However, we will continue to look for new ideas to take the Model Equity Portfolio forward.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.