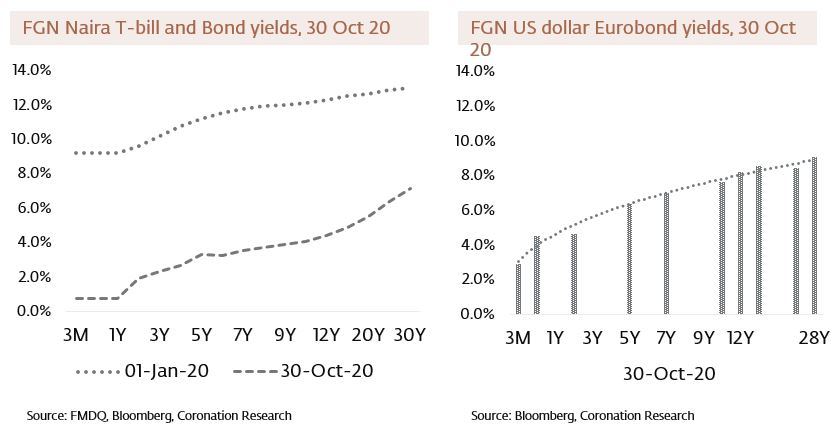

The Naira yields of T-bills and Federal Government of Nigeria (FGN) bond are lower than its US dollar Eurobonds. This is highly unusual. See more below.

FX

Last week, the foreign exchange rate markets closed essentially flat, with the Naira depreciating by 0.05% against the US dollar to N385.95/US$1 in the NAFEX market (also known as the I&E Window). In the parallel, or street market, the Naira appreciated by 0.22% to close at an offer price of N462/US$1. There is still no convergence between the two rates, though they are still within 20% of each other. We expect this situation to continue for some time. It seems that there is sufficient liquidity in the parallel market to prevent the rate falling far from its current level but not enough US dollar supply to bring the rate in line with the NAFEX rate. The result appears to be an impasse.

Bonds & T-bills

Last week, the secondary market yield for an FGN Naira bond with 10 years to maturity decreased by 1 basis point (bps) to 4.16%, and at 7 years fell by 56bps to 3.44%, while at 3 years the yield declined by 55bps to 2.63%. The annualised yield on 328-day T-bill fell by 6bps to 0.71% while the yield on a OMO bill with similar tenure rose by 4bps to 0.82%. Following the contraction in yields witnessed two weeks ago, the demand for instruments in the T-bill secondary market slowed down as investors focused on the primary market auction (PMA) that held on Wednesday. At the auction, the Central Bank of Nigeria offered bills worth N154.3bn (US$395.6M) and stop rates across the curve were less than 1.00%. While we doubt investors are enthusiastic about driving rates down, liquidity seems strong enough to prevent a significant rise over the coming weeks.

Oil

The price of Brent crude dropped by 10.32% last week to US$37.46/bbl. The average price, year-to-date, is US$42.43/bbl, 33.79% lower than the average of US$64.20/bbl in 2019. Oil prices dropped on the news of the new lockdown measures imposed in countries like the USA, Germany and France. However, such a sharp sell-off has not been observed in other commodity markets, notably copper, iron ore and lead. This suggests that oil traders are not only concerned with the world economic outlook but also with the resolve of the Organization of the Petroleum Exporting Countries (OPEC) to maintain current production cuts into next year. Among OPEC members it appears that Kuwait, the United Arab Emirates and Iran oppose rolling over the current schedule of production cuts. We must revise our forecast price range of between US$40.00/bbl to US$46.00/bbl downwards to reflect the new reality.

Equities

The Nigerian Stock Exchange All-Share Index (NSE-ASI) rose by 6.39% last week, with a gain of 13.74% year-to-date. This happened as reported corporate earnings spurred strongly positive market sentiment, bringing the NSE-ASI above the 30,000 mark. Last week, FCMB Group (+28.28%), Sterling Bank (+26.43%) and Fidelity Bank (+24.26%) closed positive, while there were no losers. See model Equity Portfolio below.

US dollar Eurobond yields now higher than Naira yields?

Which has the higher yield, the Federal Government of Nigeria’s (FGN) Naira-denominated debt, or its US dollar-denominated debt? After a huge rally in the Naira T-bill and FGN bond market this year, the answer is the US dollar-denominated debt.

Why? The answer is a simple case of the weight of money. 23rd October 2020 marked the one-year anniversary of the closure of the auctions of new Open Market Operations (OMO) bills of the CBN to most Nigerian institutions. The OMO market at the time was six times the size of the T-bill market and OMO bills and T-bills were traded as nearly-fungible instruments. As OMO bills are redeemed, money flows through the accounts of pension funds and other institutions into the T-bill and FGN bond markets, forcing yields down.

In the charts below we show the yields for 17 maturities of Naira-denominated T-bills and FGN Bonds from the beginning of the year and (1 January) and from last Friday (30 October). These show the enormous compression in yields over the past ten months. On the right-hand side are the yields, also from last Friday, for 10 maturities of US dollar-denominated FGN Eurobonds. The matches between maturities are not exact, but the comparison in yields between roughly-comparable durations is revealing. Among the 10 Eurobonds the simple average yield is 3.01 percentage points (pp) higher than the comparable Naira maturities, with a range between 1.93pp to 3.81pp.

The weight of Naira cannot reach the US bond market, so the two markets are essentially separate. Low rates in the Naira bond market does not mean that Naira are more valuable than US dollars.

However, from the point of view of US dollar issuers, there is a comparison between alternative rates. The FGN, having abstained from making a US dollar Eurobond issue in 2019 and most of 2020, would be a welcomed issuer in our view. But Naira are simply cheaper.

For those US dollar-based offshore investors who can buy FGN Eurobonds, the situation is as follows: the long-term average yield across maturities is in the range of 5.8%. The government does not want to negotiate private sector debt terms (keeping Eurobonds out of debt renegotiations) and therefore appears to be a good and committed credit. US dollar rates above 6% look attractive, in our view.

Model Equity Portfolio

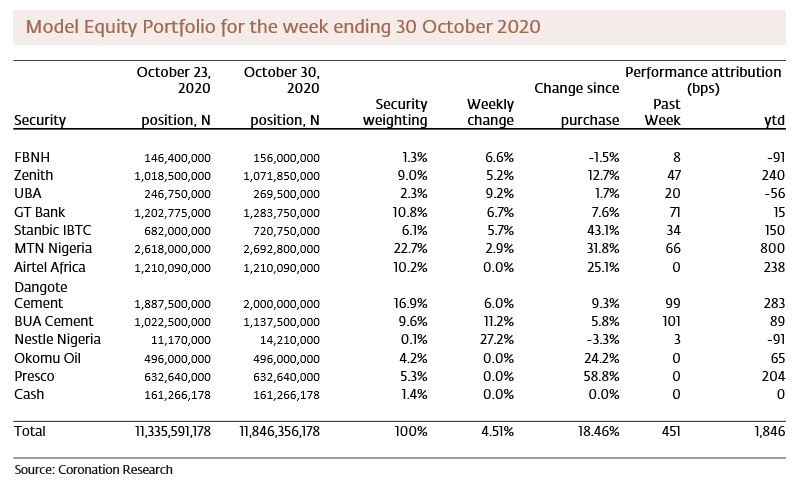

Last week the Model Equity Portfolio rose by 4.51% compared with rise in the Nigerian Stock Exchange All-Share Index (NSE-ASI) of 6.39%, therefore underperforming it by 188 basis points. Year-to-date it has gained 18.46% against a gain of 13.74% in the NSE-ASI, outperforming it by 451bps.

To underperform the index by 188bps in a week is an unpleasant shock (in many equity markets a fund manager might hope to outperform by that much in a year). However, it was a short week, of four trading days as Thursday was a public holiday. Trading was volatile.

Three stocks (Fidelity Bank, Sterling Bank and FCMB Group) rose by 24.0% or more over the four trading days. These are among the smaller and the less-liquid bank stocks. It is difficult to accommodate moves of this sort, unless one decides to hold an index-neutral position across a large number of not-very-liquid stocks, a tactic which have decided not to follow.

Model Equity Portfolio for the week ending 30 October 2020

More significantly, Nestle Nigeria and Flour Mills of Nigeria rose by more than 20% over the four days. These are reasonable index weights and therefore worth thinking carefully about. We have noticed a certain enthusiasm for Nestle Nigeria given its high profitability and return on equity (RoE). But we doubt that its long-term sales trend is strong (especially when we adjust it for inflation) and we have observed, in the past, that the RoE of consumer-facing industrials can falter when sales growth is lacklustre.

We shall take a close look at Flour Mills of Nigeria and report back. We plan no model portfolio changes this week.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.