Interest rates have been falling all year and the government is running a deficit. So, is it safe to assume that the government is issuing a lot more Treasury Bills and bonds than before? Not quite. Issuance has risen, but not much, as we explain below. Meanwhile, customer deposits are increasing rapidly in the banking system, generating a source of public sector money through the cash reserve requirement

FX

Last week the exchange rate in the NAFEX market (also known as the I&E Window and the interbank market) weakened by 0.79 % to N388.54/US$1. In the parallel, or street market, the Naira ceded 2.27% to close the week at an offer rate of N495.00/US$1. A recent communique from the Central Bank of Nigeria, reported widely in the press shows that it has weakened the Naira by 1.5% to 390 per dollar for Bureaux de change (BDC), to ease pressure on the currency. The new rate, which takes effect from today, takes the exchange rate closer to the NAFEX rate. The World Bank has pressed Nigeria to implement currency reforms as it considers granting a $1.5 billion loan. We think that there will be continued pressure on exchange rates in the run-up to the festive season.

Bonds & T-bills

Last week, the secondary market yield for an FGN Naira bond with 10 years to maturity dropped by 2 basis points (bps) to 4.37% from 4.39%, and at 7 years dropped by 7 bps to 4.03% from 4.10%, while at 3 years the yield dropped by 5 bps to 1.77% from 1.82%. The annualized yield on 335-day T-bill dropped by 3 bps to 0.15% from 0.18%, while the yield on a 333-day OMO bill dropped by 5 bps to 0.14% from 0.19%. At last week’s Monetary Policy Council meeting, the members unanimously voted to leave all policy rates unchanged with the Monetary Policy Rate at 11.5%. The effect of this decision is to signal satisfaction with low market interest rates, in our view. Therefore, as a high volume of Open Market Operation (OMO) bills are due soon, which will likely raise market liquidity, we see nothing in the way of further rate tightening in December.

Oil

The price of Brent crude rose by 7.16%% last week to US$48.18/bbl. The average price, year-to-date, is US$42.54/bbl, 33.65% lower than the average of US$64.12/bbl in 2019. Market participants are closely watching the OPEC+ members as they begin their two-day meeting to discuss next steps in production policy. The market is responding to good news on Covid-19 vaccines, a steady increase in oil demand from Asia, a weakening US dollar and easing political uncertainty in the US as President-elect Joe Biden began his transition process.

Back in April, OPEC agreed to cut production by 9.7 million barrels per day but has scaled it back further to 7.7 million bpd since August. The original plan was to bring back another 2.0 million bpd in January 2021, but markets seem convinced that this step will be delayed, even though it could come at the cost of losing market share to US shale oil producers as American rig counts have been steadily increasing since mid-September.

Equities

Last week, the Nigerian Stock Exchange All-Share Index (NSE-ASI) rose by 2.19% with a gain of 29.97% year-to-date to close at 34,885.51. Mobil (+9.89%), FCMB Group (+7.26%) and Airtel Africa (+7.00%) closed positive while Honeywell Flour Mills (-10.83%), Ardova Oil (-8.33%) and Oando (-7.17%) closed negative. During the week, the outcome of the Monetary Policy Committee (MPC) meeting on Tuesday to hold interest rate at 11.5% spurred bullish momentum in the market as investors took more interest in tier-1 banks and other bellwether stocks. See Model Equity Portfolio below.

Where is the money going?

2020 has brought many things: a pandemic; a commodity price slump (now recovering); a global recession. For Nigeria, 2020 has also been the year when interest rates collapsed. In January a 10-year Federal Government of Nigeria (FGN) Naira-denominated bond yielded 10.40% pa: today it yields 4.37%. How has this affected government finances and lending by private-sector banks?

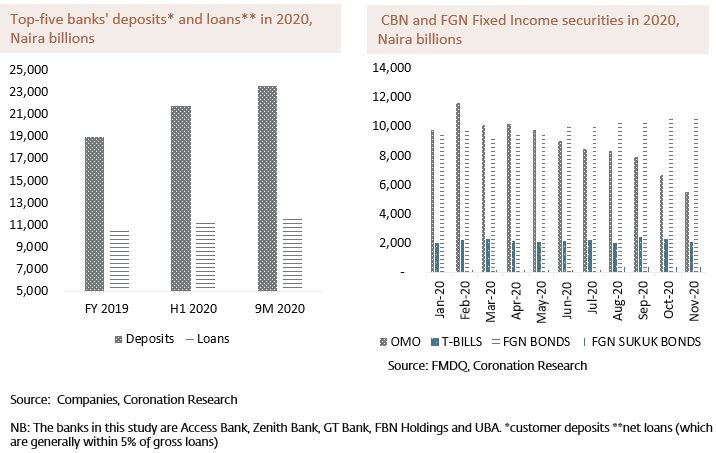

One might have expected the FGN, which carries a substantial budget deficit, to have issued a lot of T-bills and bonds this year, given the opportunity to finance itself at low rates. The strange thing is that the volume of outstanding T-bills and FGN bonds (including Sukuk bonds) has only risen by 11.8% year-to-date, or by N1.37 trillion (US$3.51bn). At the same time, the size of the CBN’s open market operation (OMO) bill market has contracted by 43.9% year-to-date, or by N4.29 trillion (US$11.02bn). So, the sum of FGN and CBN obligations in their respective securities markets has shrunk by N2.93 trillion (US$7.51bn) year to date.

Where has it gone? A very obvious effect of a large amount of money leaving the OMO market, being received by pension funds and banks (when not being received by foreign investors), is that it moves into the T-bill and FGN bond markets, causing rates to fall. The face value of FGN bonds is some N10.55 trillion (US$27.06bn) but their combined market capitalization is N16.69 trillion (US$42.80bn). This, however, does not tell where all the money has gone.

Detailed financial information from Nigeria’s largest banks supplies clues. Taking five leading banks (Access Bank, Zenith Bank, GT Bank, UBA and FBN Holdings), their total net loans rose by 11.03%, or by N1.17 trillion (US$3.01bn) in the first nine months of 2020 (9M 2020) to N11.80 trillion (US$30.27bn). However, their total deposits grew by 24.38%, or by N4.61 trillion (US$11.8bn) in 9M 2020 to N23.51 trillion (US$60.39bn). After almost zero loan growth during 2019 and lacklustre deposit growth that year, this represents a massive increase in liquidity.

Commercial banks are subject to the cash reserve requirement (CRR) under which (since October 2019) they leave at least 27.5% of their deposits with the CBN (banks we speak with sometimes state that it is higher than this in practice). So, this implies that a minimum (just taking our five banks at 27.5%) N6.47 trillion (US$16.58bn) of CRR funds available to the public sector, N1.27 trillion (US$3.25bn) more than at the beginning of the year.

So, the public sector is taking back some of what it has lost from the contraction in its securities market. And low-interest rates leave the way open to issue more bills and bonds later on.

Model Equity Portfolio

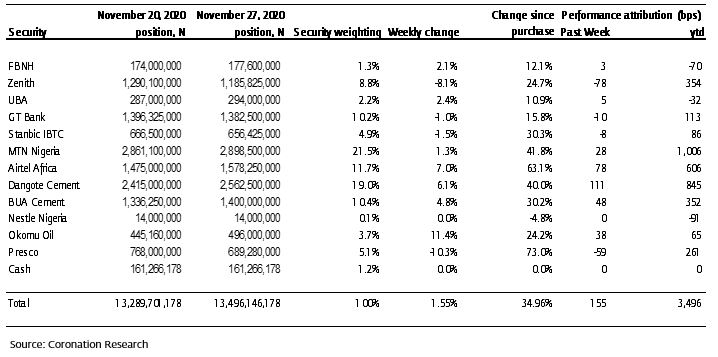

Last week the equity market continued its march upwards, a notable feature being the way in which several stocks with large index weights (notably Airtel Africa, Dangote Cement, BUA Cement and to a lesser extent MTN Nigeria) were carried upwards by the market rally. Fortunately we tend to have neutral notional positions in these stocks, so we do not miss out on the action.

However, there was profit-taking in some of the major bank names during the week, and since we are overweight in these names we ended up with some poor performance here and underperformance overall.

Last week the Model Equity Portfolio rose by 1.55% compared with a rise in the Nigerian Stock Exchange All-Share Index (NSE-ASI) of 2.19%, therefore underperforming it by 64 basis points. Year-to-date it has gained 34.96% against a gain of 29.97% in the NSE-ASI, outperforming it by 500bps.

Model Equity Portfolio for the week ending 27 November 2020

As the last month of the year starts tomorrow we feel we have limited time in which to adjust the portfolio. As described last week, we will take a close look at Flour Mills of Nigeria and Dangote Sugar in order to figure out whether they are worth taking on. We plan no changes in the Model Equity Portfolio this week.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.