A year ago this month the Central Bank of Nigeria (CBN) banned most domestic institutions from buying new issues of its open market operation (OMO) bills. The result was an exodus of money from the OMO market into government bills and bonds, which has driven down rates without a break for coming up to one year. While we think that this trend is likely to continue for the rest of this year, what of next year? Much depends on how policymakers wish to finance the government deficit and how (if at all) they want foreign investors to play a role.

FX

Last week the foreign exchange rate in the NAFEX market (also know as the I&E Window and the interbank market), strengthened by 0.05% to N385.83/US$1. In the parallel or street market, the Naira gained 0.43% to close the week at an offer rate of N465/US$1. These moves were attributable to the supply of FX to the Bureaux de Change (BDC) by the Central Bank of Nigeria (CBN). Much depends on how long the CBN will supply FX and how much it will supply. Overall, we think that the parallel rate will remain under pressure over the coming weeks, though unlikely to waken significantly from current levels.

Bonds & T-bills

Last week the secondary market yield for an FGN Naira bond with 10 years to maturity decreased by 141 basis points (bps) to 7.86%, and at 7 years advanced by 49bps to 7.25%, while at 3 years the yield declined by 80bps to 3.13%. However, we have changed our benchmark from the 17 March 2027 bond to the 23 February 2028 bond for the 7-year bond. On a like-for-like basis, the yield contracted by 2bps. The annualised yield on 328-day T-bill increased by 42bps to 3.14% while the yield on a CBN Open Market Operation (OMO) bill with similar tenure decreased by 8bps to 2.20%. Last week, at the NTB primary market auction, the CBN rolled over N133.97bn (US$343.51m) worth of instruments, with allotments of NGN10.0 billion of 91-day, N17.60bn of 182-day and N106.37bn of 364-day paper. Our sense is that the market continues to be liquid and that we will continue to see moderate downward pressure on rates over the coming week.

Oil

The price of Brent crude fell by 6.35% last week to US$39.26/bbl. The average price, year-to-date, is US$42.51/bbl, 33.79% lower than the average of US$64.20/bbl in 2019. Crude prices fell on Friday following news that US President Donald Trump tested positive for the coronavirus. However, the impact of this was short-lived as the price of oil rebounded to the US$40.00/bbl level over the weekend and is currently trading at US$40.65/bbl.

Equities

The Nigerian Stock Exchange All-Share Index (NSE-ASI) rose by 2.53% last week, closing positive again since its positive returns in January and February. Last week Oando (+12.81%), Sterling Bank (+10.34%) and International Breweries (+8.33%) closed positive, while Nigerian Breweries (-6.67%), PZ Cussons (-5.88%) and Mobil (-4.20%) closed down. See Model Equity Portfolio below.

Which way for interest rates?

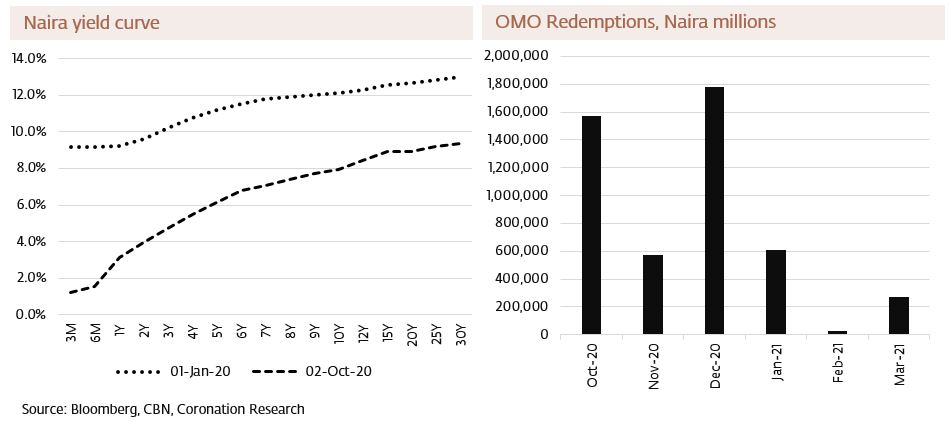

This month marks the one-year anniversary of the ban on most domestic institutions from buying new issues of open market operation (OMO) bills from the Central Bank of Nigeria (CBN). This started a year-long decline in rates available on Treasury Bills and government bonds. In technical terms, this was achieved by the large amounts of money invested in OMO bills being reinvested in bills and bonds whenever they came due for redemption. And, as the chart shows, there are sufficient OMO redemptions in Q4 2020 for us to believe that market interest rates will stay low for the rest of this year.

The link between policy rates and inflation (August: 13.22% y/y) is a thing of the past. The Monetary Policy Committee (MPC) of the CBN explained this when it cut the Monetary Policy Rate (MPR) from 12.50% to 11.50% on 22 September. Noting the rise in several measures of inflation in August, the MPC wrote:

“These upticks were driven primarily by legacy structural factors such as the inadequate state of critical infrastructure and broad-based security challenges across the country . .”

In other words, inflation would not respond to interest rates but to other factors, including “targeted investment by the fiscal authorities to resuscitate critical infrastructure to improve the ease of doing business across the country.” We interpret these words to mean that CBN intends to continue making life easy for the Federal Government of Nigeria (FGN) whose own budget requires significant deficit financing.

Does this mean that market interest rates will not go up at all during 2021? Very low-interest rates, i.e. as low as the ones have now, might be desirable for a sustained program of deficit financing by the FGN. On the other hand, as liquidity becomes less abundant (e.g. there will be fewer OMO redemptions in Q1 2021 than in Q4 2020) rates could move up slightly unless the authorities intervene again to keep them down. And it may be seen as desirable to set rates at a level attractive to foreign investors. Decisions on these two topics, in our view, will determine the path of rates next year.

Model Equity Portfolio

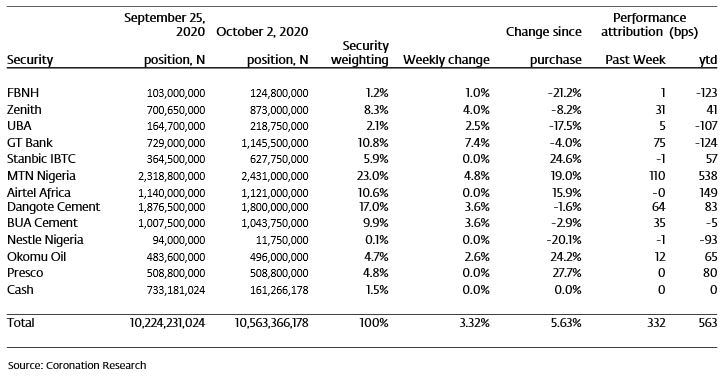

Last week the Model Equity Portfolio rose by 3.32% compared with rising in the Nigerian Stock Exchange All-Share Index (NSE-ASI) of 2.53%, therefore outperforming it by 79 basis points. Year-to-date it has gained 5.63% against a gain of 0.54% in the NSE-ASI, outperforming it by 510bps.

Our performance last week was largely driven by our notional positions in MTN Nigeria, Dangote Cement and BUA Cement, but there were also strong performances from GT Bank and Zenith Bank.

As advised last week, we took our total notional positions in the banks from 20.2% (which was only a little higher than a neutral weight in the NSE-ASI) to just under 30.0%, in fact, 28.3%. We made notional purchases, mid-week, in FBNH, Zenith Bank, UBA, GT Bank and Stanbic IBTC.

Model Equity Portfolio for the week ending 2 October 2020

We did not have enough notional cash to do this. So, as advised last week, we made notional sales, mid-week, in Nestle Nigeria, taking our notional position in it down to a 0.1%. We trimmed our notional holdings in Dangote Cement and Airtel Africa and brought them close to index-neutral weights.

Our technique is to buy the stocks which we like when we believe they are below their fair values, and we do this more than attempting to call the market as a whole. However, following the 100-basis point cut in the Monetary Policy Rate by the CBN on 22 September, we have observed the market in buoyant mood, and we hope to take advantage of this over the coming weeks.

Nota bene: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.